يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

أرباحٌ فاقت توقعات المحللين: شركة AvePoint، Inc. تفوقت للتو على توقعات المحللين، وقد قام المحللون بتحديث نماذجهم.

AvePoint, Inc. Class A AVPT | 10.50 | -1.22% |

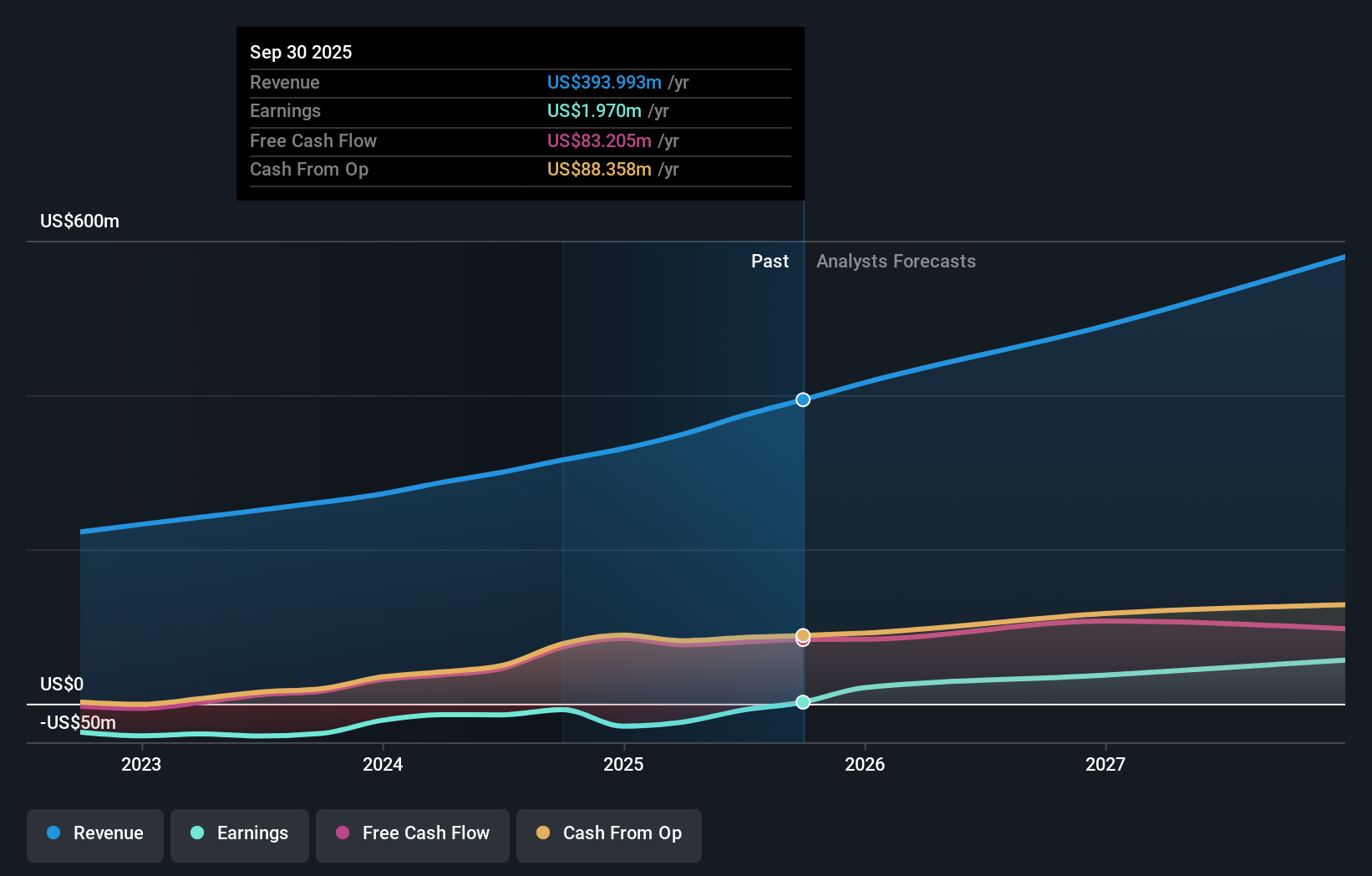

أعلنت شركة AvePoint, Inc. ( المدرجة في بورصة ناسداك تحت الرمز: AVPT ) للتو عن نتائجها المالية للربع الثالث، وتشير المؤشرات إلى أداءٍ واعد. فقد حققت الشركة نتائج إيجابية بشكل عام، حيث تجاوزت الإيرادات التوقعات بنسبة 3.8% لتصل إلى 110 ملايين دولار أمريكي. كما سجلت AvePoint ربحًا صافيًا قدره 0.06 دولار أمريكي، وهو ما يمثل زيادة ملحوظة بنسبة 157% عن توقعات المحللين. تُعد فترة إعلان الأرباح مهمة للمستثمرين، إذ تُمكّنهم من تتبع أداء الشركة، والاطلاع على توقعات المحللين للعام المقبل، ورصد أي تغيير في توجهات السوق تجاه الشركة. وسيسعد القراء بمعرفة أننا جمعنا أحدث التوقعات المالية الرسمية لنرى ما إذا كان المحللون قد غيّروا رأيهم بشأن AvePoint بعد صدور النتائج الأخيرة.

