يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Did Patient Safety Allegations Just Shift Encompass Health's (EHC) Investment Narrative?

Encompass Health Corporation EHC | 108.01 | +0.39% |

- In July 2025, Encompass Health came under regulatory and legal scrutiny after the publication of a New York Times article alleging below-average safety performance and higher patient fatality rates at its hospitals, prompting multiple law firm investigations into the company’s business practices.

- This heightened scrutiny highlights the significant reputational and compliance risks facing healthcare providers, even during periods of operational expansion and recent dividend increases.

- We'll examine how regulatory probes and questions about patient safety may reshape Encompass Health's investment narrative and risk outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Encompass Health Investment Narrative Recap

To own shares of Encompass Health, investors need to believe in the ongoing demand for inpatient rehabilitation services and the company’s ability to execute on expansion plans while maintaining efficient operations. However, the recent regulatory attention and legal probes following allegations of below-average patient safety and higher fatality rates have brought significant near-term risk, casting uncertainty over both the company's operational momentum and its reputation. This scrutiny could potentially outweigh short-term catalysts, such as earnings or facility growth, depending on any regulatory developments that follow.

Amid this turbulence, Encompass Health’s announcement of a $0.02 dividend increase to $0.19 per share reflects the board’s confidence in the company’s underlying financial footing and continuing cash generation. Yet, even with these signals of financial strength, the relevance of compliance and safety risks has sharply increased, pushing these issues to the forefront of what shareholders need to watch ahead of the next earnings report.

By contrast, what many investors may not realize is just how quickly a reputational issue can ...

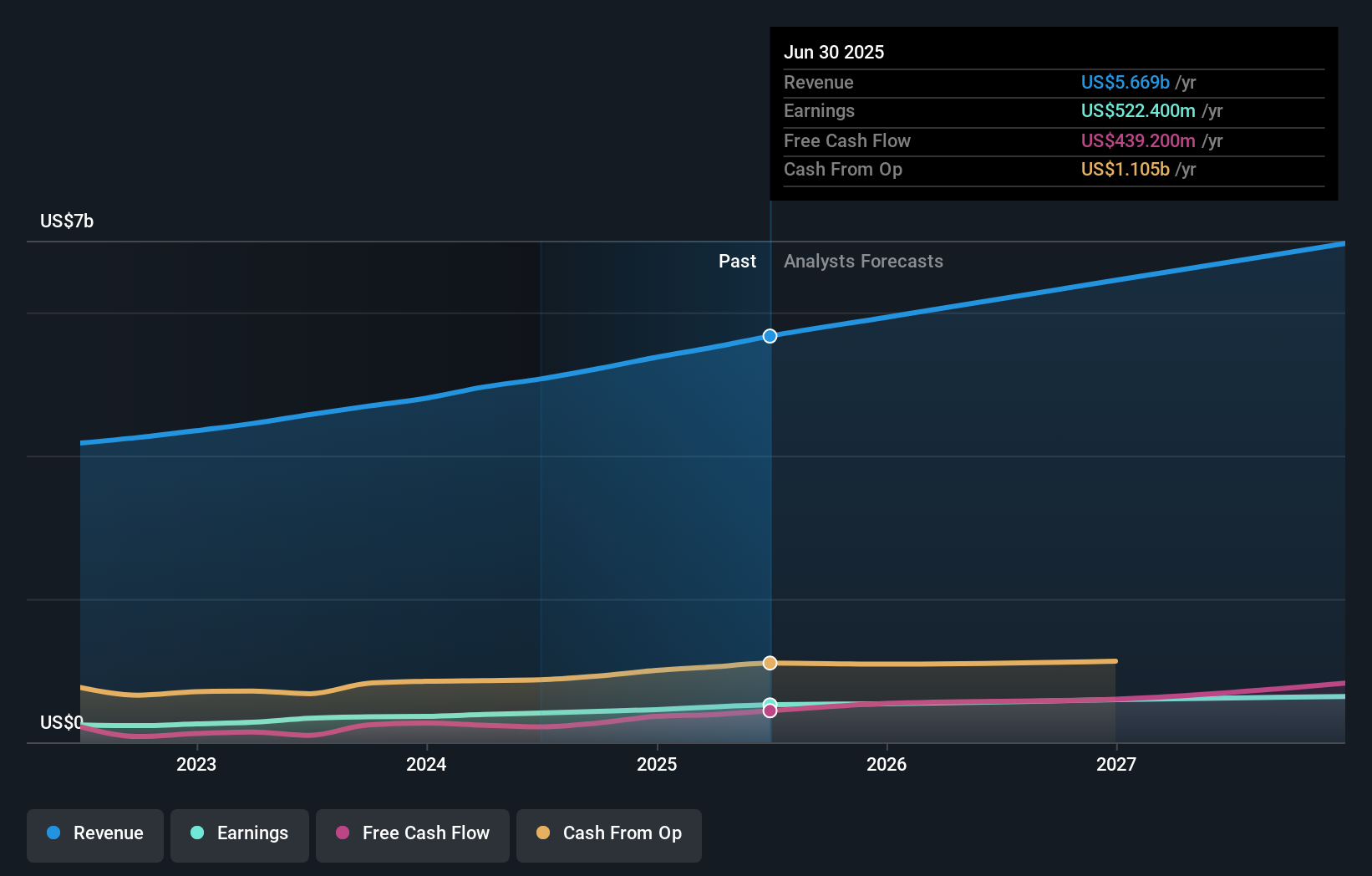

Encompass Health's outlook anticipates $7.0 billion in revenue and $647.8 million in earnings by 2028. This requires 8.2% annual revenue growth and a $153.5 million increase in earnings from the current $494.3 million.

Uncover how Encompass Health's forecasts yield a $131.58 fair value, a 20% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community estimates fair value at US$131.58 across 1 analysis, with no variation in perspectives. As regulatory risk rises, your view on compliance could shape your expectations for Encompass Health ahead.

Explore another fair value estimate on Encompass Health - why the stock might be worth just $131.58!

Build Your Own Encompass Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Encompass Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Encompass Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Encompass Health's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.