يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Did Analyst Concerns Over Slow Growth and High Leverage Just Shift Restaurant Brands International's (QSR) Investment Narrative?

Restaurant Brands International Inc QSR | 69.88 | +0.45% |

- In the past week, analysts voiced concerns about Restaurant Brands International amid slowing sales growth, decreased profitability, and high leverage, prompting renewed caution from investors.

- This marks a turning point, as earlier optimism about the company's capital-light growth strategies and international expansion is now challenged by efficiency issues and elevated risk factors.

- We'll explore how heightened worries around the company's leverage and operational efficiency now shape its future investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Restaurant Brands International Investment Narrative Recap

To be a shareholder in Restaurant Brands International, you need confidence in the company’s ability to sustain growth through its global franchise model and digital modernization despite short-term volatility. The latest analyst caution regarding sales slowdowns and higher leverage doesn't materially change the importance of operational execution as the key short-term catalyst, but it does sharpen focus on the risk that debt pressure could impact future flexibility and profit margins.

Among recent company announcements, Restaurant Brands’ continued commitment to its dividend, confirmed with another US$0.62 per share declaration for Q3 2025, stands out. This move signals management’s intent to maintain shareholder returns even as sales growth and profitability have faced pressures, highlighting the balance the business must strike between returning capital and managing leverage. Yet, investors should also weigh the implications if current profitability trends persist …

Restaurant Brands International is expected to reach $10.1 billion in revenue and $2.0 billion in earnings by 2028. This outlook is based on analysts projecting 3.5% annual revenue growth and a $1.14 billion increase in earnings from the current $862 million.

Uncover how Restaurant Brands International's forecasts yield a $76.32 fair value, a 23% upside to its current price.

Exploring Other Perspectives

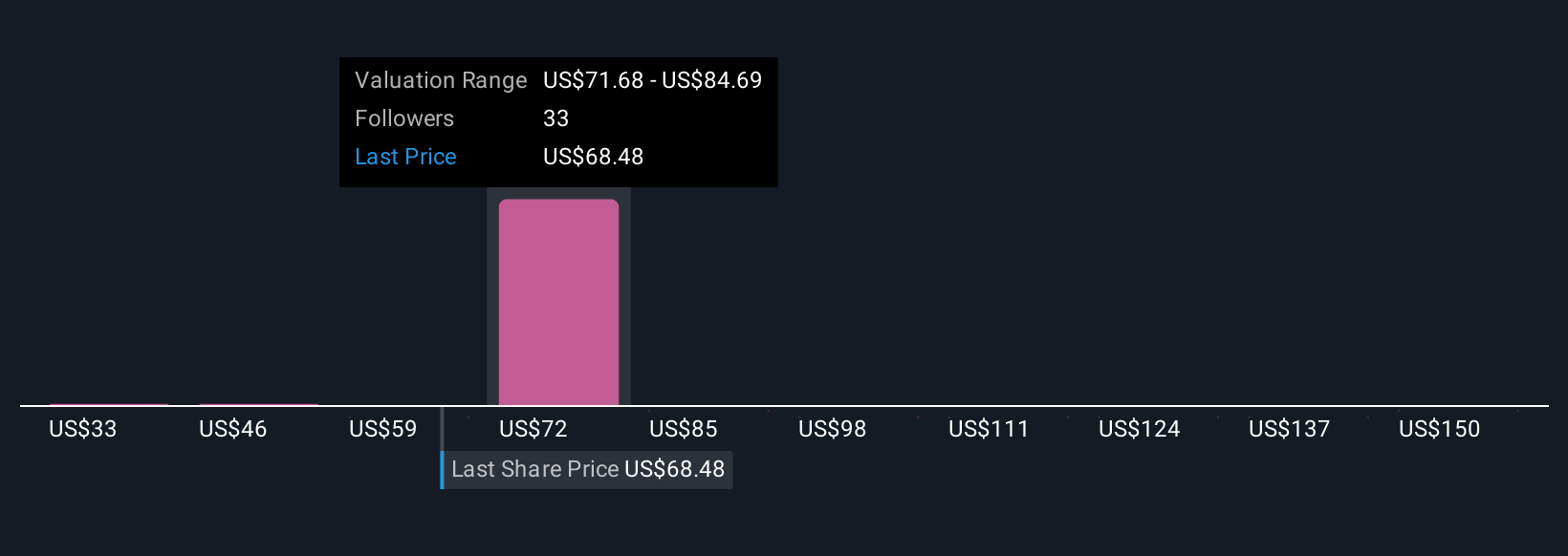

Eight Simply Wall St Community members estimate Restaurant Brands’ fair value from as low as US$32.65 to as high as US$162.75. While opinions on valuation differ sharply, recent market concerns about operational efficiency and debt levels add weight to the conversation about future earnings resilience.

Explore 8 other fair value estimates on Restaurant Brands International - why the stock might be worth over 2x more than the current price!

Build Your Own Restaurant Brands International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Restaurant Brands International research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Restaurant Brands International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Restaurant Brands International's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.