يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Estée Lauder Faces Regulatory Fine And Restructuring As Valuation Shifts

Estee Lauder Companies Inc. Class A EL | 114.23 | +2.23% |

- Estée Lauder Companies (NYSE:EL) was fined in Canada after pleading guilty to using banned forever chemicals in certain products.

- The company is subject to a government compliance order tied to these regulatory breaches.

- At the same time, Estée Lauder announced a global restructuring plan that includes significant job cuts and efforts to improve profitability.

- These moves come as the company faces tariff related pressures across key international markets.

For investors looking at NYSE:EL, the current share price of $99.47 sits against a mixed performance backdrop. The stock is down 13.7% over the past week and 12.5% over the past month. The 1 year return is 55.7%, while the 3 year and 5 year returns are declines of 58.0% and 63.2% respectively.

Both the Canadian fine and the global restructuring plan highlight how regulatory risk and cost control are front and center for Estée Lauder. As you assess the company, it may be worth watching how it implements compliance changes, manages job cuts, and responds to tariff related pressures across different regions.

Stay updated on the most important news stories for Estée Lauder Companies by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Estée Lauder Companies.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$99.47, the share price is about 8% below the US$108.29 analyst target, which sits within the typical range of analyst views.

- ✅ Simply Wall St Valuation: Shares are described as trading around 13.2% below the estimated fair value, which points to a discount on Simply Wall St's model.

- ❌ Recent Momentum: The 30 day return of roughly a 12.5% decline highlights weak short term momentum as the restructuring and regulatory news is absorbed.

Check out Simply Wall St's in depth valuation analysis for Estée Lauder Companies.

Key Considerations

- 📊 The Canadian fine and restructuring indicate a period of operational change that could affect margins, brand perception, and near term costs.

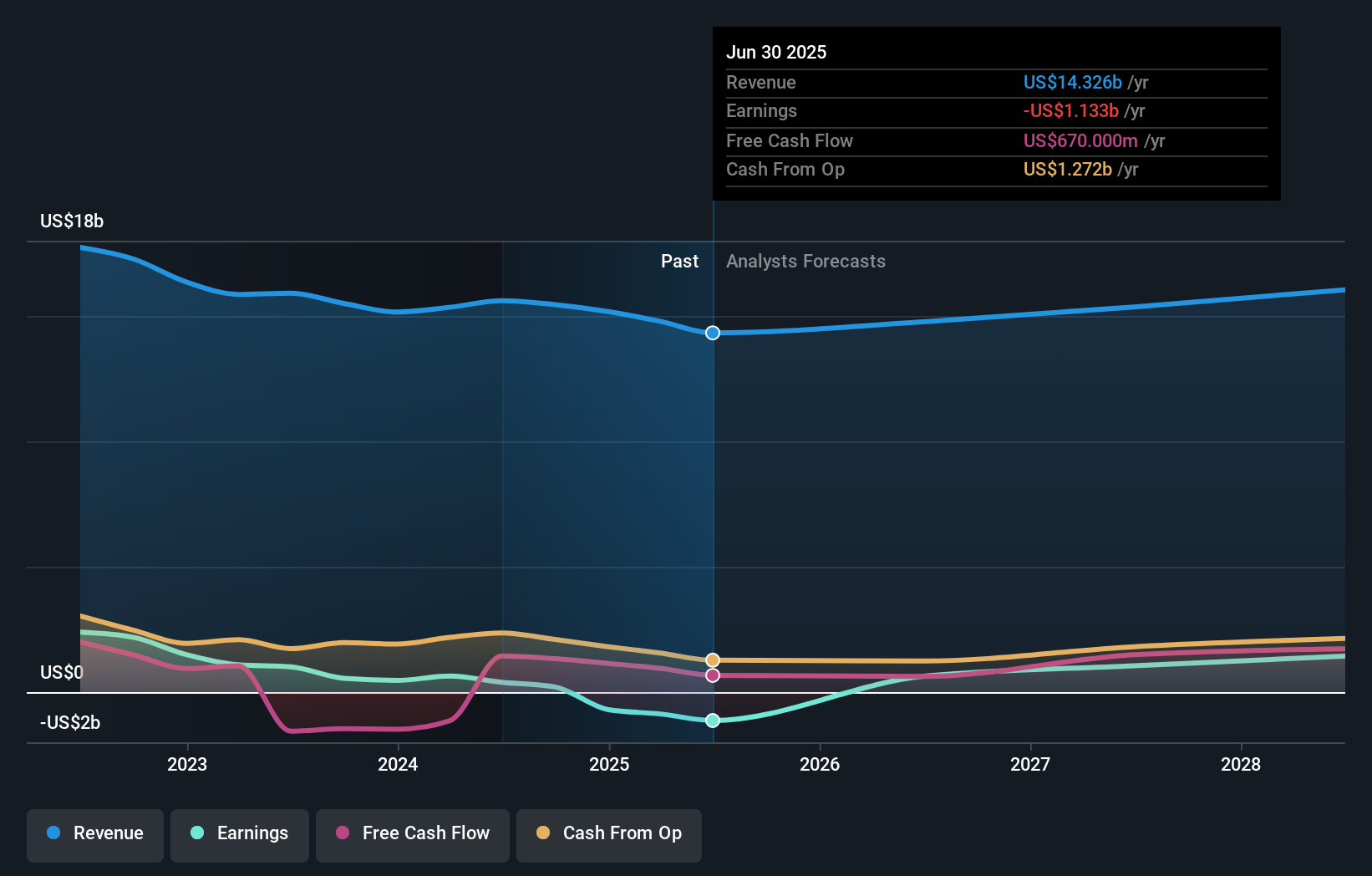

- 📊 It may be useful to monitor the scale of cost savings relative to restructuring charges, progress on compliance, and how revenue and earnings per share forecasts are updated over time.

- ⚠️ The flagged high debt level and a dividend that is not well covered by earnings may limit flexibility if the turnaround or compliance spending proves more expensive than expected.

Dig Deeper

For a fuller picture, including additional risks and potential rewards, see the complete Estée Lauder Companies analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.