يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Did Pediatrix Medical Group's (MD) Swing to Profit Signal a Turning Point in Its Investment Narrative?

MEDNAX, Inc. MD | 22.50 | 0.00% |

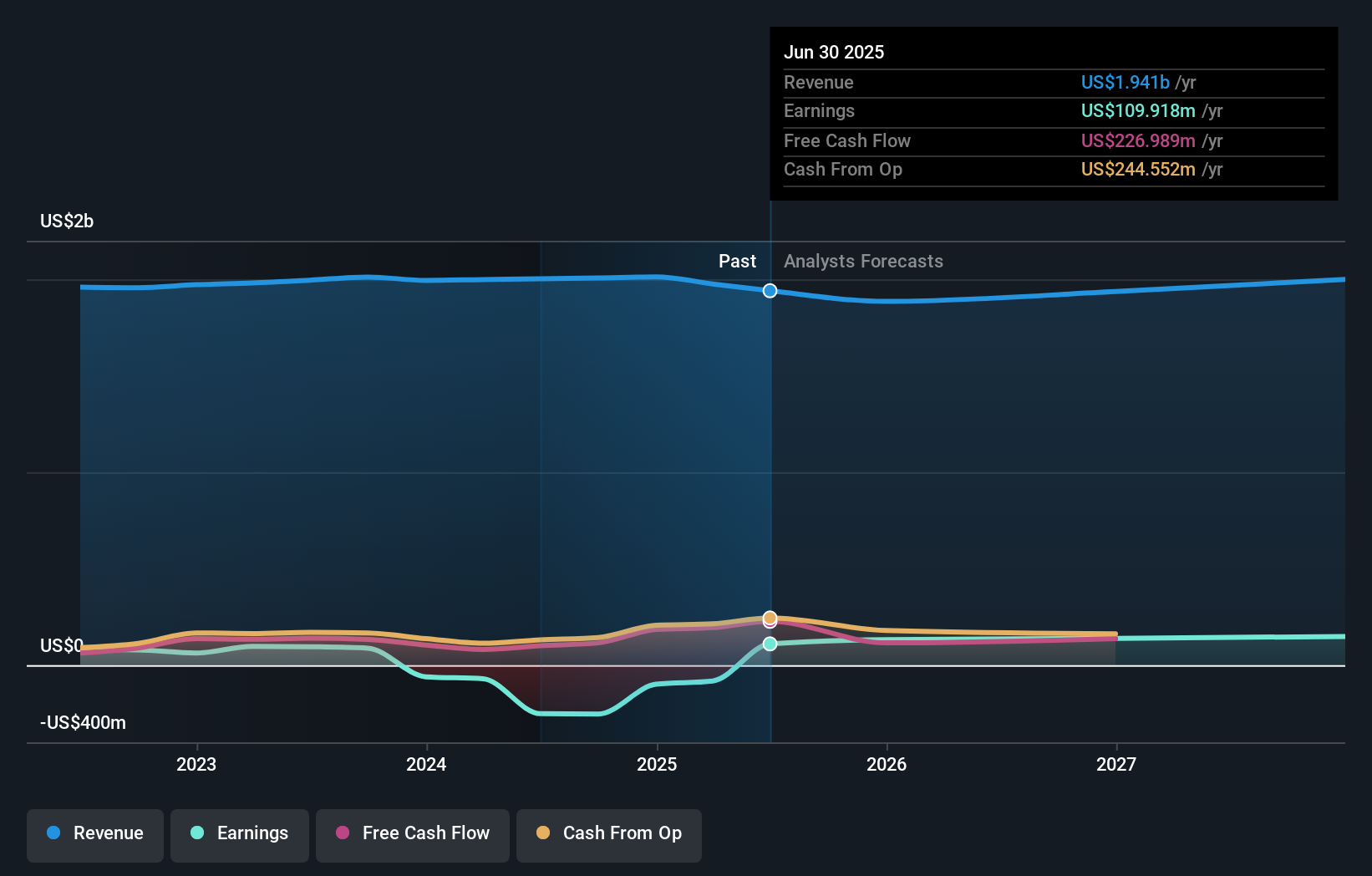

- In the past year, Pediatrix Medical Group moved from a loss to a profit in its earnings per share, highlighting an earnings inflection point even though revenue declined by 7% year-over-year.

- Despite this revenue drop, analysts remain optimistic, with no sell ratings and a forward P/E ratio that suggests the company may be undervalued compared to industry peers.

- We'll now examine how the company's return to profitability influences Pediatrix Medical Group's overall investment narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Pediatrix Medical Group Investment Narrative Recap

To be a shareholder in Pediatrix Medical Group, you need confidence in the demand for pediatric and neonatal care, and believe that the company’s improving profitability can offset ongoing challenges with revenue growth. The recent shift from a loss to profitability is an encouraging development and has buoyed short-term sentiment, but the main catalyst remains the company’s ability to sustain margin improvements. The most significant risk still centers on whether restructuring-driven revenue declines can be sufficiently counterbalanced by growth in core service volumes; this news does not materially change that focus.

Among recent company announcements, the approval of a new US$250 million share repurchase program in August 2025 stands out. While the new buyback authorization demonstrates capital flexibility after returning to profitability, its lasting impact will likely depend on whether the company can maintain consistent earnings and revenue stabilization, a critical watchpoint given the recent swing in earnings results.

However, investors should be aware that in contrast to the positive earnings swing, the persistent pressure from portfolio restructuring on top-line growth is a real concern that could...

Pediatrix Medical Group's narrative projects $2.1 billion revenue and $145.1 million earnings by 2028. This requires 2.5% yearly revenue growth and a $35.2 million earnings increase from $109.9 million today.

Uncover how Pediatrix Medical Group's forecasts yield a $16.71 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from four members of the Simply Wall St Community range from as low as US$0.16 up to US$24.08 per share. These wide-ranging views reflect sharply differing expectations for Pediatrix Medical Group's recovery, while revenue volatility from restructuring remains a key topic to watch for future growth stability.

Explore 4 other fair value estimates on Pediatrix Medical Group - why the stock might be worth as much as 41% more than the current price!

Build Your Own Pediatrix Medical Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pediatrix Medical Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pediatrix Medical Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pediatrix Medical Group's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.