يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

City Holding (CHCO) Valuation Check After Earnings And Revenue Miss Versus Analyst Forecasts

City Holding Company CHCO | 124.96 | +0.22% |

City Holding (CHCO) is back in focus after its latest quarterly and full year 2025 results, where reported revenue and earnings came in below analyst forecasts despite year on year growth in net income and net interest income.

The stock has softened in the short term, with a 1 day share price return of a 3.93% decline and a 30 day share price return of a 1.83% decline. However, a 1 year total shareholder return of 7.87% and a 5 year total shareholder return of 103.15% show that longer term holders have seen considerably stronger gains. This suggests recent earnings and buyback news may be prompting investors to reassess momentum rather than the broader story.

If City Holding’s update has you thinking about where else capital might work for you, this could be a good moment to look at solid balance sheet and fundamentals stocks screener (None results).

With record full year earnings, a recent earnings miss and an ongoing buyback, the big question now is whether City Holding’s current valuation still leaves room for upside or if the market is already pricing in future growth.

Price-to-Earnings of 13.5x: Is it justified?

City Holding shares last closed at $121.56, and on a P/E of 13.5x the stock is priced above both the US Banks industry average of 11.8x and its direct peer average of 12.2x.

The P/E multiple reflects how much investors are currently paying for each dollar of earnings. It is a common yardstick for banks where profits and returns on equity are key focus points. A higher P/E can sometimes line up with stronger profit growth or higher expected returns, while a lower P/E can point to more cautious expectations.

Here, the picture is mixed. On one hand, City Holding has grown earnings by 9.2% per year over the past 5 years, with the latest year showing 11.5% growth and net profit margins at 41%. On the other hand, earnings are forecast to decline by an average of 0.05% per year over the next 3 years and return on equity of 16.1% is described as low, with forecasts suggesting it could ease to 14.8% in 3 years. That combination of slower expected earnings and moderate returns makes the current premium P/E harder to explain purely on growth or profitability grounds.

Versus the wider US Banks industry, the current 13.5x P/E is clearly rich compared with 11.8x, and it also sits well above the estimated fair P/E of 9.9x that our fair ratio work suggests the market could move toward over time. That gap indicates investors are paying materially more for City Holding’s earnings than both peers and this fair ratio estimate would imply.

Result: Price-to-Earnings of 13.5x (OVERVALUED)

However, the picture could shift if earnings forecasts keep pointing to slower growth or if the premium to the wider US Banks sector P/E narrows abruptly.

Another view: cash flows paint a different picture

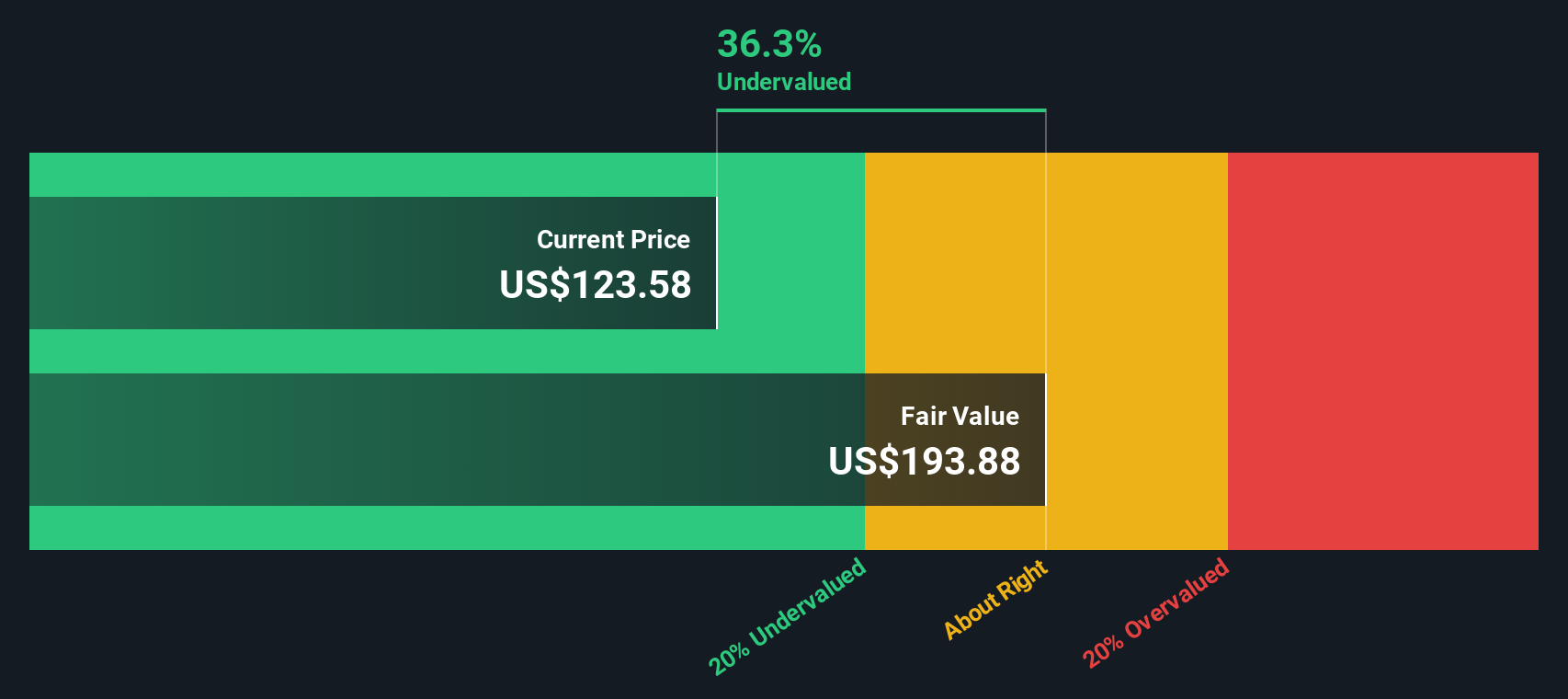

While the 13.5x P/E suggests City Holding looks expensive versus banks and peers, our DCF model points the other way. With the shares at $121.56 and our estimate of future cash flow value at $201.58, the stock is described as trading 39.7% below that fair value. Which signal do you treat as more important: earnings today or cash flows over time?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out City Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 871 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own City Holding Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to work from your own research, you can put your version together in just a few minutes by starting with Do it your way.

A great starting point for your City Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If City Holding does not fully fit what you want, do not stop here. Use this momentum to widen your watchlist with focused, data driven ideas.

- Spot potential value before the crowd by checking out these 871 undervalued stocks based on cash flows that line up with strong cash flow signals and measured expectations.

- Tap into long term themes in medicine and diagnostics by reviewing these 109 healthcare AI stocks, shaping how healthcare uses data and automation.

- Target regular income streams by scanning these 13 dividend stocks with yields > 3% that pair higher yields with supporting fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.