يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Does Record US$21.6 Billion Backlog and New Contracts Change The Bull Case For Tutor Perini (TPC)?

Tutor Perini Corporation TPC | 75.09 | -0.11% |

- Recently, analysts issued upbeat commentary on Tutor Perini’s outlook, highlighting improved profitability prospects as the company converts its higher‑margin backlog into revenue and pointing to two newly awarded contracts worth over US$260 million that pushed its project backlog to a record US$21.6 billion by the end of Q3 2025.

- This combination of analyst confidence and backlog expansion adds weight to the view that Tutor Perini’s long-term revenue visibility is improving as it secures and begins to execute larger, higher‑margin projects.

- We’ll now examine how this record US$21.6 billion backlog and recent contract wins reshape Tutor Perini’s existing investment narrative and risks.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Tutor Perini Investment Narrative Recap

To own Tutor Perini, you need to believe the company can steadily convert its record US$21.6 billion backlog into profitable work while avoiding a repeat of past cost overruns and contract disputes. The recent analyst optimism and backlog-related share price move support the near term profit improvement story, but they do not remove the central risk that large, complex projects can still produce earnings volatility if execution falters.

Among recent developments, the two new contracts worth over US$260 million stand out because they directly contribute to the record backlog that underpins current expectations for higher margin work. These awards reinforce the idea that upcoming project execution is now the key catalyst for Tutor Perini, as investors watch to see whether these larger jobs translate into cleaner earnings rather than future litigation or write downs.

But while the backlog story is appealing, the ongoing exposure to mega project cost overruns is something investors should be aware of as...

Tutor Perini's narrative projects $7.1 billion revenue and $515.9 million earnings by 2028.

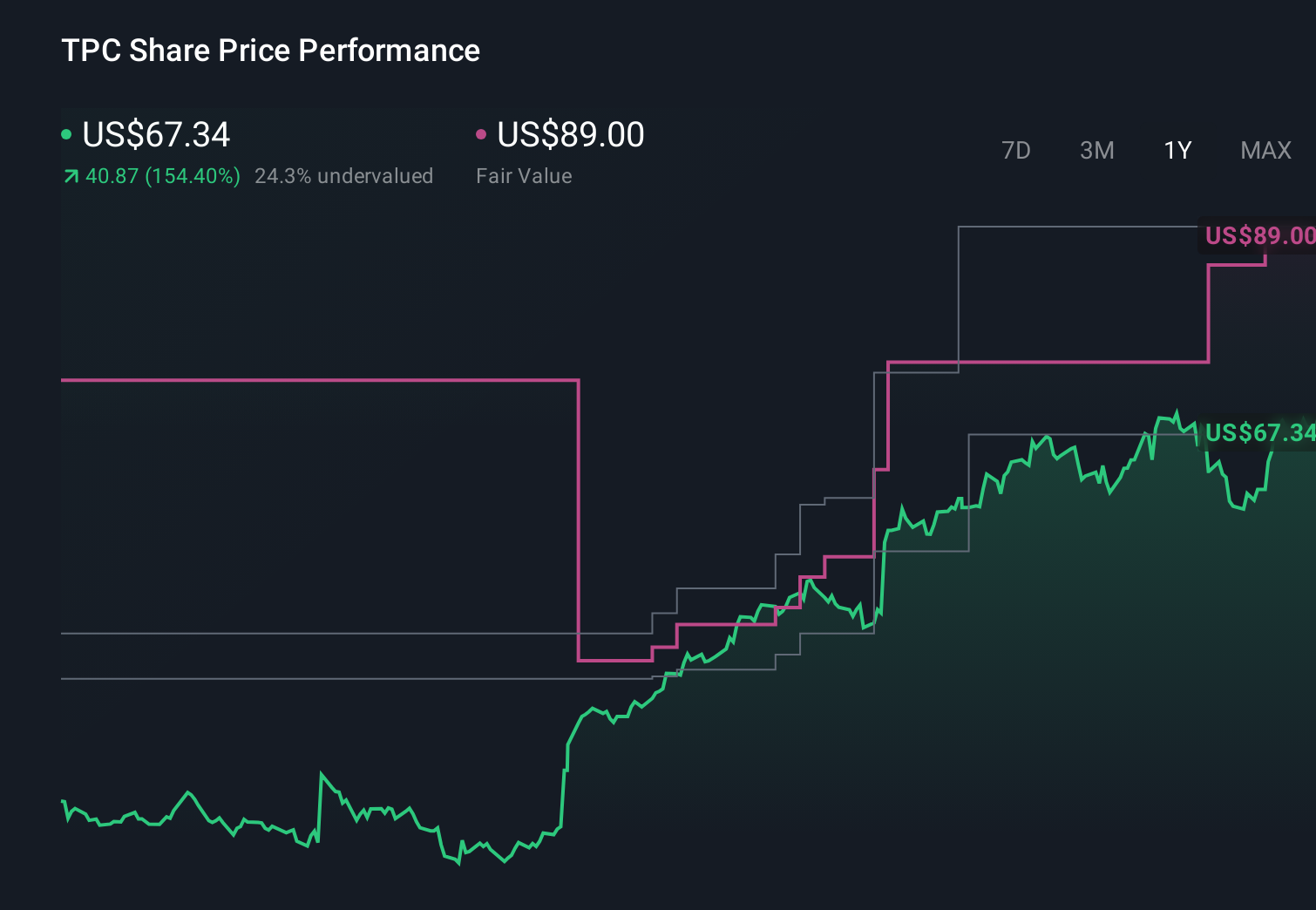

Uncover how Tutor Perini's forecasts yield a $89.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently see fair value for Tutor Perini between US$79.89 and US$89.00, highlighting a tight cluster of optimistic views. You can set those expectations against the company’s heavy reliance on a small number of very large public projects, which can amplify both execution risk and future earnings swings, and then explore how different investors weigh those trade offs.

Explore 4 other fair value estimates on Tutor Perini - why the stock might be worth just $79.89!

Build Your Own Tutor Perini Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tutor Perini research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Tutor Perini research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tutor Perini's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.