يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Does Recent 14% Jump Signal Hidden Value in USA Compression Partners for 2025?

USA Compression Partners LP USAC | 26.72 26.72 | +1.40% 0.00% Post |

- Wondering if USA Compression Partners could be a hidden value in today’s market? You’re not alone. It’s a popular question among investors searching for reliable growth and income.

- The stock has seen positive momentum lately, rising 6.5% in the last week, jumping 14.1% over the past month, and posting a strong 14.3% gain in the past year. This has helped it outpace many sector peers.

- Much of this movement follows industry-wide optimism about growing demand for natural gas infrastructure, as well as renewed attention on midstream energy names. Recent analyst upgrades and speculation on new pipeline investments have also caught investors’ attention, fueling further interest in the stock.

- If you’re keeping score, USA Compression Partners currently lands a 3 out of 6 on our valuation checks. Next, let's break down exactly how we arrive at that score. Stick around, because we’ll wrap up with a smarter perspective for valuing the company that investors sometimes overlook.

Approach 1: USA Compression Partners Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by forecasting its future cash flows and discounting them back to their present value. This approach provides a forward-looking measure that attempts to capture a company's true worth beyond short-term market swings.

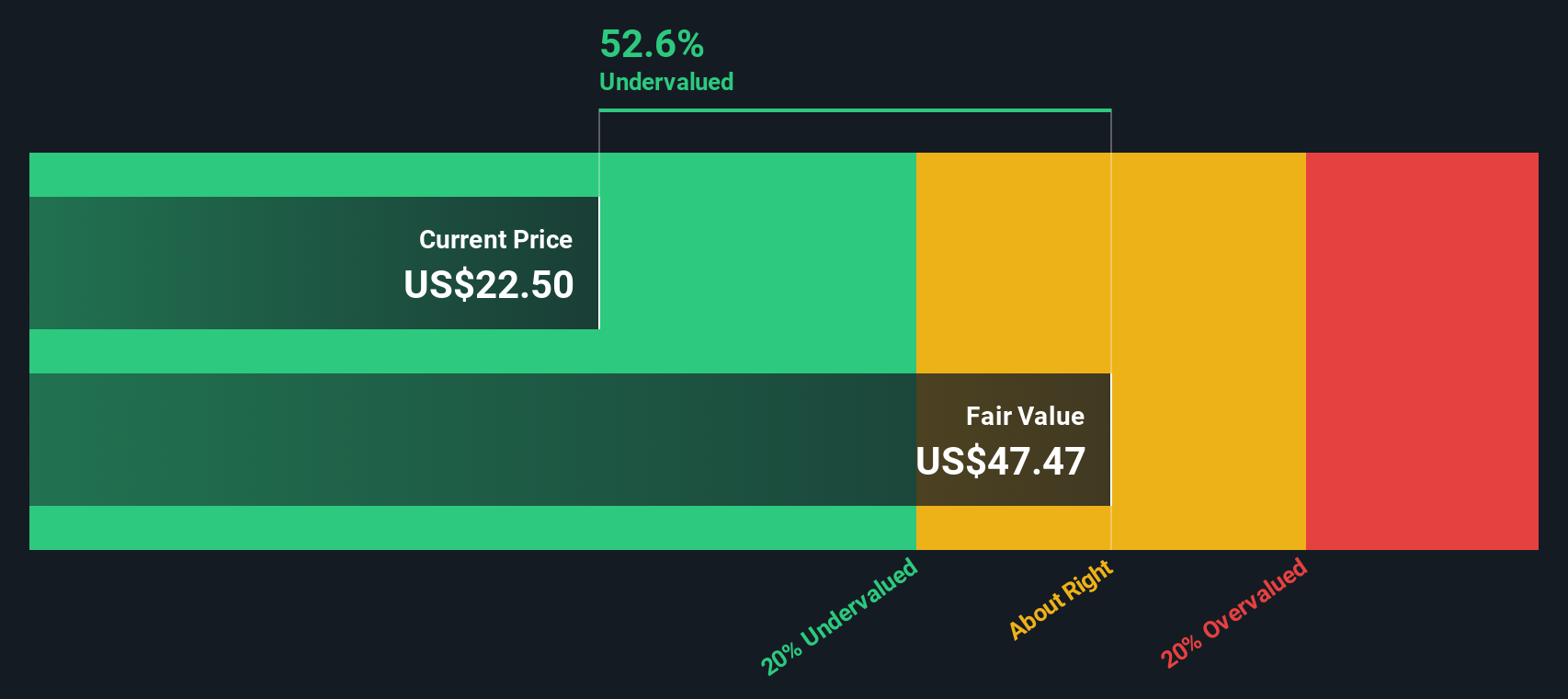

For USA Compression Partners, the DCF analysis starts with its latest twelve-month Free Cash Flow of $183.55 million. Analysts project this figure to steadily increase, reaching $254.67 million by the end of 2026. Over the next decade, further annual increases are extrapolated, with projections as high as $522.01 million in 2035. These forecasts are discounted to today’s dollars using appropriate rates, ensuring that long-range growth assumptions do not overly inflate present value.

