يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Dover (DOV): Valuation Insights as New MP Series Digital Printers Signal Strategic Growth Shift

Dover Corporation DOV | 199.12 | -1.07% |

Dover (DOV) just gave investors something to think about. Subsidiaries MS Printing Solutions and JK Group have launched the new MP Series, a lineup of multi-pass digital textile printers designed for speed, improved durability, and easier usability. These printers aren’t just an upgrade; they bring integrated touchscreen controls, automated color management, and sustainability features meant to serve a range of printing markets. For shareholders, it’s the kind of focused innovation that can make you wonder how much room Dover has to run.

This launch comes against a backdrop of modest stock declines. Dover’s return over the past year is down 6%, sliding a bit further since January. Longer-term, however, it’s a different picture. The company has delivered a nearly 49% total return over three years and 64% over five years, suggesting its momentum has ebbed in the short term even as its fundamentals remain intact. Annual growth in revenue and net income have continued, with both ticking up in the mid-single digits.

After a year of underperformance despite new product momentum, should investors bet on a rebound, or is the market already betting on Dover’s future growth?

Most Popular Narrative: 18.9% Undervalued

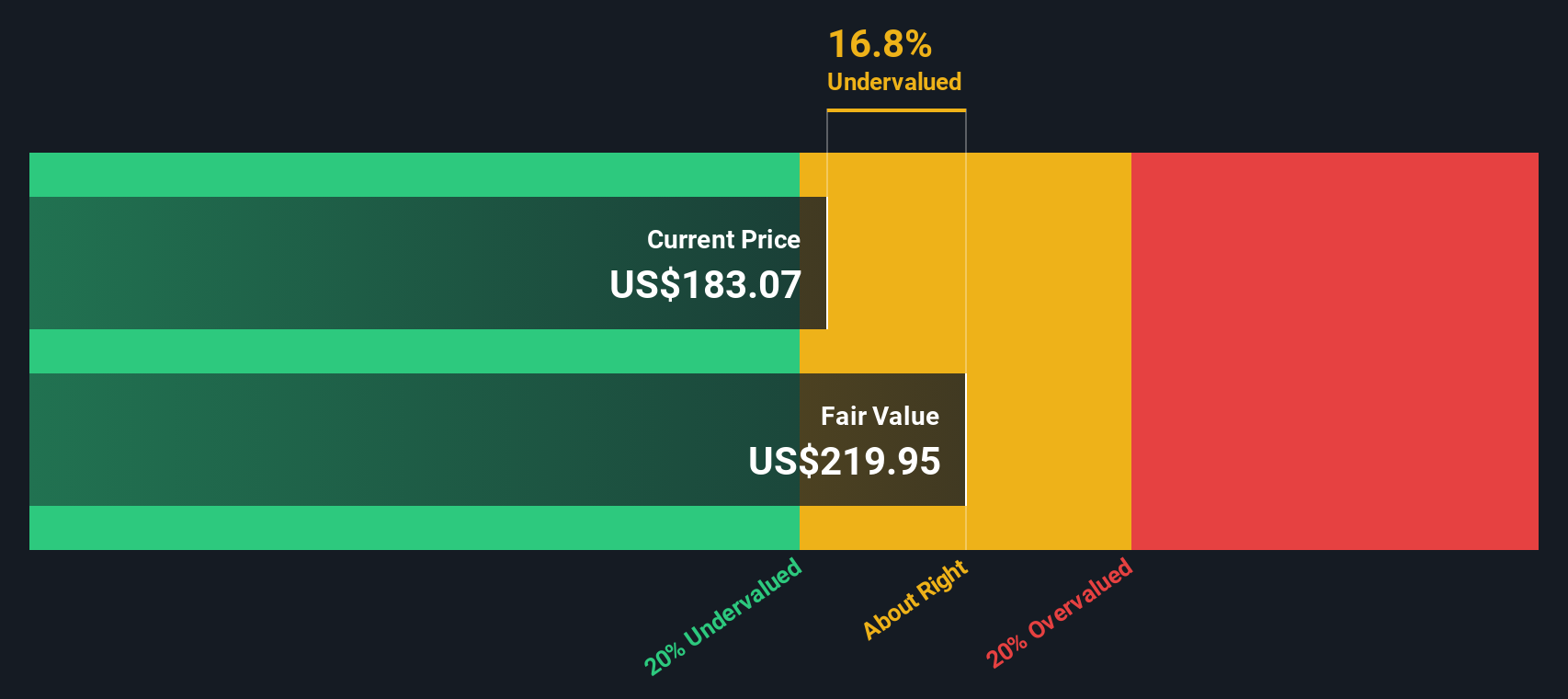

According to the most widely followed narrative, Dover shares are trading well below what analysts see as fair value. Analysts expect that the company’s strategic moves and long-term sector trends will help drive higher margins and sustainable earnings, creating an appealing gap between today’s price and their fair value target.

Significant ongoing portfolio optimization, through targeted acquisitions (e.g. SIKORA) and divestitures of lower-value segments, continues to shift the business mix toward higher-growth, higher-margin sectors. This should structurally improve consolidated EBIT margins and long-term earnings growth.

Curious about how this “undervalued” call was reached? The secret lies in just a handful of bold financial forecasts, such as steady sales growth, profits holding up, and a much richer future earnings multiple than you might expect. Does this valuation rest on a few outsized assumptions? You will want to see exactly what is driving the gap between market price and target.

Result: Fair Value of $213.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing macroeconomic uncertainty and Dover's exposure to volatile cyclical markets could quickly challenge analysts' optimistic assumptions for future growth.

Find out about the key risks to this Dover narrative.Another View: SWS DCF Model Puts Things in Perspective

Our DCF model approaches Dover’s value from a different perspective, focusing on cash flows rather than market assumptions. Interestingly, this method also results in the stock appearing undervalued. Are two methods always better than one?

Build Your Own Dover Narrative

If these analyst estimates don't quite resonate or you would rather draw your own conclusions, crafting a personalized narrative takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Dover.

Looking for More Smart Investment Moves?

Don’t let opportunity pass you by. The right investment idea could be a click away. Try these targeted searches to put your next big trade in motion:

- Unlock real potential by targeting penny stocks with strong financials using penny stocks with strong financials to spot gems before Wall Street catches on.

- Capitalize on tomorrow's healthcare breakthroughs through healthcare AI stocks, where leading-edge medical tech and AI innovation come together.

- Turn steady income into your financial foundation by finding dividend stocks with yields above 3% through dividend stocks with yields > 3% for reliable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.