يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Evaluating ESCO Technologies’ Valuation as Backlog Growth, Margin Gains and EPS Outperformance Strengthen Its Outlook

ESCO Technologies Inc. ESE | 276.56 | +1.39% |

ESCO Technologies, trading near record levels after a stretch of strong execution, is drawing attention as its growing backlog, higher margins, and faster earnings growth begin to reshape how investors view the business.

Despite a softer 1 month share price return of negative 8.33%, ESCO’s year to date share price return of 50.70% and 3 year total shareholder return of 120.91% point to momentum that is still very much intact as investors reassess its growth and quality.

If this kind of rerating story interests you, it is worth exploring aerospace and defense stocks to see which other aerospace and defense names are starting to earn similar attention from the market.

With earnings power rising faster than sales and the stock still trading at a notable discount to analyst targets, the key question now is whether ESCO remains a buyable growth compounder or if the market is already pricing in its next leg of expansion.

Most Popular Narrative Narrative: 22.3% Undervalued

With the narrative fair value set at $255 against a last close of $198.21, the valuation case leans heavily on faster growth and fatter margins.

Strong multi-year backlog growth in Aerospace and Defense anchored by substantial orders related to submarine programs and long-term military contracts provides high revenue visibility and improved operating leverage, resulting in sustained organic growth and higher segment margins.

Want to see what turns backlog and grid spending into that punchy valuation? The narrative leans on ambitious growth, richer margins, and a surprisingly confident earnings multiple. Curious how those pieces fit together into that fair value target?

Result: Fair Value of $255 (UNDERVALUED)

However, this upbeat view could unravel if Maritime integration underdelivers, or if geopolitical shocks and tariffs squeeze margins and delay high value defense programs.

Another Take on Valuation

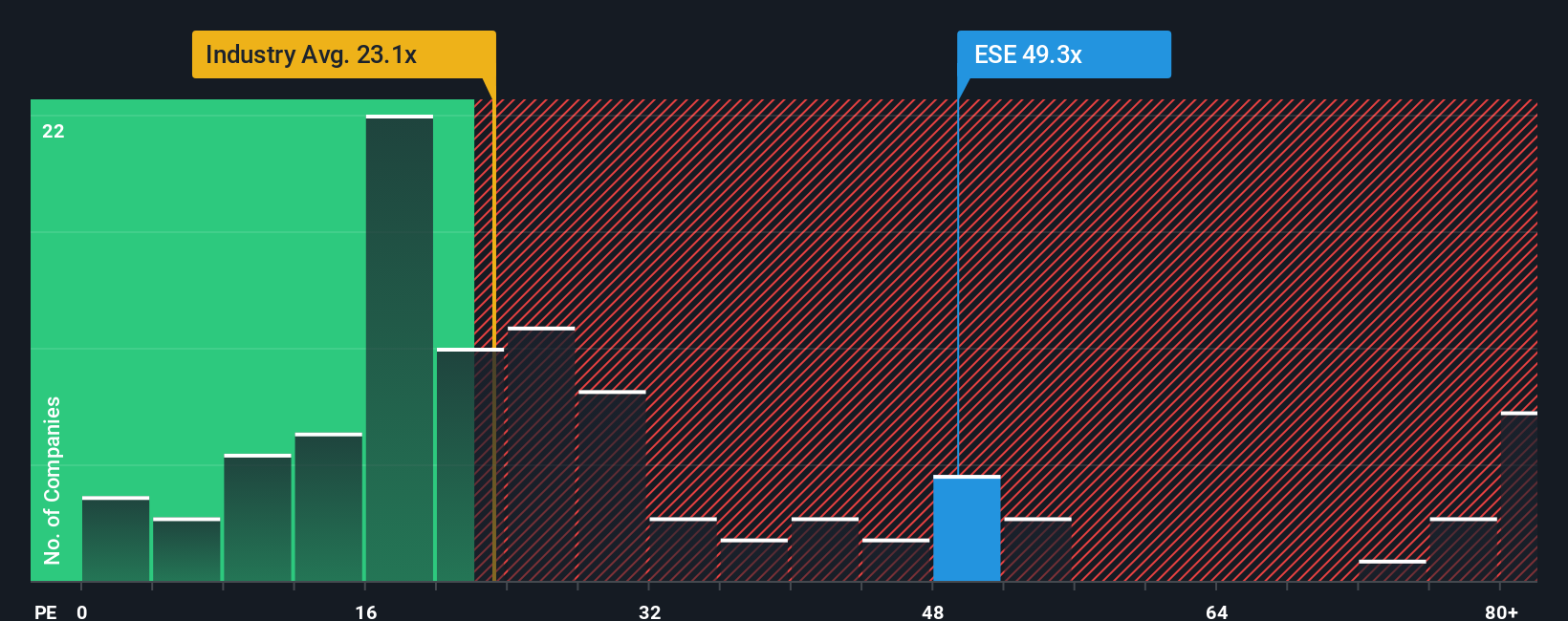

While the narrative argues ESCO is 22.3% undervalued, its 44x earnings multiple looks demanding compared with the US Machinery industry at 25.5x, peers at 33.4x, and a fair ratio of 30.5x. That premium already prices in many expectations, which raises the question of where the real margin of safety lies.

Build Your Own ESCO Technologies Narrative

If this view does not quite match your own, or you would rather dig into the numbers yourself, you can craft a fresh perspective in just a few minutes, Do it your way.

A great starting point for your ESCO Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If you are serious about leveling up your portfolio, do not stop at ESCO. The Simply Wall St Screener uncovers new opportunities others will miss.

- Capitalize on potential mispricing by targeting quality names trading below intrinsic value through these 903 undervalued stocks based on cash flows before the market fully catches on.

- Ride structural trends in automation and intelligent software by screening for innovators powering the AI boom using these 27 AI penny stocks.

- Lock in more predictable income streams by focusing on companies with reliable payouts via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.