The resulting intrinsic value estimated by this DCF model is $58.42 per share. Compared to recent market prices, this calculation indicates the stock is currently trading at a 56.9% discount to its estimated true value. This suggests that the shares appear significantly undervalued from the perspective of long-term cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests USA Compression Partners is undervalued by 56.9%. Track this in your watchlist or portfolio, or discover 923 more undervalued stocks based on cash flows.

Approach 2: USA Compression Partners Price vs Earnings

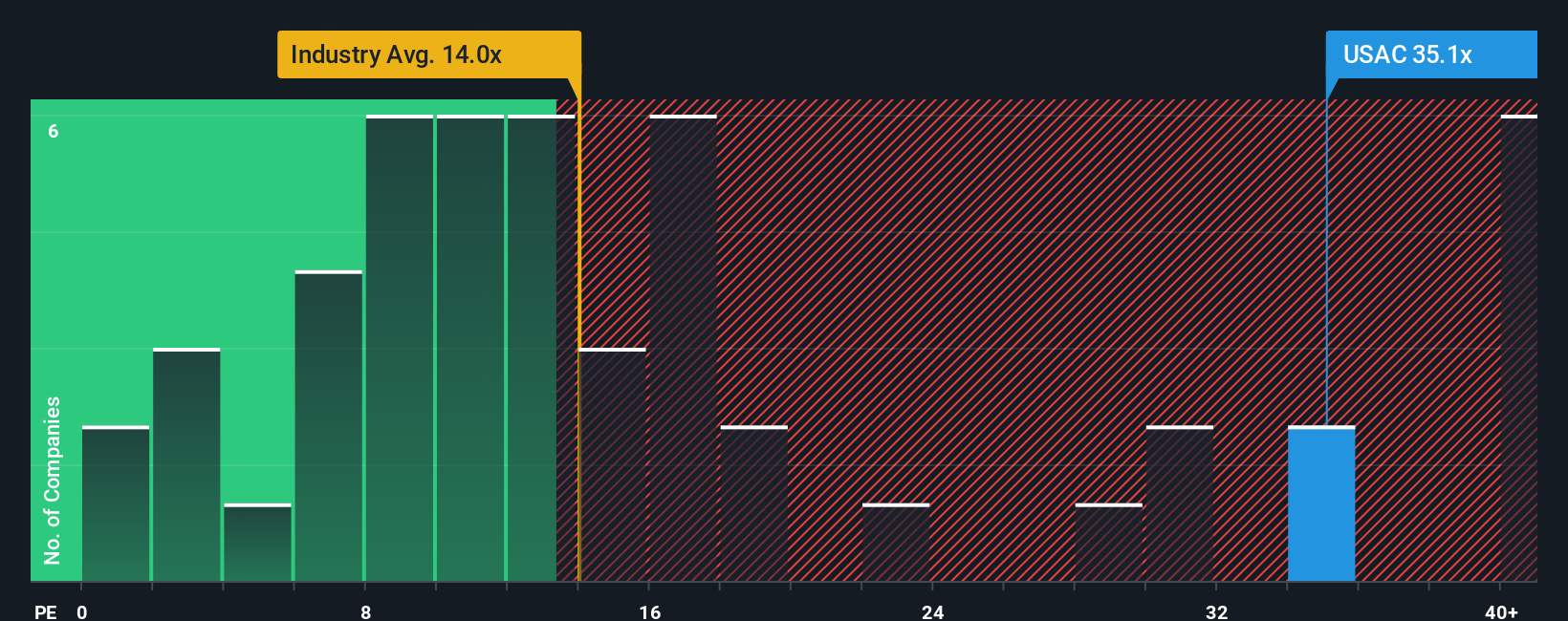

The Price-to-Earnings (PE) ratio is the preferred way to value profitable companies like USA Compression Partners because it directly measures how much investors are willing to pay for each dollar of earnings. For businesses that generate consistent profits, the PE ratio offers a straightforward sense of value and market sentiment.

A "normal" or "fair" PE ratio for any company depends on growth and risk. Companies expected to grow faster, with higher margins or lower risk, usually trade at higher PE multiples. In contrast, slow-growing or riskier businesses should have lower PE ratios to reflect future uncertainty.

