يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Did Keysight’s (KEYS) Advanced HDMI Test Launch Signal a New Era in Electronic Design Validation?

Keysight Technologies Inc KEYS | 208.81 | -2.49% |

- In late August 2025, Keysight Technologies announced the launch of an enhanced HDMI physical layer compliance test solution, along with the introduction of the Smart Bench Essentials Plus portfolio, which delivers advanced core bench instruments for improved testing accuracy and compliance with evolving industry standards.

- These product releases expand Keysight's capabilities in helping engineers manage the growing demands of ultra-high-definition video, high-speed connectivity, and increasingly complex electronic design, placing the company at the forefront of compliance and test solution innovation for next-generation electronic devices.

- We'll now explore how meeting stricter HDMI standard requirements could strengthen Keysight's position in advanced electronic design testing.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Keysight Technologies Investment Narrative Recap

To believe in Keysight Technologies as a shareholder, you need conviction in the company's ability to lead the innovation cycle in electronic design and connectivity testing, especially as new industry standards drive demand for high-precision validation tools. The recent launch of the enhanced HDMI compliance test solution may bolster Keysight’s product positioning, but its impact on near-term results will likely be less significant than mitigation of newly announced tariffs, which remain the main short-term risk to profitability.

Among Keysight’s most recent developments, the upgraded HDMI compliance platform stands out; it complements rising next-generation video and connectivity requirements, reinforcing Keysight’s relevance in advanced markets where rapid adoption of AI and high-speed data centers continues to be the most important growth driver.

However, with cost headwinds from tariffs still in the spotlight, investors should also be aware that if mitigation proves slower or less effective, then...

Keysight Technologies' outlook anticipates $6.3 billion in revenue and $1.2 billion in earnings by 2028. This projection relies on a 6.5% annual revenue growth rate and a $656 million increase in earnings from the current $544 million.

Uncover how Keysight Technologies' forecasts yield a $187.60 fair value, a 15% upside to its current price.

Exploring Other Perspectives

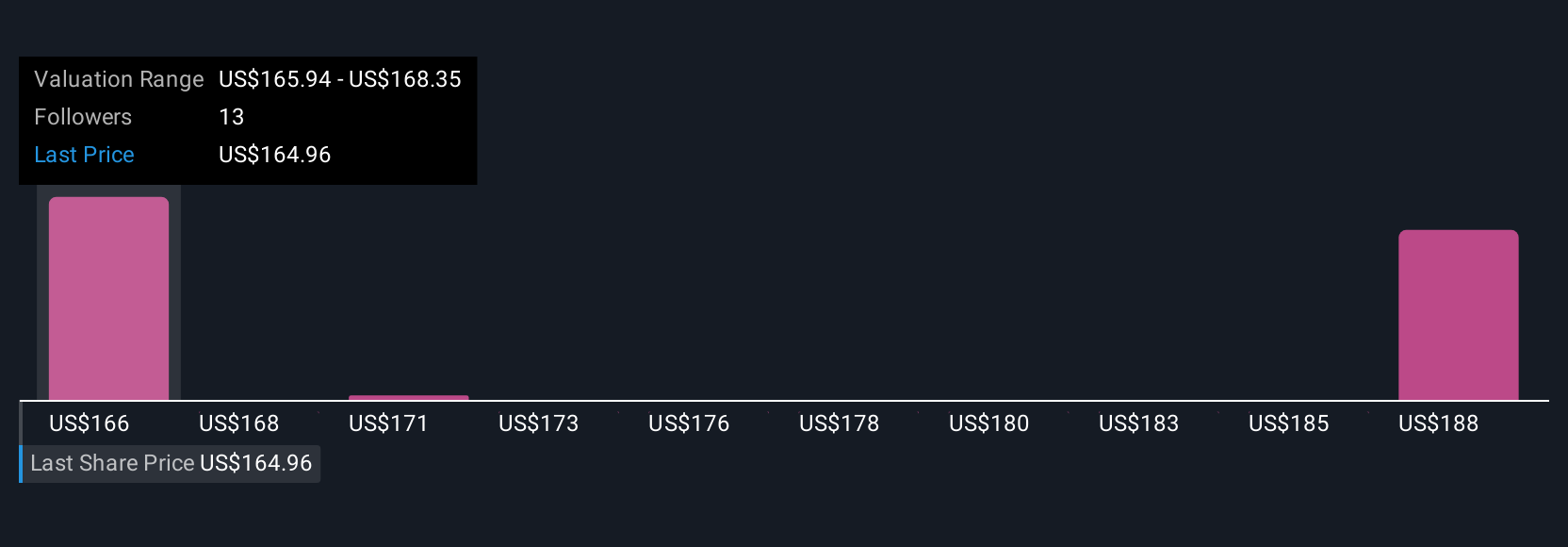

Five fair value estimates from the Simply Wall St Community span US$157 to US$190 per share. Investor opinions vary widely, with many weighing ongoing tariff risks that could still influence Keysight’s margins and competitive stance.

Explore 5 other fair value estimates on Keysight Technologies - why the stock might be worth as much as 16% more than the current price!

Build Your Own Keysight Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Keysight Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Keysight Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Keysight Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.