يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

CSG Systems International (CSGS) Margin Compression Tests Bullish Earnings Growth Narratives

CSG Systems International, Inc. CSGS | 79.93 | +0.35% |

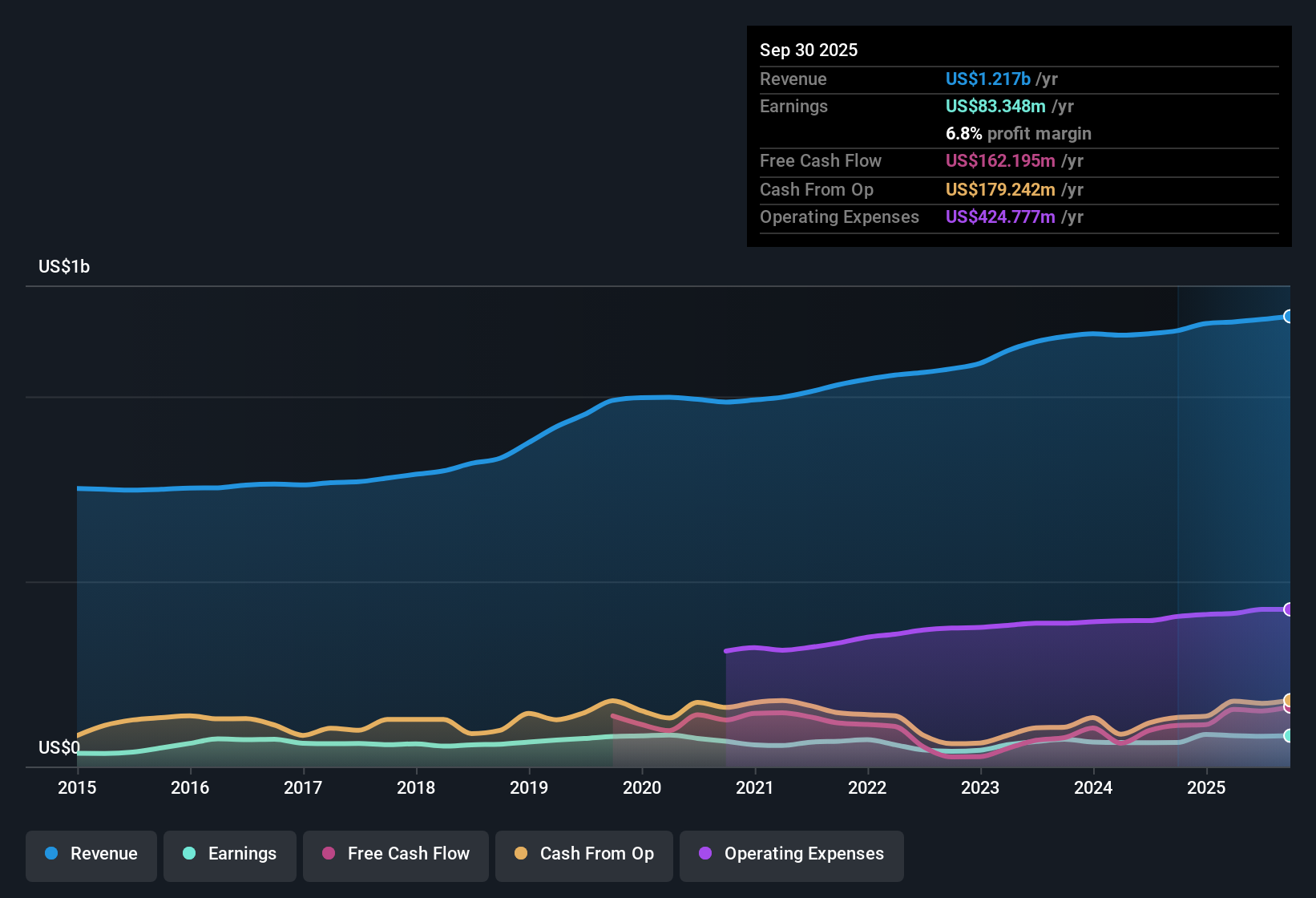

CSG Systems International (CSGS) has wrapped up FY 2025 with fourth quarter revenue of US$323.1 million and basic EPS of US$0.25, alongside trailing twelve month revenue of about US$1.2 billion and EPS of US$2.02. Together these figures set a clear snapshot of its recent earnings power. Over recent quarters, the company has seen revenue move from US$295.1 million in Q3 2024 to US$316.7 million in Q4 2024 and then to US$323.1 million in Q4 2025. Over the same period, quarterly EPS shifted from US$0.67 to US$1.23 and then to US$0.25, leaving investors weighing how these headline numbers square with softer net profit margins.

See our full analysis for CSG Systems International.With the latest results on the table, the next step is to set these figures against the prevailing stories around CSG Systems International and see which narratives around growth, profitability and risk really hold up.

Margins Tighten As Net Income Shrinks To US$7 Million

- Net income in Q4 FY 2025 was US$7.0 million on US$323.1 million of revenue, compared with US$34.5 million on US$316.7 million in Q4 FY 2024. This is consistent with the trailing net margin moving from 7.3% a year earlier to 4.6% now.

- Critics highlight that this weaker profitability challenges a bullish case built on earnings strength, because:

- Over the last 12 months, net income on a trailing basis was US$55.9 million on about US$1.2b of revenue, lower than the US$86.9 million on US$1.2b of revenue a year earlier. The recent year therefore does not mirror the 6.2% annual earnings growth seen over five years.

- The drop in quarterly net income from US$20.5 million in Q3 FY 2025 to US$7.0 million in Q4 FY 2025 adds to the concern that current margins are under pressure, even though forecasts in the data call for earnings growth of about 34.5% per year over the next three years.

Analysts looking for a more detailed breakdown of how these profit trends fit into a broader story will often turn to a balanced narrative that weighs both the margin pressure and the earnings growth forecasts. You can review that in the 📊 Read the full CSG Systems International Consensus Narrative..

