يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Did Rising Aero-Defense Orders and Leadership Changes Just Shift ATI's (ATI) Investment Narrative?

ATI Inc. ATI | 143.93 | +2.95% |

- Recently, several research firms expressed increased confidence in ATI, citing stronger aerospace and defense order activity and ongoing strength in jet engine and maintenance markets, alongside leadership changes including a new Chief Financial Officer effective January 2026 and the current CEO’s planned transition to Board Chair in May 2026.

- The concentration of analyst optimism around ATI’s aerospace and defense exposure highlights how improving OEM demand and a tight aftermarket are becoming central to the company’s outlook.

- With analysts pointing to rising aerospace and defense OEM order activity as a key driver, we’ll now examine how this reshapes ATI’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ATI Investment Narrative Recap

To own ATI, you need to be comfortable with a thesis anchored in aerospace and defense materials demand, especially jet engines and aftermarket support, while accepting exposure to softer industrial and medical markets. Recent analyst target increases tied to stronger OEM order activity appear supportive of the current aerospace led catalyst, but they do not fundamentally change ATI’s key risk around customer concentration and the health of non aerospace segments in the near term.

The leadership transition announced in December, with J. Robert Foster set to become CFO in January 2026 and the current CEO moving to Board Chair in May 2026, is particularly relevant here because it comes alongside higher capital needs and continued investment in high performance materials capacity. How effectively this new finance leadership balances growth investments, debt levels and cash returns could influence how much ATI benefits from stronger aerospace and defense demand.

However, investors should also weigh how ATI’s dependence on a small group of large aerospace OEMs could affect results if ...

ATI's narrative projects $5.5 billion revenue and $635.6 million earnings by 2028.

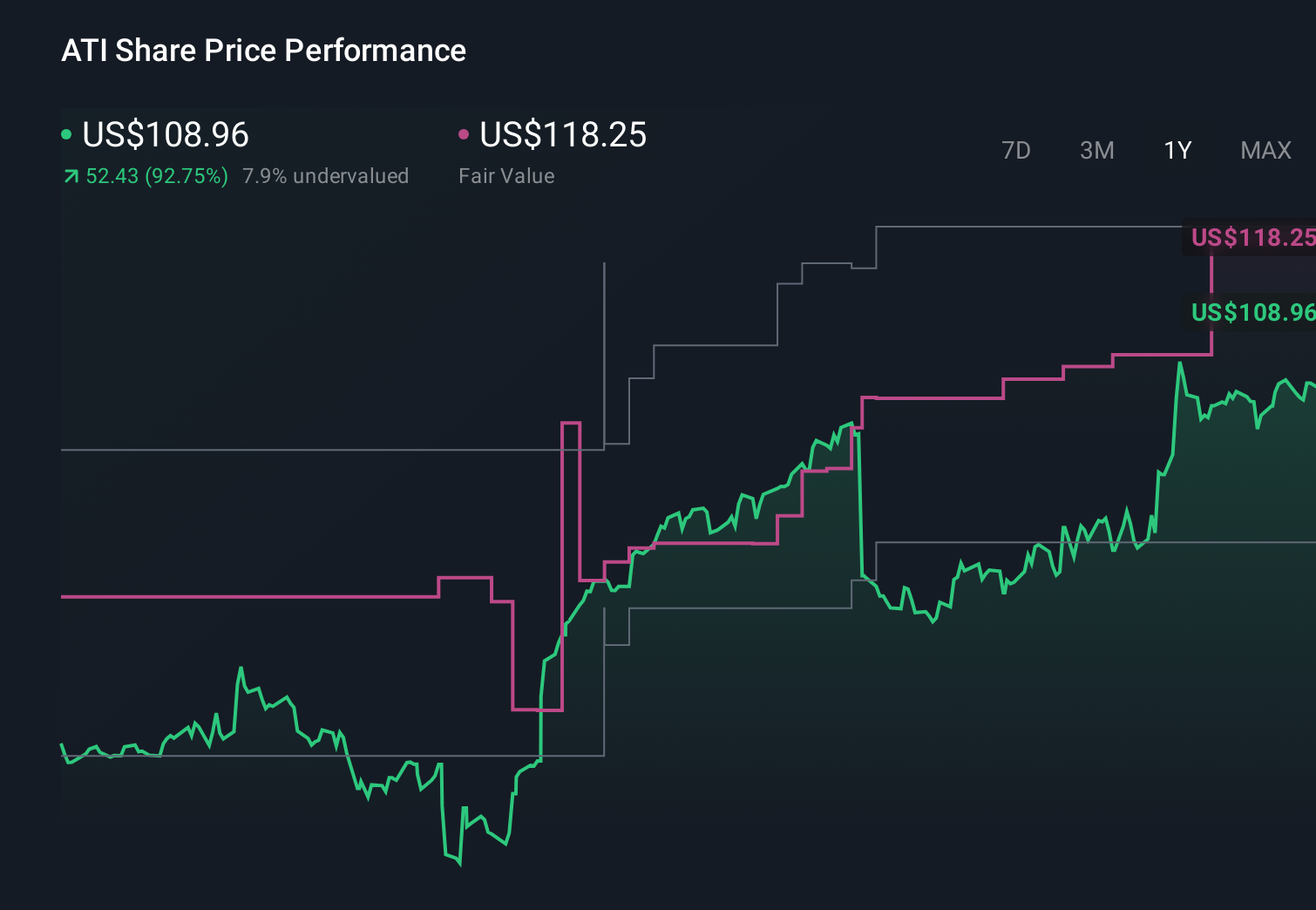

Uncover how ATI's forecasts yield a $118.25 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span roughly US$62.70 to US$133.11, showing how far individual views on ATI can stretch. Against this wide range, the recent focus on stronger aerospace and defense OEM order activity as a core catalyst underlines why you may want to compare several different risk and growth assumptions before forming your own view.

Explore 5 other fair value estimates on ATI - why the stock might be worth 50% less than the current price!

Build Your Own ATI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ATI research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ATI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ATI's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.