يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

First Bancorp (FBNC) Margin Dip Challenges Bull Case as Growth Forecasts Outpace History

First Bancorp FBNC | 53.36 | -0.02% |

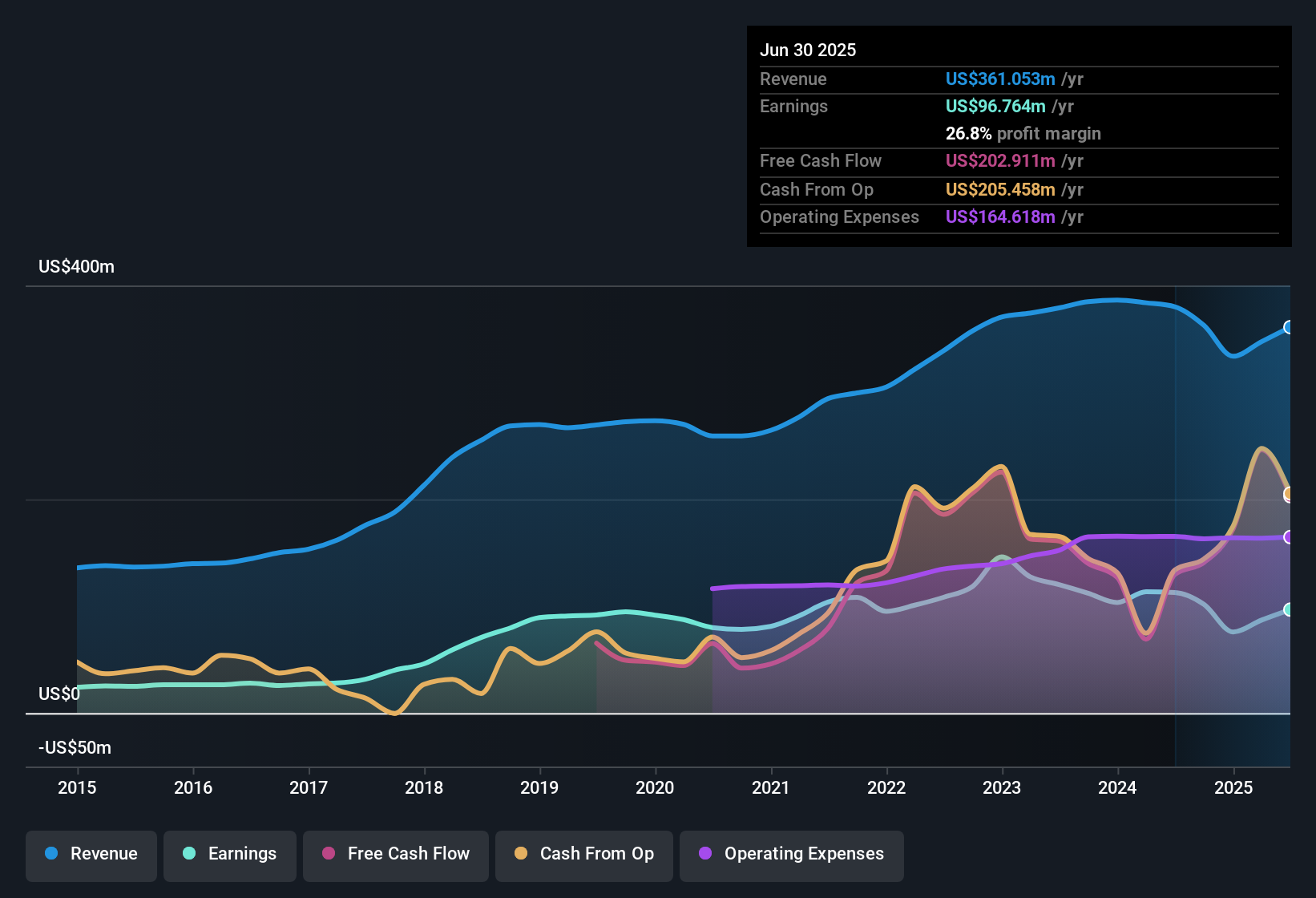

First Bancorp (FBNC) reported annual earnings growth of 31.5% and revenue growth of 17%, both outpacing the US market averages of 15.5% and 10%. The company’s net profit margin came in at 27%, slightly below last year’s 28%, with a five-year average annual earnings growth of just 0.8% and negative growth recorded in the most recent year. Despite these mixed profitability trends, FBNC's stock currently trades at $47.66, below its discounted cash flow fair value estimate of $60. Its 20.1x P/E multiple is well above peers but supported by attractive dividend prospects and strong forecast momentum.

See our full analysis for First Bancorp.Up next, we’ll see how the latest numbers hold up against the broader narratives driving market expectations. This includes where the figures confirm the consensus and where the data tells a different story.

Profit Margins Hold Steady in Challenging Year

- Net profit margin remained solid at 27%, only a touch below last year's 28% even as most regional banks reported increased cost pressures.

- What is surprising is that, despite negative earnings growth in the most recent year and just 0.8% annualized earnings growth over five years, margin strength still supports optimism about future profitability.

- Margin resilience stands out as a key quality, even while growth has lagged typical bullish expectations.

- This creates a push-pull dynamic for investors weighing near-term profit durability against longer-term mixed growth history.

Premium Valuation Against Industry Norms

- FBNC trades at a 20.1x P/E multiple, well above the US Banks industry average of 11.3x and direct peer average of 16.8x. This highlights that the market is willing to pay a premium for its perceived earnings quality and momentum.

- Bulls highlight that the elevated P/E is justified by FBNC’s forecast 31.5% annual earnings growth, outpacing sector trends. However, history complicates a purely bullish stance since five-year average earnings growth was just 0.8%.

- Supporters point to consensus profit and revenue forecasts that validate paying up for growth, but critics may note recent negative earnings as a caution flag before chasing the premium.

- The premium valuation directly reflects investors’ willingness to bet on forward momentum, even with recent growth volatility on record.

DCF Fair Value Shows Discount

- The current share price of $47.66 remains well below the DCF fair value estimate of $60.00. This suggests that FBNC could be undervalued by more than 20% on this metric, despite the rich P/E ratio.

- Prevailing market analysis points out this valuation gap offers room for upside if profit growth materializes, but the market’s caution stems from the disconnect between historically sluggish five-year earnings growth and strong short-term forecasts.

- The positive fair value gap highlights a classic value-versus-growth debate, with profit margin stability providing a partial counterweight to recent sluggish performance.

- Investors may see the discounted price as compensation for past volatility and muted long-term earnings trends.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on First Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite resilient margins, First Bancorp’s earnings growth has been volatile and lags the market. This raises questions about its ability to sustain steady expansion.

If you want to prioritize consistency and filter for companies proven to deliver smoother results, check out stable growth stocks screener (2088 results) for a list of stocks with reliable growth track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.