Premium P/E Of 38.6x Versus Peers

- The stock trades on a trailing P/E of 38.6x, compared with a peer average of 26x and a Professional Services industry average of 21.4x, while the current share price of US$79.86 is below a stated DCF fair value of about US$146.81.

- For a bullish narrative, the valuation mix sends a split signal:

- On one hand, the P/E premium suggests the market is already paying more per dollar of trailing earnings than peers, even though trailing net margin is 4.6%, lower than the 7.3% margin a year earlier.

- On the other hand, the data points to a DCF fair value of US$146.81 versus the US$79.86 share price, and an earnings growth forecast of roughly 34.5% per year. Together, these support the idea that forward earnings could matter more than the weaker recent margin history.

Revenue Steady, Profit Trails Behind

- On a trailing basis, revenue is about US$1.2b with an indicated revenue growth forecast of 1.1% per year, while the last four quarters individually ranged between US$297.1 million and US$323.1 million. This sits in contrast to earnings having been negative over the past year as referenced in the analysis data.

- Bears argue that this combination of modest revenue growth and weaker profit metrics challenges the case for paying up for the stock:

- The analysis summary describes earnings over the past year as negative and net margin at 4.6%, even though the five year earnings growth rate averaged 6.2% per year. Recent profitability therefore does not line up neatly with the longer term trend.

- At the same time, the company carries a 1.6% dividend yield and is described as having a high level of debt, which means investors weighing the income stream are also being asked to accept both elevated leverage and a higher P/E multiple than sector and peer averages.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on CSG Systems International's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

CSG Systems International shows tighter margins, weaker recent earnings versus its longer term trend, and a higher P/E alongside commentary about a high level of debt.

If that mix of margin pressure and leverage has you looking for sturdier options, check out our solid balance sheet and fundamentals stocks screener (46 results) to quickly focus on companies with stronger financial footing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.