يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

First Bancorp (FBNC): Evaluating Valuation as Share Price Momentum Slows

First Bancorp FBNC | 53.36 | -0.02% |

First Bancorp (FBNC) shares have drawn attention after recent trading movement, inviting fresh perspectives on the bank's current valuation. With performance metrics shifting over the past month, investors are weighing longer-term trends in comparison to recent results.

After a steady climb from earlier in the year, First Bancorp’s share price momentum has slowed in recent weeks. However, the bigger story is its respectable 1-year total shareholder return of 0.3%. This suggests that, while near-term sentiment is muted, investors who stuck with the stock for the long haul have been rewarded slightly above breakeven. This keeps the focus on sustained performance and potential re-rating as conditions evolve.

If you’re interested in other sectors showing resilience and fresh growth, now might be the right moment to discover fast growing stocks with high insider ownership

With shares trading at a modest discount to analyst targets and steady earnings growth in recent years, the question arises: is First Bancorp undervalued right now, or is the market already factoring in its future prospects?

Price-to-Earnings of 22.3x: Is it justified?

First Bancorp is currently trading at a price-to-earnings (P/E) ratio of 22.3x, noticeably above sector peers and the wider market. With the last close price at $52.08, this premium hints at high expectations from investors. Does the company have the earnings profile to warrant it?

The P/E ratio is a key metric indicating how much investors are willing to pay per dollar of earnings. In banking, a high P/E can reflect anticipated profit growth, superior business quality, or a share price running ahead of fundamentals in the short term.

However, First Bancorp’s current P/E is significantly higher than the US Banks industry average of 11.8x and its own peer group average of 16.2x. This signals that the market is ascribing a much steeper valuation to its future prospects. Compared to the estimated fair P/E ratio of just 16.4x, the stock appears considerably expensive. This implies earnings growth will need to accelerate, or expectations may soon correct.

Result: Price-to-Earnings of 22.3x (OVERVALUED)

However, a slowdown in earnings growth or a broader market shift could quickly challenge the premium that investors are currently paying for First Bancorp shares.

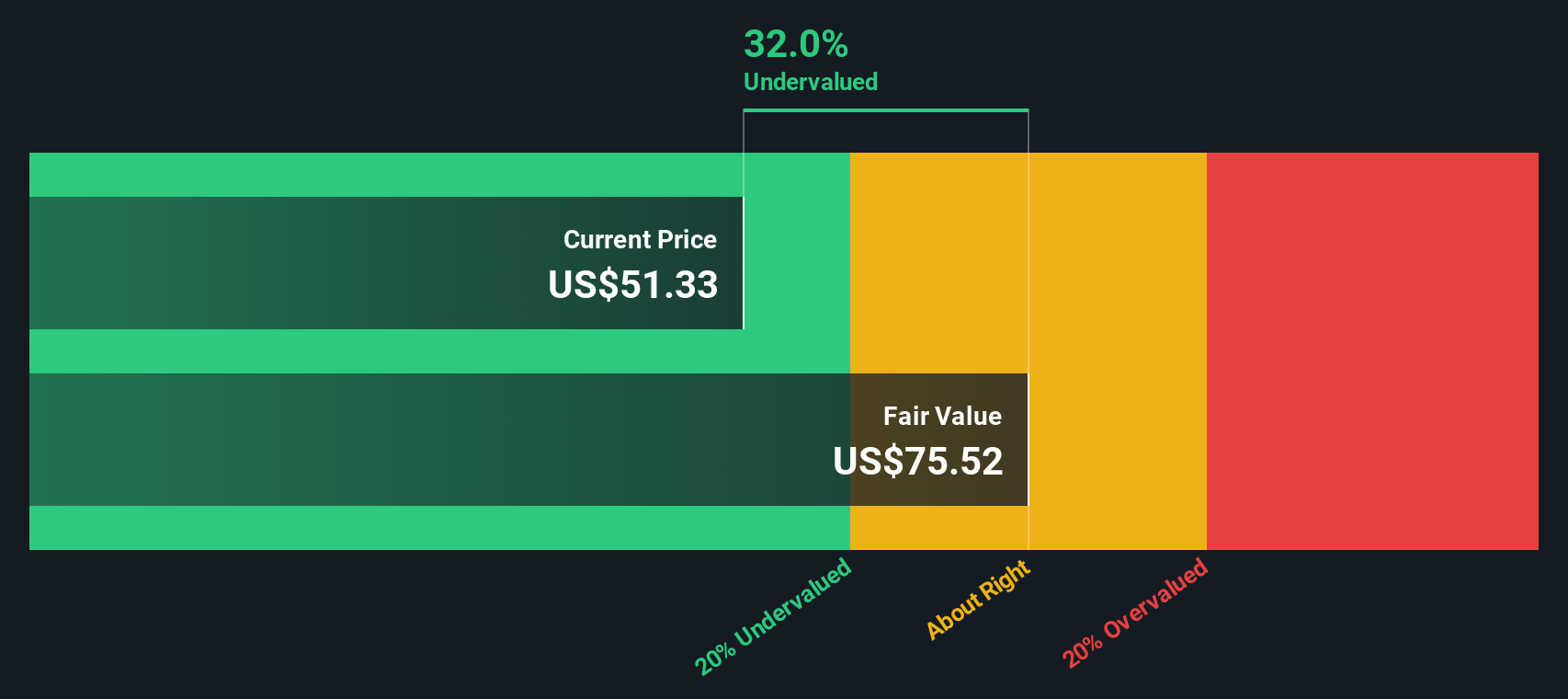

Another View: Discounted Cash Flow Says Undervalued

While First Bancorp looks expensive against its earnings compared to peers, our DCF model paints a different picture. By projecting the bank’s future cash flows, this method values the stock at $75.52, which is well above today’s price. This suggests the market may be overlooking longer-term potential. Could this disconnect reveal an opportunity, or is the optimism unwarranted?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Bancorp Narrative

If you see the story differently or want to dive into the details your own way, you can easily craft your own perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding First Bancorp.

Ready for Fresh Investment Ideas?

Don’t let opportunity slip away. Simply Wall Street Screener makes it easy to uncover companies that might become tomorrow’s biggest winners, long before they hit the headlines.

- Spot companies with the power to shake up global markets by checking out these 3563 penny stocks with strong financials, which are bursting with surprising financial strength and untapped potential.

- Turbocharge your portfolio’s growth with these 904 undervalued stocks based on cash flows, where strong fundamentals meet attractive price points for those seeking real value.

- Tap into the future of medicine and technology with these 31 healthcare AI stocks, connecting you to firms at the forefront of innovative healthcare solutions driven by artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.