يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

CSG Systems Extends DISH Partnership As Long Term Growth Story Builds

CSG Systems International, Inc. CSGS | 79.93 | +0.35% |

- CSG Systems International (NasdaqGS:CSGS) has extended its multi year contract with DISH Network to provide billing and payment platform services.

- The agreement continues a decades long relationship and is set to run through 2030.

- The renewal supports DISH Network’s customer experience goals while keeping CSG at the core of its connectivity operations.

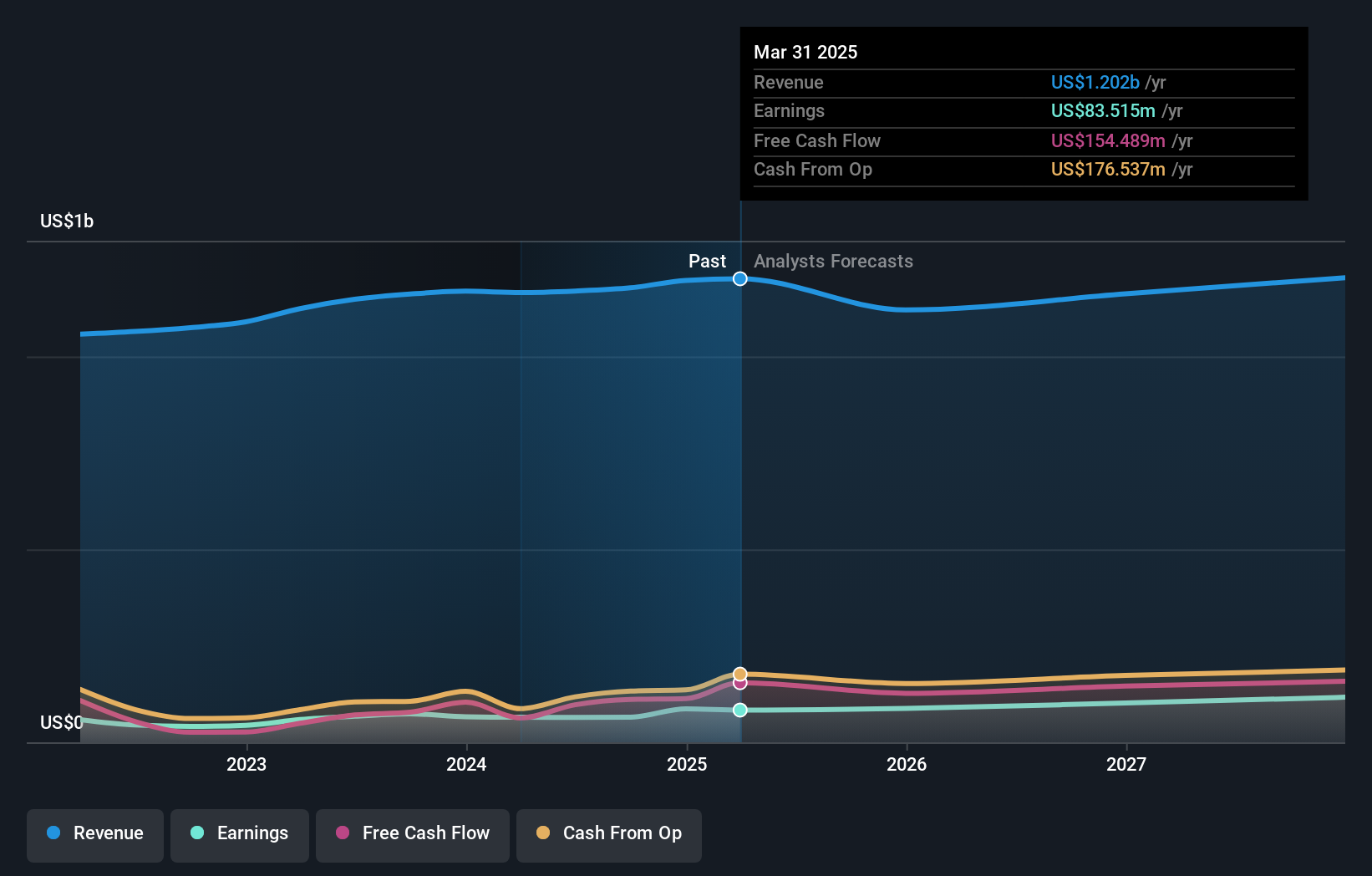

For investors watching NasdaqGS:CSGS, this long term renewal with a major client comes as the stock trades at $79.65, with a 1 year return of 39.9% and a 5 year return of 99.1%. The contract helps frame those numbers in the context of a business that is embedded in large scale billing and customer management for connectivity providers.

The DISH extension also increases visibility on a portion of future revenue through 2030, which many investors look for in business services companies. It may influence how you think about CSG’s role in telecom and connectivity, particularly if similar clients view this renewal as a reference point when evaluating their own platform providers.

Stay updated on the most important news stories for CSG Systems International by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on CSG Systems International.

The DISH renewal keeps CSG embedded in a long-running, mission-critical role, providing billing and payment services for millions of subscribers through at least 2030. For a company that competes with names like Amdocs and Netcracker in telecom billing and customer management, a renewed, multidecade client relationship signals that its telco-specific SaaS platform continues to meet the needs of a large, diversified connectivity provider.

How This Fits The CSG Systems International Narrative

This contract extension lines up with the existing narrative that CSG is using cloud-based, AI-powered platforms to support complex subscription and usage models for large communication service providers. It also fits with the idea that long-term, recurring contracts help balance customer concentration risk while the company works to diversify into new verticals such as financial services and healthcare.

CSG: Key Rewards And Risks Around The DISH Renewal

- Contract visibility with DISH to 2030 supports the view that CSG’s telecom-focused platforms remain relevant to large connectivity clients.

- The renewal adds to recent contract momentum alongside wins and extensions with Comcast, Orange Business and Liberty, which can help underpin recurring revenue.

- Customer concentration remains a theme, with large clients historically accounting for a meaningful share of revenue, so investors may still watch for terms and renewal outcomes at Charter and Comcast.

- Industry headwinds in North American broadband and elongated sales cycles, flagged by management, are still part of the backdrop even with this long-dated agreement.

What To Watch Next

From here, it is worth watching whether CSG can use the DISH extension as a reference win in competitive bids against other billing providers and how quickly it can broaden beyond cable and telecom into newer verticals. If you want to see how this development fits into the wider story, take a moment to check community narratives on the dedicated CSG Systems International page.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.