يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Cooper Standard (CPS) Returns To Q4 Profit And Tests Turnaround Narratives

Cooper-Standard Holdings Inc. CPS | 39.54 | +0.56% |

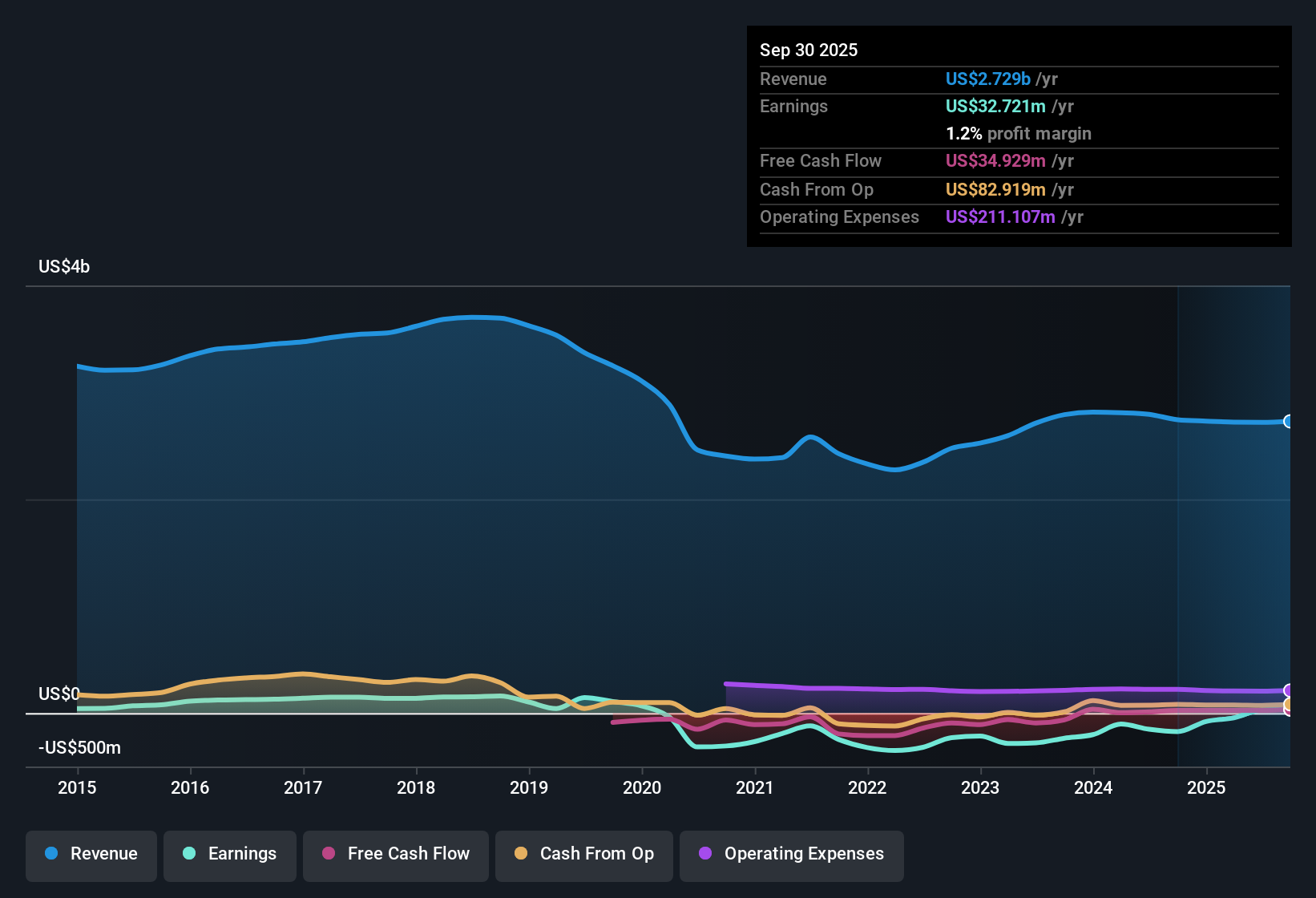

Cooper-Standard Holdings (CPS) closed out FY 2025 with Q4 revenue of US$672.4 million and basic EPS of US$0.19, alongside net income of US$3.3 million excluding extra items. The company has seen quarterly revenue move from US$660.8 million in Q4 2024 to a range of US$667.1 million to US$706.0 million through FY 2025, while basic EPS has swung between a loss of US$0.43 in Q3 and a profit of US$0.19 in Q4, highlighting a story that focuses on how consistently those thin margins can be maintained.

See our full analysis for Cooper-Standard Holdings.With the headline numbers on the table, the next step is to set these results against the widely followed narratives around Cooper-Standard and assess which stories about its profitability and recovery prospects still appear valid, and which may be starting to look stretched.

TTM still shows small loss on US$2.7b revenue

- On a trailing twelve month basis to Q4 2025, Cooper-Standard booked about US$2.7b in revenue and a loss of US$4.2 million, with basic EPS of US$0.23 loss per share.

- Consensus narrative talks about cost savings and higher margin contracts supporting future profitability, yet the latest trailing numbers still show negative net income, which means:

- Losses have narrowed compared with earlier trailing periods, where net losses were as large as US$174.1 million. This improvement trend backs the idea of a gradual turnaround.

- At the same time, the company has not yet put a full year of profitability together. This keeps the consensus focus on execution risks around margins and volumes rather than assuming the job is done.

Quarterly swings keep the bullish case honest

- Within FY 2025, basic EPS moved from a loss of US$0.43 in Q3 to a profit of US$0.19 in Q4, while quarterly net income excluding extra items shifted from a loss of US$7.6 million to a profit of US$3.3 million.

- Bullish investors highlight margin upside from efficiency and new programs, and this back and forth in quarterly profits cuts both ways:

- The return to profit in Q4, after losses in Q2 and Q3, lines up with the bullish view that cost actions and higher value programs can support better earnings as they ramp.

- However, the fact that two of the four FY 2025 quarters still showed losses is a reminder that the bullish view is leaning on future execution, not on a long history of stable quarterly profits.

Low P/S and negative equity pull in the bears

- The shares trade on a P/S of about 0.3x versus roughly 0.8x for the US Auto Components industry and 0.6x for peers, while the company still has negative shareholders’ equity flagged as a major risk.

- Bears focus on balance sheet strain and industry shifts, and the data here give them plenty to talk about:

- The low P/S multiple and a DCF fair value of about US$59.46 compared with a share price of US$45.20 point to a valuation gap. At the same time, the presence of negative equity and recent share price volatility suggest the market is assigning a clear risk discount.

- Trailing unprofitability, even with shrinking losses, sits alongside that weak equity position, which supports the bearish concern that leverage and capital needs could limit how quickly any operational improvement flows through to shareholders.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cooper-Standard Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers in a different light and think your take tells a slightly different story? Shape that view into your own narrative in just a few minutes, Do it your way.

A great starting point for your Cooper-Standard Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Cooper-Standard is still working through trailing losses, thin margins, and negative shareholders’ equity, which together keep its balance sheet looking fragile.

If you want ideas where financial footing is the priority, check out our solid balance sheet and fundamentals stocks screener (44 results) today and compare alternatives with sturdier foundations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.