مع الأخذ في الاعتبار أحدث النتائج، تشير أحدث التوقعات الصادرة عن 14 محللاً لشركة AvePoint إلى تحقيق إيرادات بقيمة 489.6 مليون دولار أمريكي في عام 2026. وفي حال تحقق هذا التوقع، فسيمثل زيادة هائلة بنسبة 24% في إيرادات الشركة خلال الاثني عشر شهرًا الماضية. كما يُتوقع أن ترتفع الأرباح القانونية للسهم الواحد بنسبة 1470% لتصل إلى 0.14 دولار أمريكي. وقبل صدور هذا التقرير، كان المحللون يتوقعون إيرادات بقيمة 484.8 مليون دولار أمريكي وأرباحًا للسهم الواحد (EPS) بقيمة 0.11 دولار أمريكي في عام 2026. ورغم أن تقديرات الإيرادات لم تتغير بشكل ملحوظ، إلا أننا نلاحظ ارتفاعًا كبيرًا في توقعات أرباح السهم الواحد، مما يشير إلى تزايد تفاؤل المحللين بعد صدور النتائج الأخيرة.

انخفض متوسط السعر المستهدف للسهم من قِبل المحللين بنسبة 5.2% إلى 19.94 دولارًا أمريكيًا، مما يشير إلى وجود مخاوف أخرى لدى المحللين، وأن تحسن توقعات ربحية السهم لم يكن كافيًا لتبديدها. ومن المفيد أيضًا النظر إلى نطاق تقديرات المحللين لتقييم مدى اختلاف الآراء المتطرفة عن المتوسط. حاليًا، يُقيّم أكثر المحللين تفاؤلًا سهم AvePoint عند 26.00 دولارًا أمريكيًا، بينما يُقيّمه أكثرهم تشاؤمًا عند 16.00 دولارًا أمريكيًا. تُظهر هذه الأسعار المستهدفة وجود بعض الاختلافات في وجهات نظر المحللين حول الشركة، لكن هذه التقديرات لا تختلف بما يكفي لتوحي بأن البعض يراهن على نجاح باهر أو فشل ذريع.

بالنظر إلى الصورة الأوسع، فإن إحدى طرق فهم هذه التوقعات هي مقارنتها بالأداء السابق وتقديرات نمو القطاع . نستنتج من أحدث التقديرات أن التوقعات تشير إلى استمرار اتجاهات AvePoint التاريخية، حيث يتوافق نمو الإيرادات السنوي بنسبة 19% حتى نهاية عام 2026 تقريبًا مع نسبة النمو السنوي البالغة 19% خلال السنوات الخمس الماضية. بالمقارنة مع القطاع ككل، تشير تقديرات المحللين (إجمالًا) إلى نمو الإيرادات بنسبة 15% سنويًا. لذا، من الواضح أن AvePoint مُتوقع لها أن تنمو بوتيرة أسرع بكثير من قطاعها.

الخلاصة

أهم ما استخلصناه هو رفع التوقعات المجمعة لأرباح السهم، مما يشير إلى تحسن واضح في التوقعات بشأن إمكانات أرباح AvePoint في العام المقبل. ولحسن الحظ، أكدت الشركة أيضًا أرقام إيراداتها، مما يدل على أنها تسير وفقًا للتوقعات. بالإضافة إلى ذلك، تشير بياناتنا إلى أنه من المتوقع أن تنمو الإيرادات بوتيرة أسرع من نمو القطاع ككل. انخفض السعر المستهدف المجمع بشكل ملحوظ، حيث يبدو أن المحللين لم يقتنعوا تمامًا بالنتائج الأخيرة، مما أدى إلى تقدير أقل للقيمة المستقبلية لشركة AvePoint.

مع ذلك، فإن مسار أرباح الشركة على المدى الطويل أهم بكثير من أرباح العام المقبل. في موقع Simply Wall St، لدينا مجموعة كاملة من تقديرات المحللين لشركة AvePoint حتى عام 2027، ويمكنكم الاطلاع عليها مجاناً على منصتنا هنا.

هذا المقال من Simply Wall St ذو طبيعة عامة. نقدم تعليقاتنا بناءً على البيانات التاريخية وتوقعات المحللين فقط، باستخدام منهجية محايدة، ولا يُقصد بمقالاتنا أن تكون نصائح مالية. لا يُشكل هذا المقال توصيةً بشراء أو بيع أي سهم، ولا يأخذ في الاعتبار أهدافك أو وضعك المالي. نهدف إلى تزويدك بتحليلات طويلة الأجل مدفوعة بالبيانات الأساسية. يُرجى ملاحظة أن تحليلنا قد لا يأخذ في الاعتبار آخر إعلانات الشركات الحساسة للسعر أو المعلومات النوعية. لا تمتلك Simply Wall St أي أسهم في أي من الشركات المذكورة.