Right now, USA Compression Partners trades at a PE ratio of 32.1x. This compares closely with the peer average of 32.5x, but it is almost double the broader Energy Services industry average of 16.86x. These benchmarks indicate how the stock compares to similar businesses and the general sector.

The proprietary "Fair Ratio" from Simply Wall St builds on these basics. Unlike a straight industry or peer comparison, the Fair Ratio (19.09x for USA Compression Partners) factors in the company’s specific growth forecasts, profit margins, risk profile, industry group, and even its market cap. By accounting for all these key dimensions, the Fair Ratio provides a more precise benchmark of what the company's PE ratio should be. This helps investors avoid the pitfalls of simple averages that may not reflect real business fundamentals.

Comparing these figures, USA Compression Partners trades well above its Fair Ratio at 32.1x versus 19.09x. This suggests the market is pricing in much stronger performance or is more optimistic than the numbers currently justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1438 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your USA Compression Partners Narrative

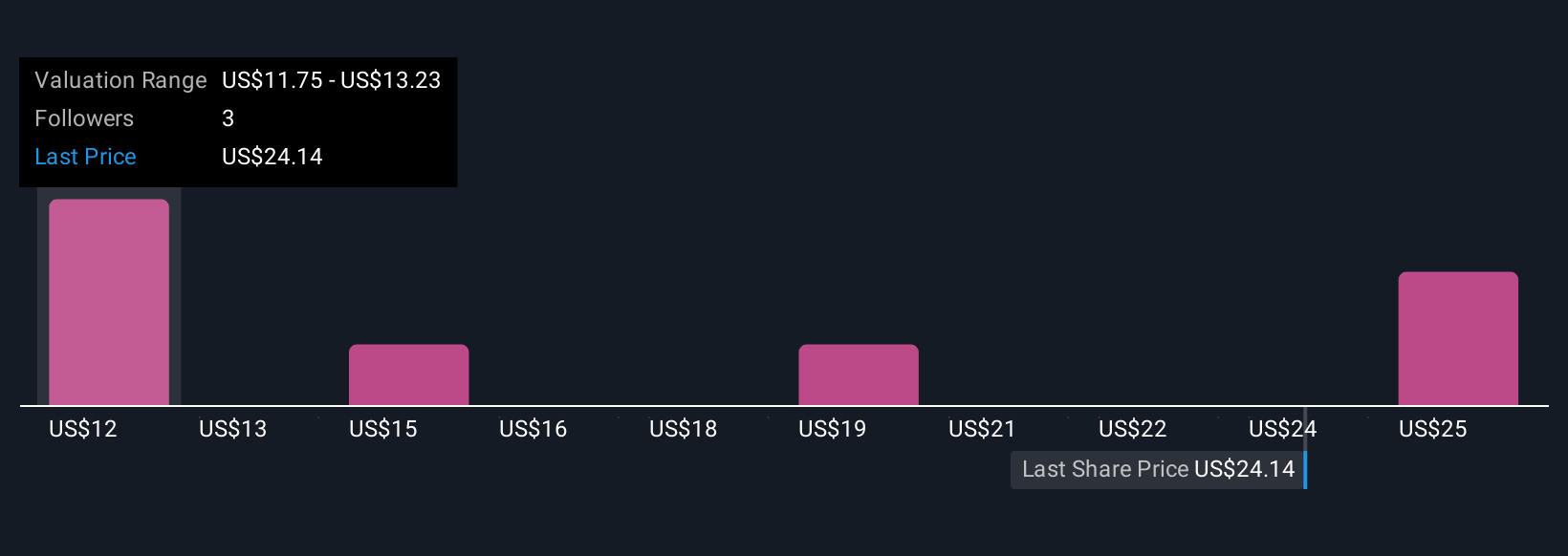

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives let you connect your own story or perspective about a company to the financial numbers, such as your estimates of future revenue, earnings, and margins, and the resulting fair value. In simple terms, a Narrative is the big picture behind the numbers. It clarifies why you believe a company is undervalued, fairly priced, or overvalued and lets you anchor investment decisions to your own view of how the business will perform.

On Simply Wall St's Community page, Narratives are a clear and accessible tool used by millions of investors. They help you see how a company’s story links directly to a financial forecast and then translates to a fair value, making it easier to decide whether to buy or sell by comparing this fair value with the current share price. Plus, Narratives update automatically as new information comes in, such as earnings releases or major news, so your investment thesis always stays current with the latest developments.

For example, with USA Compression Partners, some investors expect robust growth from expanding LNG exports and new data center demand, setting a bullish fair value of $30.00. Others remain cautious about rising costs and industry risks, justifying a lower target of $23.00.

Do you think there's more to the story for USA Compression Partners? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.