يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Corning (GLW): A Fresh Valuation Perspective After Recent Share Price Momentum

Corning Inc GLW | 122.16 | +8.31% |

Corning’s share price momentum is tough to ignore, with a recent surge building on an already robust performance. Its 1-year total shareholder return is an impressive 92.6%, while three- and five-year returns continue to reward patient investors. The latest gains hint at renewed optimism around growth potential and a shift in risk perception, placing Corning firmly on the radar for those seeking both strong short-term moves and proven longer-term resilience.

If Corning's rally has you curious about other big movers, this is the perfect time to explore fast growing stocks with high insider ownership.

But after such a strong run, investors now face a key question: Is Corning still trading at a compelling value, or has the surge already factored in all the anticipated growth ahead?

Most Popular Narrative: 4% Undervalued

Corning’s most widely followed valuation narrative puts fair value at $92.75, which is just above the recent close at $89.01. This setup suggests optimism is running slightly ahead of market price as growth prospects accelerate.

The company sees substantial growth in Optical Communications, particularly in innovations for Gen AI data centers. These developments are expected to drive incremental revenue and accelerate operating margin improvements toward 20% by the end of 2026. Corning’s significant U.S. manufacturing footprint provides a competitive edge and is expected to attract commercial agreements, enhancing sales and net margins despite tariff implications.

How did analysts arrive at this high fair value? Hint: there is a bold call on margin expansion and a revenue surge driven by both next-gen tech and policy shifts. The real surprise is what they expect Corning to earn, and how strong those profit forecasts are. Ready to see the underlying projections that justify this premium?

Result: Fair Value of $92.75 (UNDERVALUED)

However, persistent supply chain constraints and exposure to trade tensions could quickly challenge these bullish expectations if conditions worsen in the coming months.

Another View: Market Ratios Raise Questions

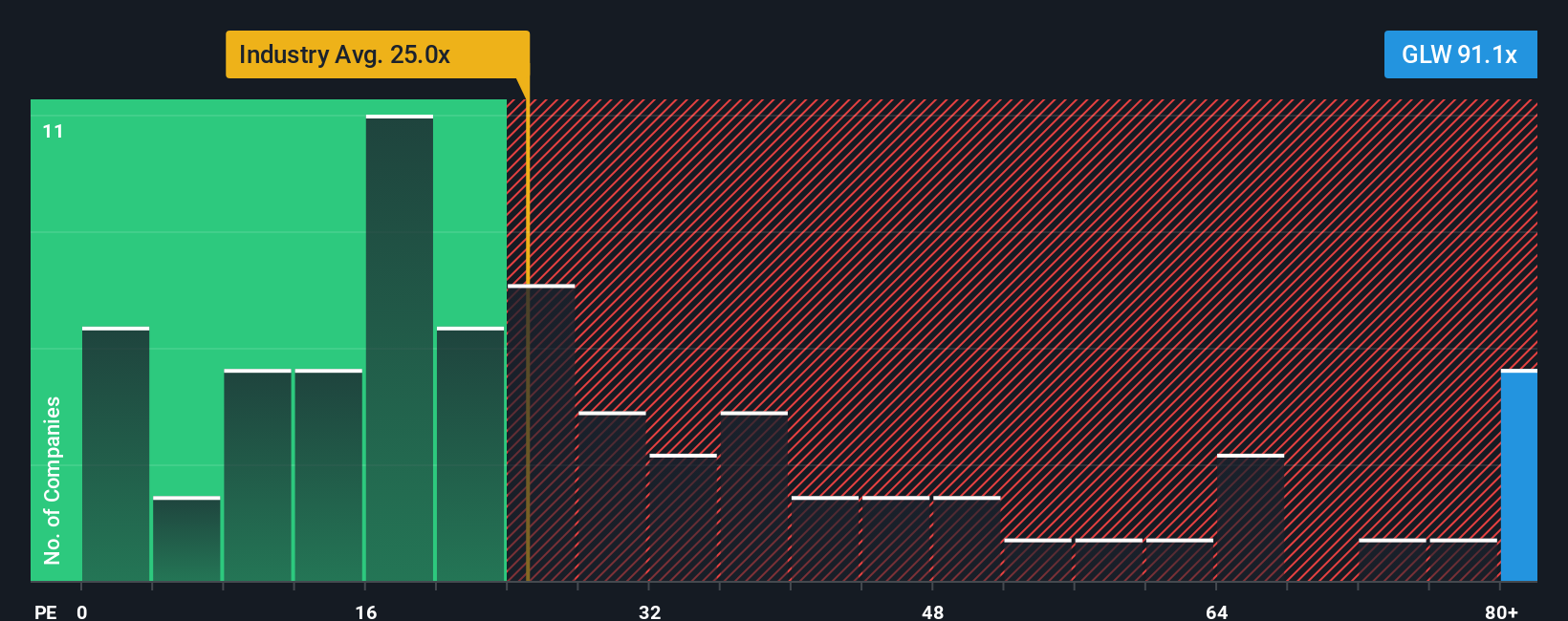

While analysts are optimistic, market valuation metrics paint a different picture. Corning's price-to-earnings ratio is much higher than both its peers' average and the broader industry. In addition, it sits well above the estimated fair ratio. This wide gap may point to a premium that is tough to justify. Could recent growth be fueling overconfidence, or is the market onto something the numbers do not yet reflect?

Build Your Own Corning Narrative

If you see the situation differently or want to dig into the numbers on your own, crafting a personal valuation takes just a few minutes. Do it your way.

A great starting point for your Corning research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize this chance to spot fresh opportunities you may have missed. The Simply Wall Street Screener uncovers stocks with the qualities smart investors seek. Don't wait to uncover your next winner.

- Capture impressive yields by reviewing these 14 dividend stocks with yields > 3% that pay out strong dividends above 3%, perfect for boosting your income streams.

- Expand your portfolio's potential with these 27 AI penny stocks delivering exposure to breakthrough technologies shaping tomorrow’s industries.

- Position yourself for growth by targeting value hidden in these 881 undervalued stocks based on cash flows, where attractive pricing meets solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.