يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Douglas Emmett (DEI): Is the Recent Pullback Creating a Value Opportunity?

Douglas Emmett, Inc DEI | 10.55 | -0.38% |

Looking at Douglas Emmett’s bigger picture, momentum has been fading lately. The 1-year total shareholder return is down 7.6%, despite some ups and downs over the past several months. The stock’s recent pullback hints at shifting investor perceptions around growth and risk, especially as the company navigates a more challenging environment.

If you’re weighing your next move in today’s market, it might be a smart time to broaden your outlook and check out fast growing stocks with high insider ownership.

The crucial question now is whether Douglas Emmett shares offer a compelling value at current levels, or if recent declines simply reflect the market’s assessment of its long-term prospects. Is there genuine upside left, or has the market already accounted for future growth?

Most Popular Narrative: 8% Undervalued

Douglas Emmett's most-followed valuation narrative places fair value at $16.86, a notch above the latest share price of $15.48. This sets up a story of cautious optimism as investors weigh the company's prospective path versus today's modest discount.

The acquisition of a new office building and residential site at the corner of Wilshire and Westwood Boulevards through a joint venture is predicted to generate significant operating and leasing synergies, potentially improving revenue and net margins. Douglas Emmett's strategy of renewing leases and achieving positive absorption during 2025, as lease expirations decrease, suggests a rebound in office demand, which could lead to increased occupancy rates and improved revenue.

Wondering how this potential turnaround justifies a premium valuation? The key: aggressive assumptions for occupancy rates, new project synergies, and a stretch in profit margins that defies current trends. These projections fuel the latest target. Find out what bold forecasts are backing them up.

Result: Fair Value of $16.86 (UNDERVALUED)

However, declining office occupancy and rising interest costs remain real threats. Tenant retention challenges are also capable of quickly shifting expectations for Douglas Emmett’s recovery.

Another View: Earnings Multiple Sends a Different Signal

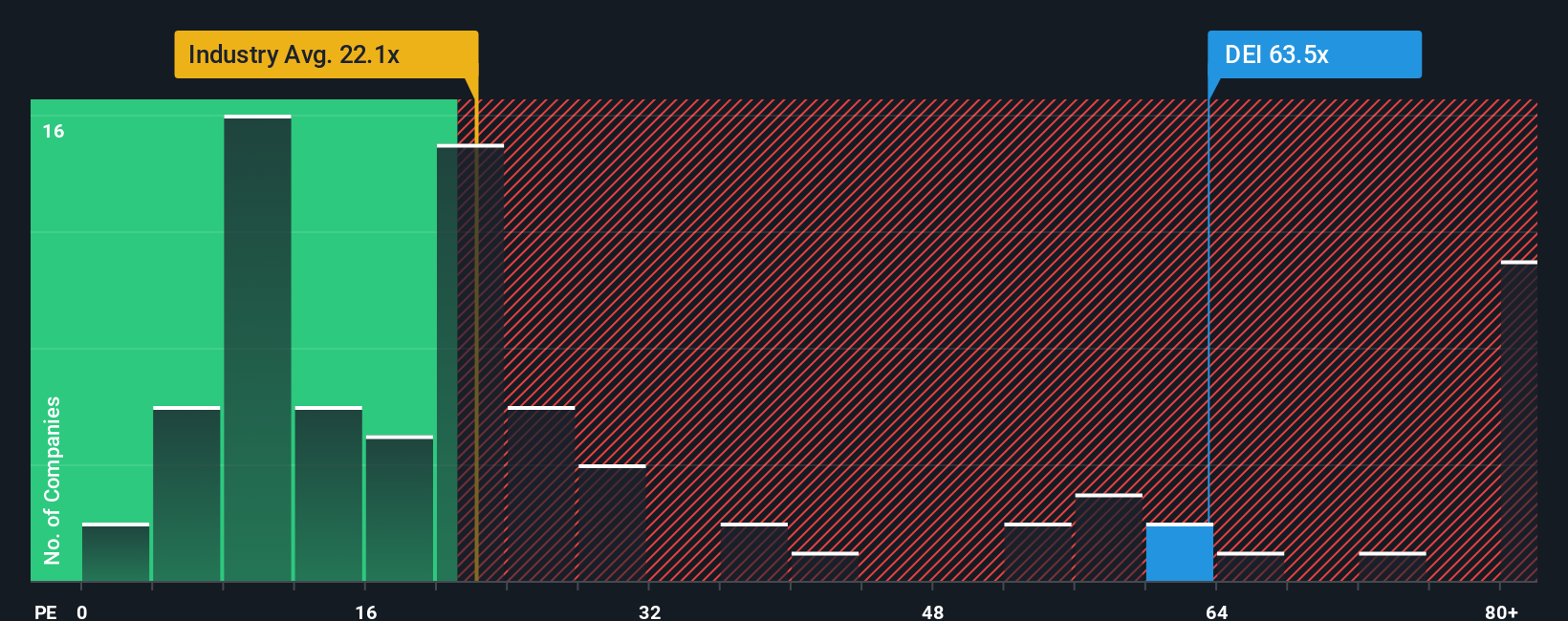

While the most popular narrative sees Douglas Emmett as undervalued, a look at the earnings multiple paints a different picture. The company trades at 71.4x earnings, which is a steep premium to both its peer average of 26.5x and the industry average of 22.6x. The fair ratio, based on historical patterns, stands at just 7.5x. This suggests significant downside risk if the market turns more cautious. Does this rich valuation leave shares vulnerable, or is the market betting on a strong recovery?

Build Your Own Douglas Emmett Narrative

Not convinced by the latest analysis, or want to examine the numbers in your own way? It takes just a couple of minutes to customize your own view and see how the data adds up. Do it your way.

A great starting point for your Douglas Emmett research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not let your strategy go stale while others are finding new opportunities. The Simply Wall Street Screener is your shortcut to unique, data-backed stock picks.

- Fast-track your search for value by zeroing in on these 886 undervalued stocks based on cash flows that consistently outpace expectations.

- Tap into high-yield opportunities with these 19 dividend stocks with yields > 3% and increase your portfolio’s income potential.

- Be among the first to discover the next era of market opportunities powered by these 24 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.