يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Did New Scrutiny Of Slowing Sales And Cash Flows Just Shift Iridium Communications' (IRDM) Investment Narrative?

Iridium Communications Inc. IRDM | 22.92 | -0.69% |

- Iridium Communications recently drew fresh attention after mixed brokerage commentary and new analyst coverage highlighted its slowing sales trends and pressure on free cash flow margins.

- The renewed research focus has sharpened debate around how effectively Iridium converts its capital spending into returns, putting management’s capital allocation decisions under a brighter spotlight.

- We’ll now examine how these questions about capital allocation and growth efficiency may shape Iridium Communications’ broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Iridium Communications' Investment Narrative?

For Iridium Communications to make sense in a portfolio, you need to believe its niche satellite network, government ties and expanding IoT partnerships can justify ongoing capital intensity and a modest revenue growth profile. The recent analyst coverage and share-price drop do not fundamentally change the near term story, but they do pull execution risk into sharper focus. Slower expected sales growth and weaker free cash flow margins, on top of earlier guidance trimming, make capital allocation the key catalyst: how Iridium balances dividends, buybacks and investment in projects like Vodafone IoT and direct-to-device services. The shift to the S&P 600 and steady dividend increases still support a shareholder-friendly message, but the latest research commentary underlines that the margin and return on capital debate is now central to the investment case.

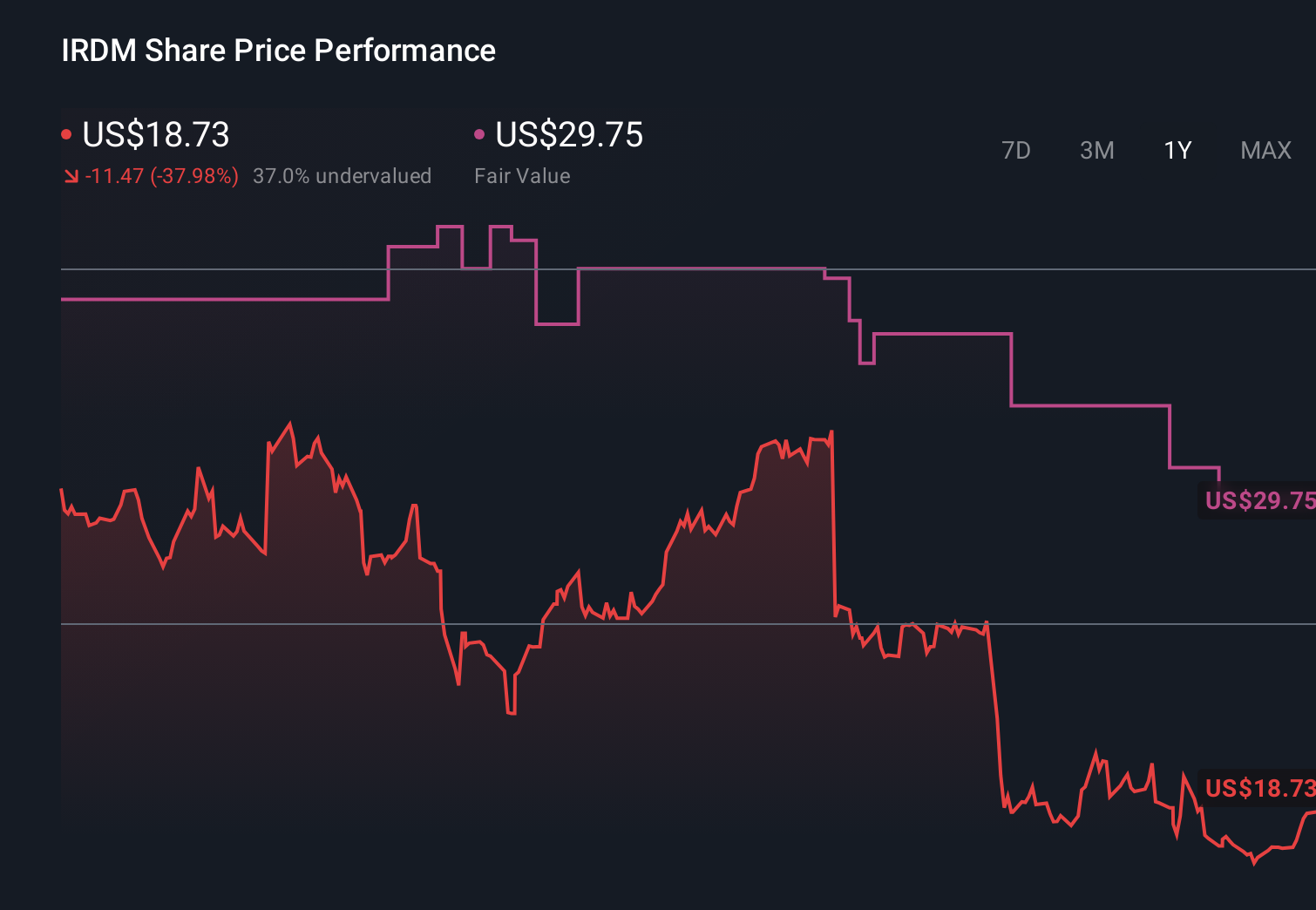

However, investors should be aware of how weaker free cash flow could constrain future flexibility. Despite retreating, Iridium Communications' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Seven Simply Wall St Community members see Iridium’s fair value anywhere from about US$16 to just over US$70, a very large spread that reflects sharply different expectations for long term returns on its heavy investment. Set that against growing concern over slowing sales and pressured free cash flow margins, and it becomes clear why opinions diverge so widely and why it is worth weighing several viewpoints before deciding how Iridium fits into your own expectations.

Explore 7 other fair value estimates on Iridium Communications - why the stock might be worth over 3x more than the current price!

Build Your Own Iridium Communications Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iridium Communications research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Iridium Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iridium Communications' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.