يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Denny's (NASDAQ:DENN) stock falls 12% in past week as three-year earnings and shareholder returns continue downward trend

Denny's Corporation DENN | 6.21 | +0.16% |

Denny's Corporation (NASDAQ:DENN) shareholders will doubtless be very grateful to see the share price up 30% in the last quarter. Meanwhile over the last three years the stock has dropped hard. Indeed, the share price is down a tragic 58% in the last three years. So the improvement may be a real relief to some. After all, could be that the fall was overdone.

Since Denny's has shed US$27m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

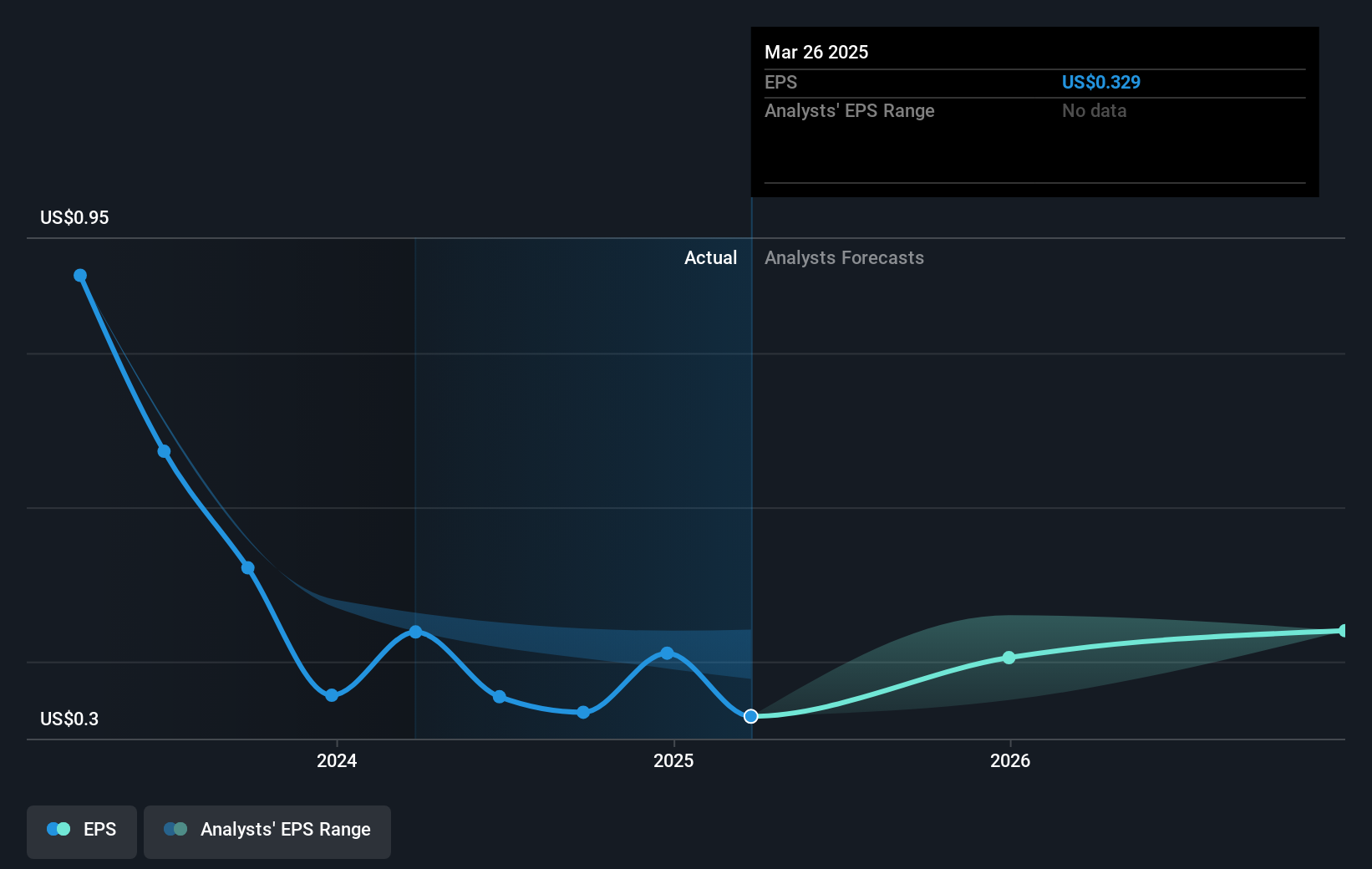

During the three years that the share price fell, Denny's' earnings per share (EPS) dropped by 34% each year. This fall in the EPS is worse than the 25% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business.

A Different Perspective

While the broader market gained around 12% in the last year, Denny's shareholders lost 49%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Denny's is showing 3 warning signs in our investment analysis , and 2 of those don't sit too well with us...

Denny's is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.