يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Did SnapInspect’s Integration Just Enhance AppFolio’s (APPF) Platform Appeal for Property Managers?

AppFolio Inc Class A APPF | 172.23 | -2.35% |

- Earlier this week, SnapInspect announced the integration of its property inspection and maintenance software into the AppFolio Stack™ Marketplace, enabling real-time updates, automated work orders, and seamless data sync for property managers.

- This collaboration enhances operational efficiency for multifamily and apartment managers by automating maintenance workflows and improving visibility across property portfolios.

- We’ll explore how SnapInspect’s integration and its automation capabilities could enhance AppFolio’s long-term platform appeal and investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

AppFolio Investment Narrative Recap

To believe in AppFolio as a shareholder, you need to have conviction that property management software will keep shifting toward integrated, AI-powered platforms that drive automation and operational excellence, fueling customer acquisition, stickiness, and pricing power. While the SnapInspect integration highlights AppFolio’s commitment to richer workflows and partner ecosystems, the immediate effect on accelerating new customer wins, arguably the biggest short-term catalyst, appears incremental rather than transformative. The most pressing risk remains competitive pressure causing potential commoditization and margin compression; this news does not materially change that concern.

One recent announcement with strong relevance is AppFolio's July partnership with Obligo, which introduced flexible deposit options for renters and broadened the platform’s financial services. This move, much like the SnapInspect integration, expands the range of third-party capabilities available through AppFolio Stack and supports its goal of creating a seamless, end-to-end property management experience, which can be a critical catalyst for platform adoption.

By contrast, with platform stickiness increasingly dependent on third-party integrations, investors should be aware of the risk that comes if AppFolio loses key partners or faces...

AppFolio's outlook projects $1.4 billion in revenue and $192.0 million in earnings by 2028. This implies a 17.7% annual revenue growth and a $11.1 million decrease in earnings from the current $203.1 million.

Uncover how AppFolio's forecasts yield a $317.20 fair value, a 28% upside to its current price.

Exploring Other Perspectives

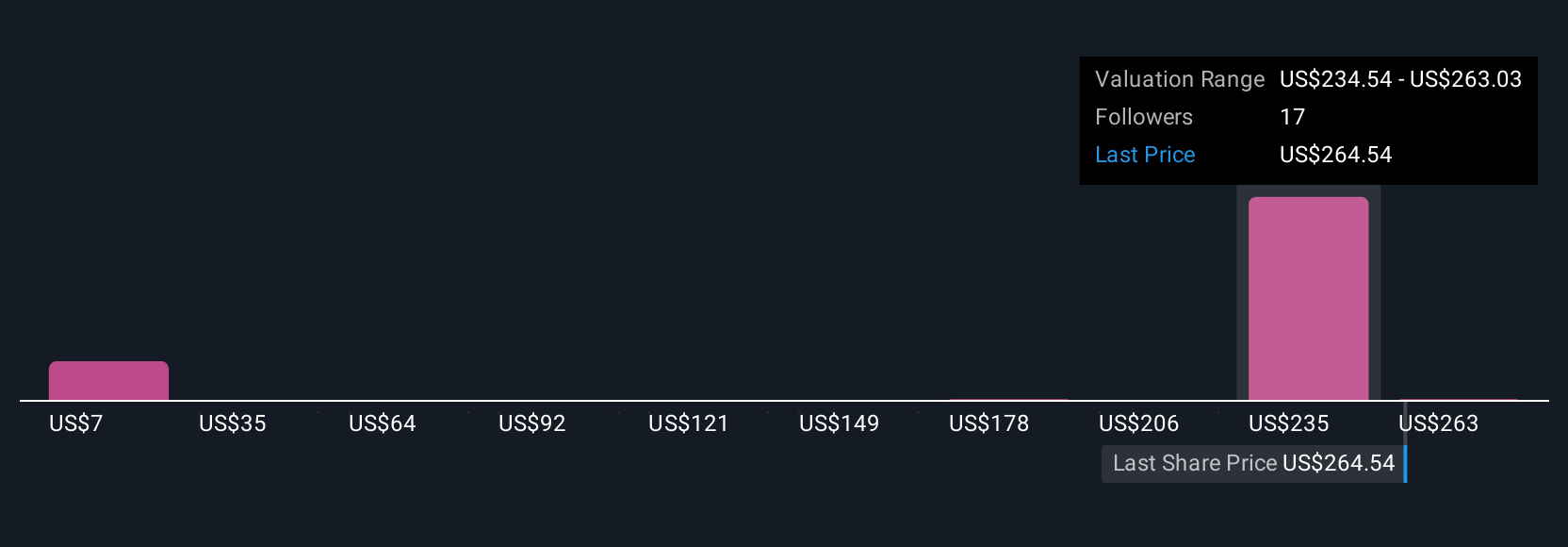

Five independent fair value estimates from the Simply Wall St Community span from US$192.61 to US$317.20 per share, showing diverse expectations for AppFolio’s growth and profitability. Many also highlight that platform partnerships are now central for sustaining customer loyalty, with broader implications for future market differentiation.

Explore 5 other fair value estimates on AppFolio - why the stock might be worth as much as 28% more than the current price!

Build Your Own AppFolio Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AppFolio research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AppFolio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AppFolio's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.