يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Federal Agricultural Mortgage (AGM): How Strong Q2 Earnings Shape the Latest Valuation Debate

Federal Agricultural Mortgage Corporation Class C AGM | 177.66 177.66 | -0.54% 0.00% Pre |

Federal Agricultural Mortgage (AGM) just released its latest quarterly results, and the performance numbers are likely giving current and potential shareholders something to consider. The company reported higher net income and earnings per share for both the second quarter and the first half of 2025 compared to last year, indicating that its business model continues to perform through changing cycles. Positive earnings often prompt swift reactions in the market, and these results may have done just that.

AGM’s share price has experienced a steady climb over the past month, adding more than 11%. Over the past year, it has gained about 8%, reflecting a strong upward trend compared to more subdued periods. There is also growth in recent annual revenue and net income, while investor sentiment may be improving further following the dividend affirmation last week. Moves like these can often impact how traders and long-term investors perceive risk and opportunity.

With momentum building after the earnings release, the key question is whether Federal Agricultural Mortgage remains undervalued or if the recent rally has already incorporated this growth potential.

Most Popular Narrative: 13.7% Undervalued

According to community narrative, Federal Agricultural Mortgage is considered undervalued by 13.7% relative to its projected fair value, with a projected fair value of $226 and a current share price that is notably lower. The narrative highlights ambitious growth drivers in renewables and rural infrastructure, which are seen as supporting substantial upside potential.

Expansion into renewable energy, broadband, and infrastructure finance is driving significant new business volume and higher spreads. This positions Farmer Mac to benefit from increasing demand for financing related to sustainability and rural connectivity initiatives, which may support revenue and earnings growth in the future.

Curious what quantitative leap is behind this optimistic outlook? This narrative is based on aggressive growth assumptions and future margin changes that differ from Farmer Mac’s recent history. Interested in the key forecasts and profit multiples supporting this view? Discover what could make these valuations exceed expectations.

Result: Fair Value of $226 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent regulatory uncertainty and rising credit losses in new segments could quickly shift the outlook and put pressure on Federal Agricultural Mortgage's expected growth trajectory.

Find out about the key risks to this Federal Agricultural Mortgage narrative.Another View: Discounted Cash Flow Model Results

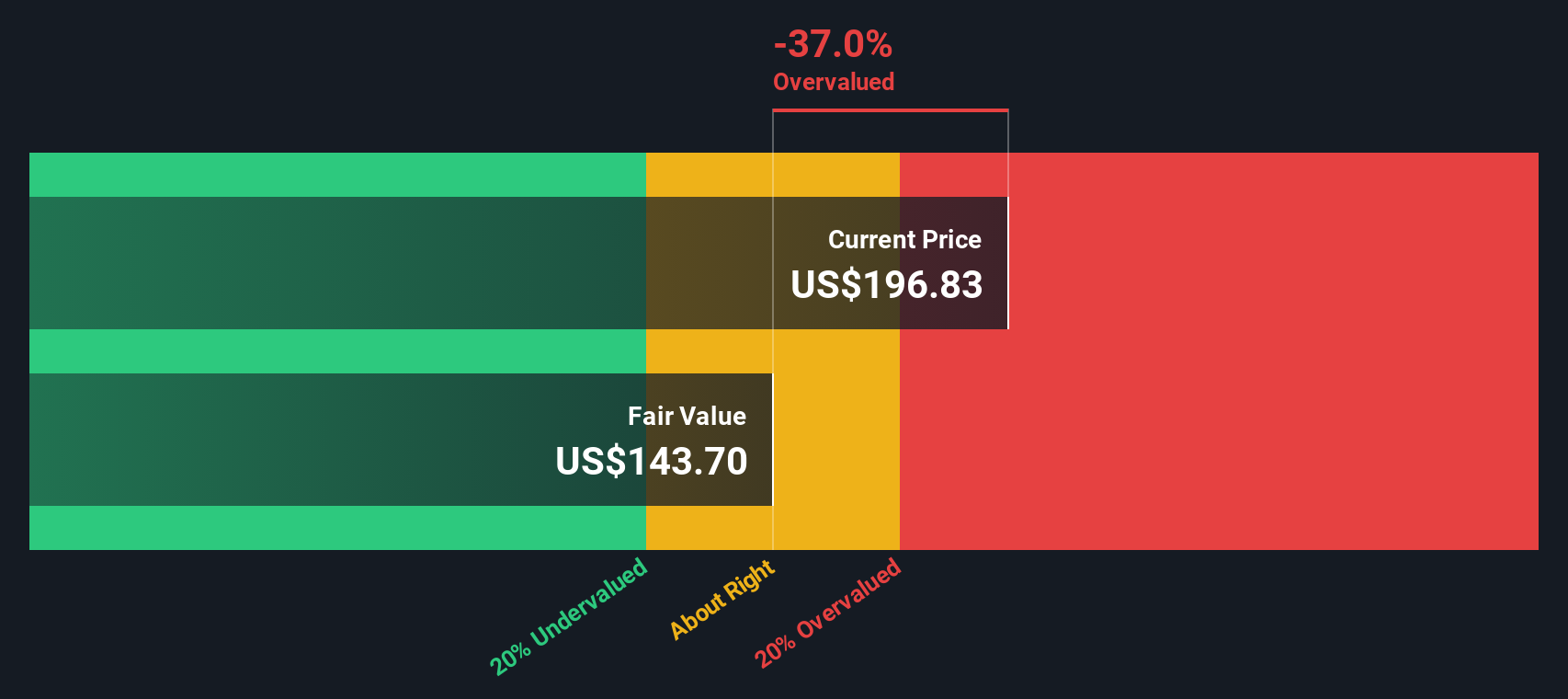

While the first valuation is based on analyst expectations for future market multiples, our DCF model offers a different perspective. Using projected company cash flows, it indicates that the shares may be overvalued in today's market. Which approach should investors trust most?

Build Your Own Federal Agricultural Mortgage Narrative

For those who want to take a closer look or challenge the current perspectives, you can dive into the numbers and craft your own view in just a few minutes. do it your way.

A great starting point for your Federal Agricultural Mortgage research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Level up your strategy and get ahead of shifting trends by uncovering standout stocks outside the usual crowd. The right screen could put unique opportunities on your radar, so don’t miss out on what other savvy investors are spotting right now.

- Consider building a smarter income portfolio by checking out dividend stocks with yields over 3% through dividend stocks with yields > 3%. This may help you lock in potential for steady returns.

- Explore the healthcare revolution by finding innovative companies at the intersection of medicine and machine learning with healthcare AI stocks. Breakthroughs in AI continue to reshape the industry.

- Add hidden values to your watchlist by browsing undervalued stocks based on cash flows at undervalued stocks based on cash flows before the market takes notice.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.