يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Cohen & Steers (CNS) Valuation Check After Q4 Revenue Growth And Lower Net Income

Cohen & Steers, Inc. CNS | 67.12 | +0.42% |

Cohen & Steers (CNS) just posted its Q4 2025 results, reporting revenue of US$143.8 million and net income of US$34.88 million. These figures have quickly sharpened investor focus on the stock.

The Q4 2025 earnings release comes after a mixed year for the stock, with a 30 day share price return of 8.74% and a 1 year total shareholder return decline of 20.43%, suggesting recent momentum has picked up even as longer term performance remains weaker.

If this earnings move has you reassessing your options, it could be a helpful moment to widen your search and check out fast growing stocks with high insider ownership.

With revenue up year on year but quarterly earnings per share lower than a year ago, and the stock still down on a 1 year basis, is Cohen & Steers now trading below its worth, or is the market already pricing in future growth?

Most Popular Narrative: 4.9% Undervalued

With Cohen & Steers last closing at $68.78 against a narrative fair value of about $72.33, the current price sits slightly below that central view.

Strategic expansion into active ETFs and broader product diversification (including the launch of integrated listed/private real estate strategies) is expected to attract new investor segments and improve client retention, supporting future AUM growth and revenue stability.

Curious what sits behind that fair value gap? This narrative leans heavily on faster earnings growth, fatter margins, and a future valuation multiple that needs to cool from today’s level. The full story connects those moving parts into one price tag.

Using an 8.13% discount rate, the most followed narrative points to a fair value of roughly $72.33, only a few dollars above where shares last traded. That small gap suggests the story here is more about whether you agree with the assumed growth in revenue, profitability and future earnings multiple than about a clear mispricing.

Result: Fair Value of $72.33 (UNDERVALUED)

However, that story can unravel if institutional outflows keep weighing on assets under management or if higher global expansion costs continue to pressure margins.

Another View: Multiples Paint a Tougher Picture

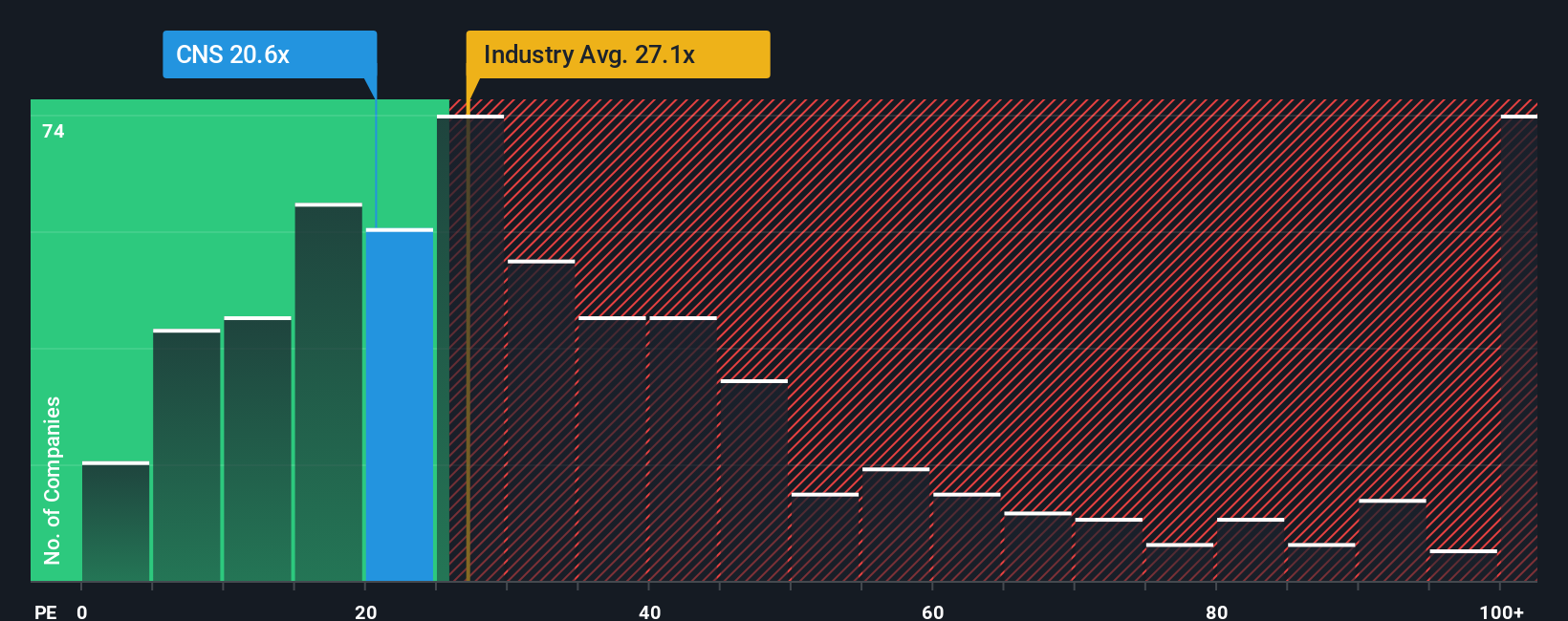

That 4.9% narrative undervaluation sits awkwardly next to how the market is pricing Cohen & Steers on earnings today. The current P/E is 21.4x, which is below the US Capital Markets industry average of 25.8x, but above both the peer average of 12.3x and a fair ratio of 15x.

In practice, that gap means the stock already carries a richer tag than closer peers and the level our fair ratio suggests the market could move toward, even if it still looks cheaper than the wider industry. The question for you is whether future growth and returns justify staying above that 15x fair ratio, or if that premium feels like valuation risk.

Build Your Own Cohen & Steers Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom view for Cohen & Steers in just a few minutes, starting with Do it your way.

A great starting point for your Cohen & Steers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Cohen & Steers is on your radar, it is worth lining up a few fresh ideas so you are not relying on a single story.

- Scan for growth potential in smaller names by checking out these 3525 penny stocks with strong financials that meet clear financial strength filters.

- Target companies linked to artificial intelligence trends with these 24 AI penny stocks that already sit on Simply Wall St watchlists.

- Zero in on income opportunities by reviewing these 12 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.