يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Did Record-Breaking Earnings Just Shift United Bankshares' (UBSI) Investment Narrative?

United Bankshares, Inc. UBSI | 39.50 | -0.40% |

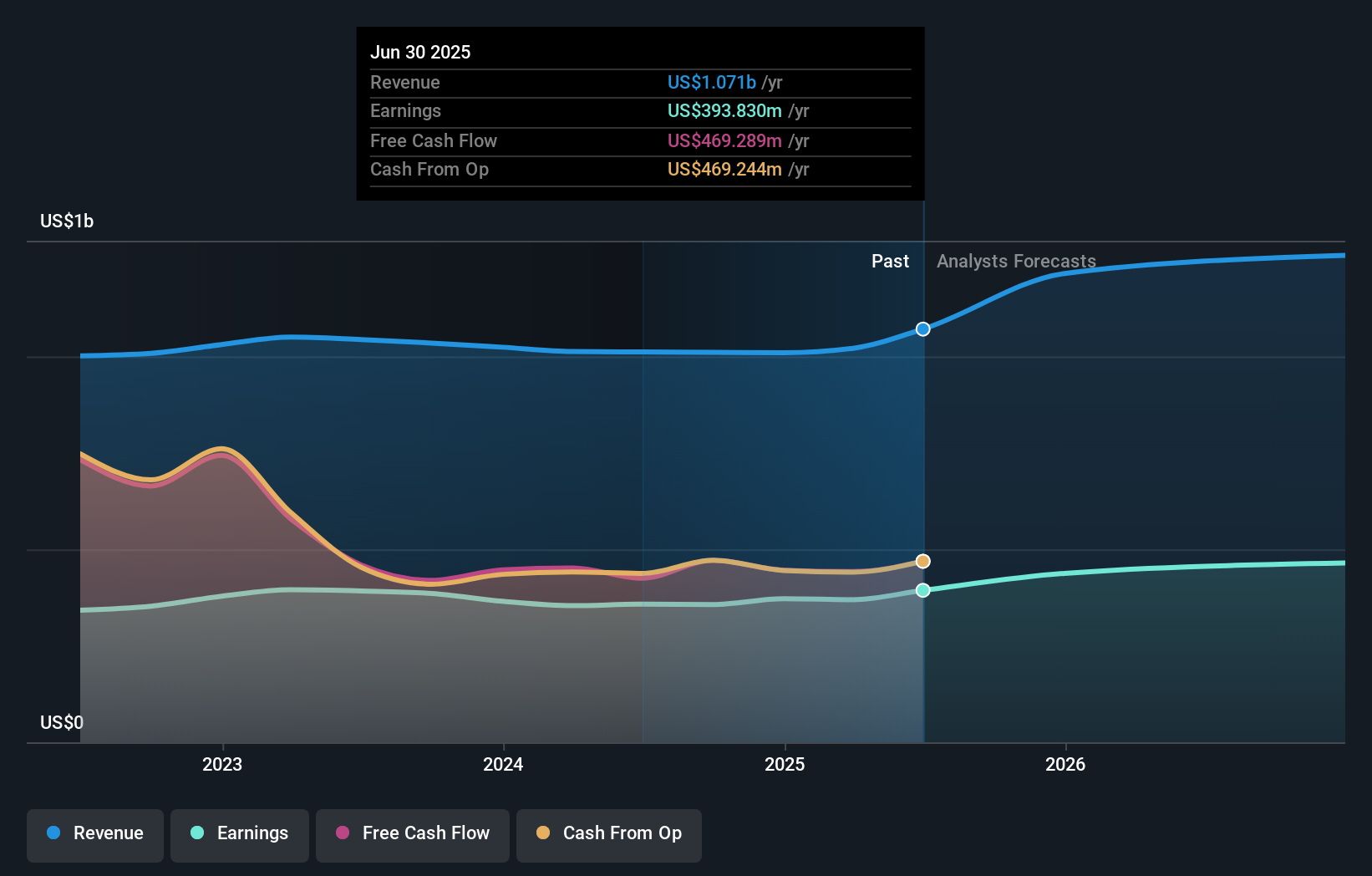

- In the past week, United Bankshares announced its strongest earnings quarter in company history, with both revenue and net interest income exceeding analyst expectations.

- This record-breaking performance highlights robust underlying operations and may signal increased confidence in United Bankshares’ ability to expand its earnings power.

- We’ll examine how surpassing analyst forecasts for both revenue and net interest income shapes United Bankshares' investment story going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is United Bankshares' Investment Narrative?

For anyone considering United Bankshares, it’s important to weigh the broader story that underpins an investment case: steady growth, a strong dividend track record, and stable management. The recent earnings beat does add weight to short-term catalysts, suggesting that operational momentum and earnings quality could become more prominent in the coming quarters. These positive results could soften some immediate concerns, such as the modest underperformance versus broader banks and ongoing questions about return on equity. However, the business still faces sector-wide challenges, and its valuation appears slightly rich relative to industry peers based on the latest price-to-earnings ratios. While the latest financial report may ease near-term risk perceptions, shifts in credit quality or market conditions remain the most pressing variables to watch, especially given the consistent, yet slowly rising, rate of charge-offs seen lately. But keep in mind, rising credit costs could challenge future profitability.

Despite retreating, United Bankshares' shares might still be trading 34% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on United Bankshares - why the stock might be worth as much as 8% more than the current price!

Build Your Own United Bankshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Bankshares research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free United Bankshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Bankshares' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.