يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Earnings Working Against Abercrombie & Fitch Co.'s (NYSE:ANF) Share Price Following 26% Dive

Abercrombie & Fitch Co. Class A ANF | 96.41 | +0.53% |

Abercrombie & Fitch Co. (NYSE:ANF) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 18% in that time.

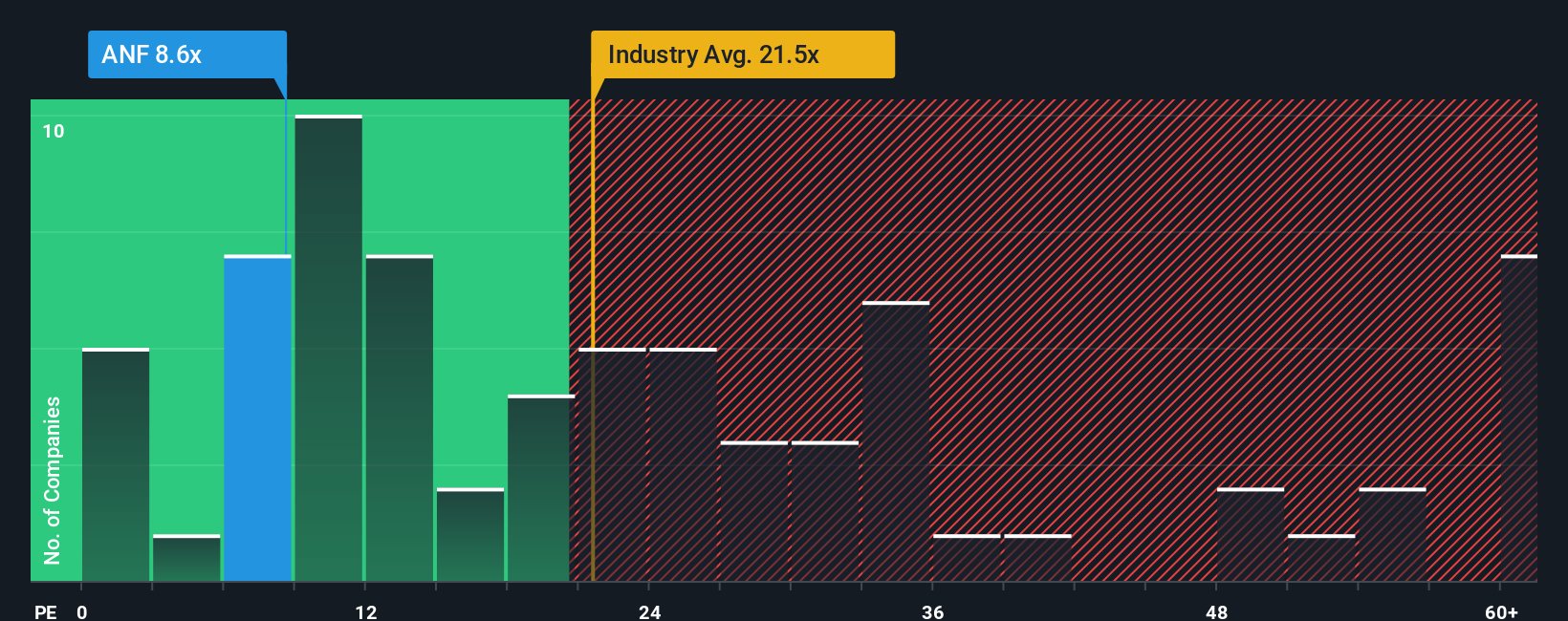

Even after such a large drop in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 20x, you may still consider Abercrombie & Fitch as a highly attractive investment with its 8.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times haven't been advantageous for Abercrombie & Fitch as its earnings have been rising slower than most other companies. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Abercrombie & Fitch would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Although pleasingly EPS has lifted 1,871% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 1.7% during the coming year according to the eight analysts following the company. That's not great when the rest of the market is expected to grow by 16%.

With this information, we are not surprised that Abercrombie & Fitch is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Abercrombie & Fitch's P/E?

Having almost fallen off a cliff, Abercrombie & Fitch's share price has pulled its P/E way down as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Abercrombie & Fitch maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Abercrombie & Fitch (at least 1 which is potentially serious), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Abercrombie & Fitch, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.