يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

First Capital (FCAP) Earnings Growth And 33.1% Margins Reinforce Bullish Community Narrative

First Capital, Inc. FCAP | 54.20 | -5.24% |

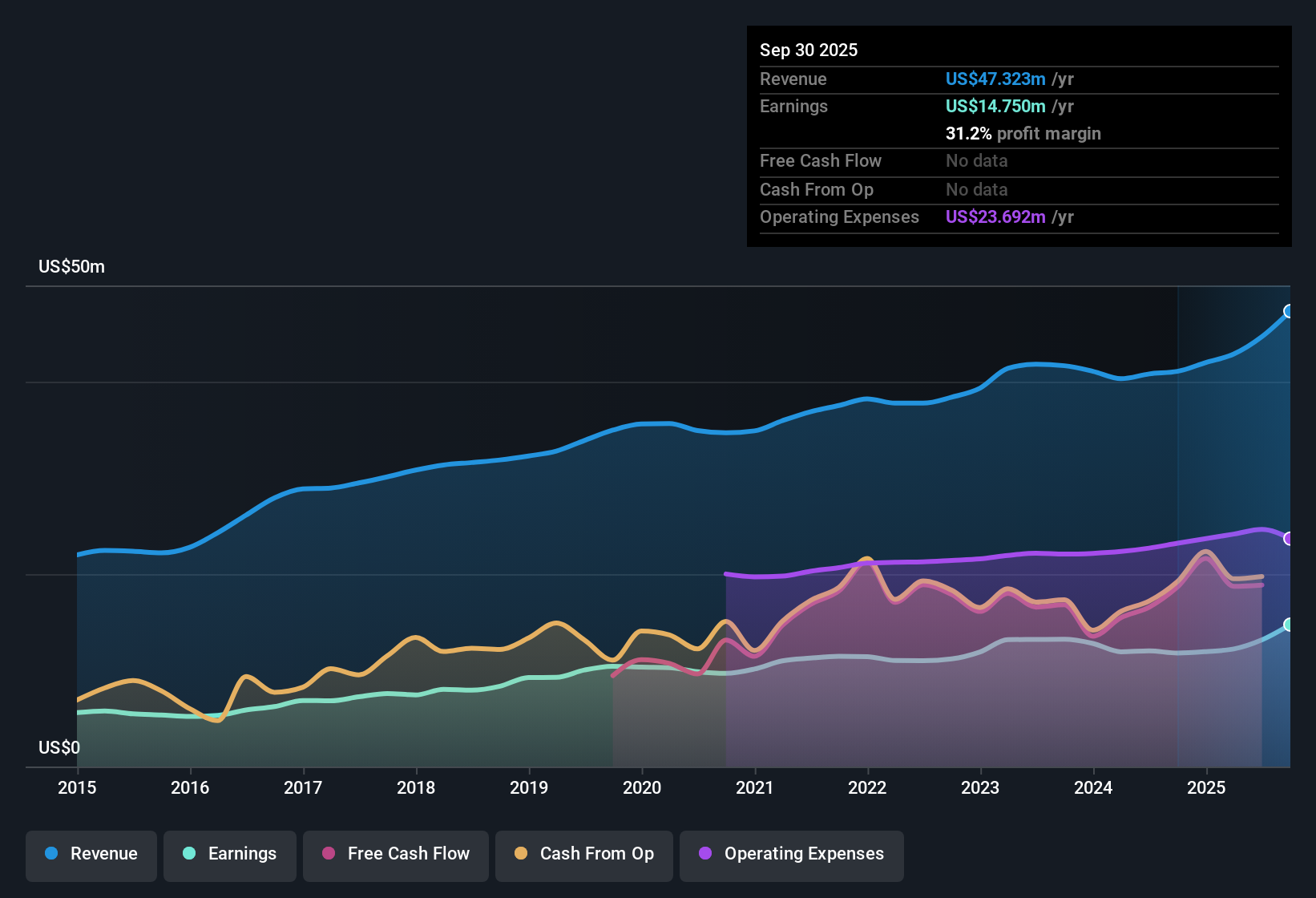

First Capital (FCAP) closed out FY 2025 with fourth quarter revenue of US$13.1 million and basic EPS of US$1.46, while trailing twelve month totals reached US$49.5 million of revenue and EPS of US$4.89. Over the past few quarters, revenue has ranged from US$10.5 million in Q3 2024 to US$13.1 million in Q4 2025, with quarterly EPS moving from US$0.87 in Q3 2024 to US$1.46 most recently, alongside trailing net income of US$16.4 million. With a net profit margin of 33.1% over the last year compared to 28.4% previously, the story this season is firmly about how profitability and efficiency are feeding through to the bottom line.

See our full analysis for First Capital.With the headline numbers on the table, the next step is to see how this earnings profile lines up with the prevailing narratives around growth, quality and income for First Capital, and where those stories might need an update.

37.1% earnings growth and 33.1% margins working together

- Over the last 12 months, earnings grew 37.1% and net profit margin sat at 33.1% compared with 28.4% the prior year, while trailing revenue reached US$49.5 million and net income was US$16.4 million.

- What really supports a bullish angle here is how that growth lines up with the bank specific metrics:

- Net interest margin over the trailing period was 3.61%, with quarterly NIM running between 3.34% in Q1 2025 and 3.79% in Q4 2025. The recent quarter therefore sits toward the upper end of that range alongside higher EPS.

- Across those same quarters, EPS moved from US$0.97 in Q4 2024 to US$1.46 in Q4 2025, which lines up with the 37.1% trailing earnings growth and a 5.6% annualized earnings growth rate over five years.

Loan quality steady with US$4.4 million non performing loans

- Non performing loans in the latest quarter were US$4.4 million on a loan book that has been reported between about US$638 million and US$658 million in recent quarters, which puts problem loans at a small portion of total lending.

- Bulls who focus on credit quality can point to this as a supporting detail, but the figures also give you a way to stress test that view yourself:

- Across the last six reported quarters, non performing loans stayed in a tight range between US$3.9 million and US$4.5 million, while total loans were consistently in the mid US$600 million area where disclosed.

- At the same time, trailing net income of US$16.4 million and a 33.1% net margin indicate that the current earnings base is comfortably larger than the current stock of problem loans in dollar terms.

P/E of 10.4x and 2.44% yield against DCF fair value

- Shares trade at a P/E of 10.4x compared with a peer average of 11.8x, while the current share price of US$50.87 sits about 32% below the stated DCF fair value of US$74.86 and the trailing dividend yield is 2.44%.

- What is interesting for a bullish narrative is how the valuation lines up with the recent profitability profile:

- Trailing EPS is US$4.89, so the current P/E of 10.4x is being applied to earnings that have grown 37.1% over the last year, not to a depressed base.

- With a 2.44% dividend yield sitting on top of a 33.1% net margin and a share price that is below the DCF fair value input of US$74.86, the numbers together show income, profitability and the quoted discount all in one place for you to weigh.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on First Capital's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

For all the strong margins and P/E context, First Capital still comes across as a single regional bank story that leaves you exposed to one earnings and loan cycle.

If you would rather spread that risk and focus on companies with steadier revenue and earnings profiles across sectors, use CTA_SCREENER_STABLE_GROWTH to quickly zero in on businesses built around more consistent growth drivers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.