يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Corning Meta Fiber Deal Puts AI Data Center Growth In Focus

Corning Inc GLW | 139.51 | +7.32% |

- Corning (NYSE:GLW) signs a multiyear US$6b fiber optic supply contract with Meta for AI data center projects.

- The agreement includes plans to support Meta's growing AI infrastructure requirements over several years.

- Corning announces international capacity growth, including a new fiber manufacturing facility in India.

For you as an investor, this deal places Corning's optical communications business squarely in the middle of AI data center build outs. The company has long been known for glass, ceramics and display technologies, and fiber optics for communications networks is a key part of its portfolio. AI workloads depend heavily on high bandwidth connectivity.

The new capacity plans, including the India facility, indicate Corning is aligning its manufacturing footprint with large scale infrastructure demand tied to AI. As this contract with Meta progresses, the size and duration of the agreement may become a useful reference point when considering Corning's role in AI related network investments.

Stay updated on the most important news stories for Corning by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Corning.

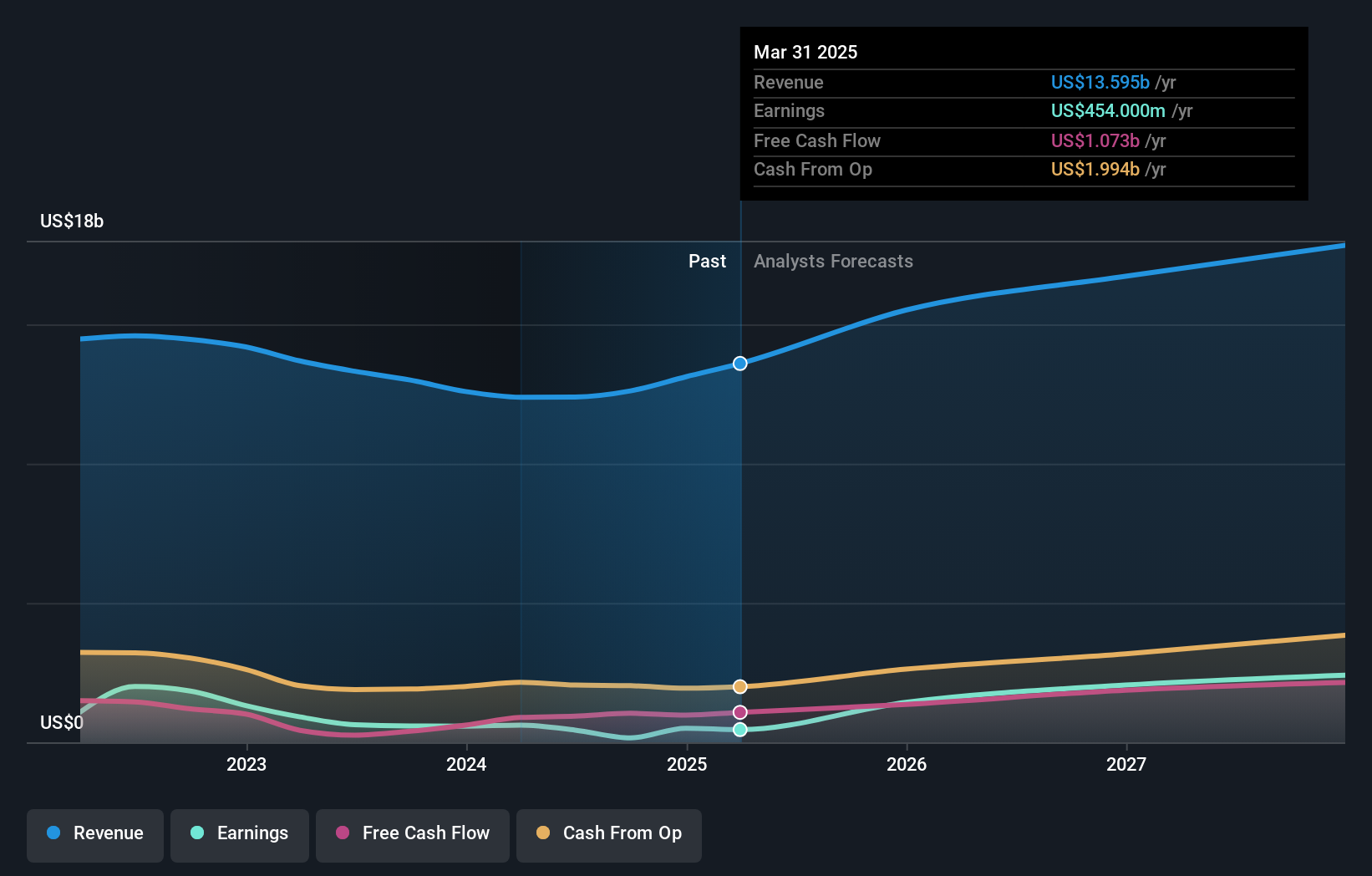

This Meta contract puts Corning closer to the center of AI data center build outs, which is where a lot of long-haul and intra‑data‑center traffic is moving. With Optical Communications already a large contributor and growing alongside AI related connectivity demand, a multiyear, up to US$6b order book from a single hyperscale customer gives more visibility into that segment. The planned international capacity additions, including India, suggest Corning is preparing for sustained high bandwidth needs rather than a one off spike in orders. For you, the key question is how efficiently Corning can convert this volume into durable margins, especially after reaching its 20% operating margin target earlier than planned and lifting its Springboard sales ambition to US$11b in incremental annualized sales by 2028. At the same time, options flow pointing to some bearish positioning and a mix of analyst views from Equal Weight to Buy show that not everyone is convinced execution risk, customer concentration and competitive pressure from players like Prysmian, CommScope and Nexans are fully reflected in expectations yet.

How This Fits Into The Corning Narrative

- The Meta deal directly supports the narrative that Optical Communications and AI data center connectivity are key drivers in Corning’s Springboard plan to grow sales.

- Relying more on large AI and data center customers could amplify the narrative’s concern that growth is tied to a few secular themes that may not progress as expected.

- The new India facility and international capacity plans extend the original focus on U.S. manufacturing and may not yet be fully reflected in the existing narrative.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Corning to help decide what it's worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Corning’s heavier tilt toward AI and data center demand increases exposure to any slowdown or shift in spending by hyperscale customers like Meta.

- ⚠️ Analysts have flagged risks around competition and financial transparency, and insider selling over the last year may worry some shareholders.

- 🎁 The Meta agreement adds multiyear revenue visibility for Optical Communications at a time when AI related connectivity is an important growth area.

- 🎁 Corning’s capacity expansion in regions like India could support future contracts with other large technology and telecom players.

What To Watch Going Forward

You will want to watch how quickly Meta volumes ramp, how much of the up to US$6b actually converts into booked sales, and whether Corning can sustain or improve operating margins while adding capacity. Keep an eye on any new contracts with other AI or cloud players, since that will show whether this is a one customer story or part of a broader trend. It is also worth tracking insider activity, dividend decisions and analyst revisions as the Meta contract moves from headline announcement into actual shipments and cash flow.

To ensure you're always in the loop on how the latest news impacts the investment narrative for Corning, head to the community page for Corning to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.