يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

First United (FUNC) Net Margins Surge to 29.8%, Reinforcing Bullish Value Narrative

First United Corporation FUNC | 38.60 38.60 | -0.41% 0.00% Pre |

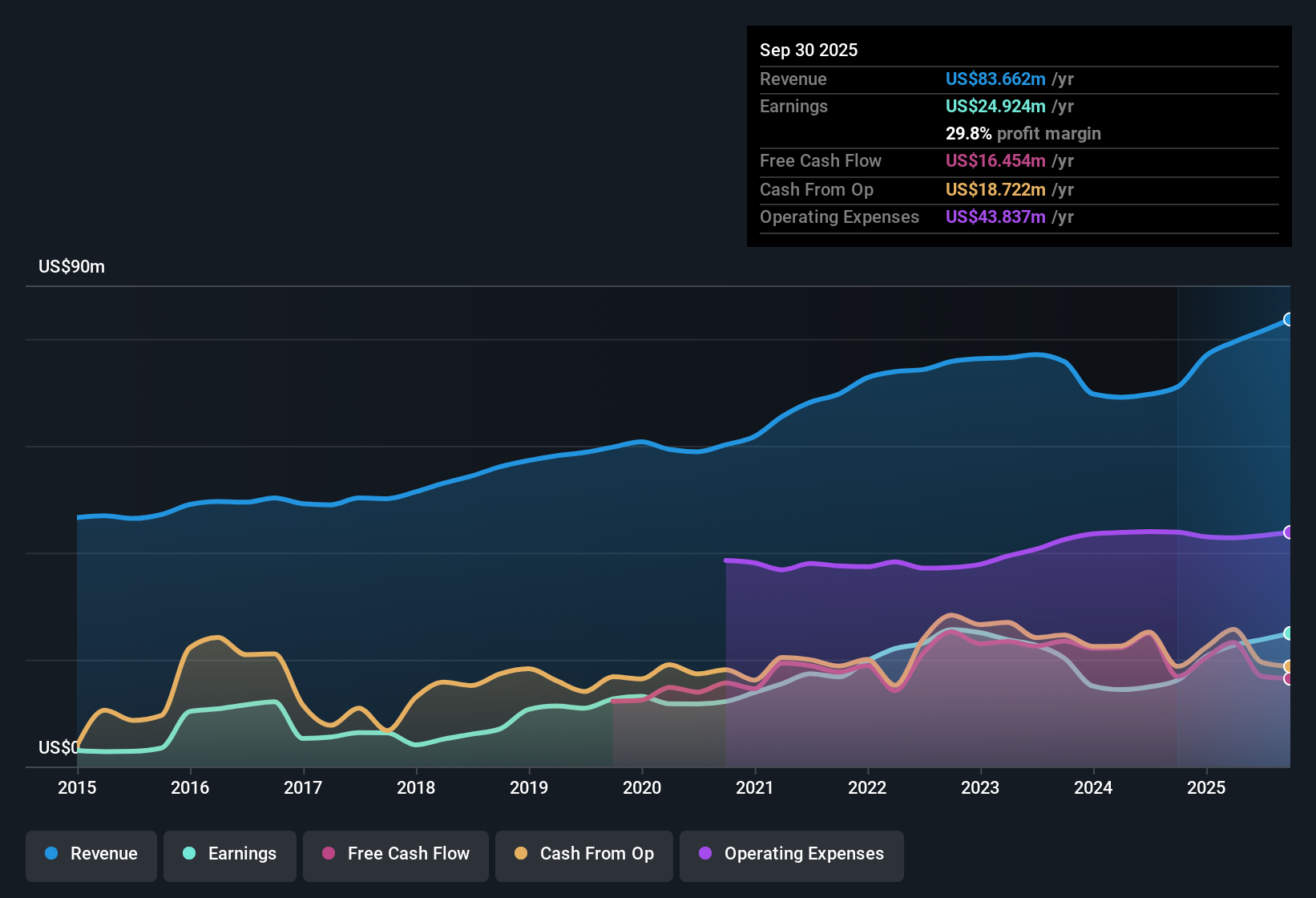

First United (FUNC) reported standout earnings growth of 54.4% over the past year, far outpacing its 5-year average of 5.3% per year. Net profit margins reached 29.8%, rising from 22.7% in the prior year, while shares are currently trading at $36.98, well below an estimated fair value of $68.47. With only one minor risk flagged and multiple rewards highlighted, including high-quality past earnings, expanding profit and revenue, and a strong value profile, the latest results point to improved profitability and constructive investor sentiment.

See our full analysis for First United.The next step is seeing how these headline numbers stack up against the main narratives: where the results echo street views, and where they might challenge them.

Margins Leap to 29.8% as Efficiency Improves

- Net profit margins increased to 29.8% from 22.7% the previous year, highlighting more effective management of costs and improved earnings quality.

- Strong margin gains support the view that First United's prudent credit handling and stable cost discipline are delivering real operating leverage.

- With margin expansion outpacing the 5-year average earnings growth, management's focus on efficiency is making a difference in the bottom line.

- Analysts watching for margin improvement may interpret this as a sign that the bank’s operational playbook remains effective despite sector pressure.

Price-to-Earnings Discount Signals Value Upside

- Trading at a Price-to-Earnings ratio of 9.6x, First United’s shares are priced below the US Banks industry average of 11.3x and below the peer average of 32.7x.

- This valuation discount, combined with high-quality historical earnings, supports the narrative that the stock offers relative upside for value-focused investors.

- The two-point discount versus the industry and even greater versus peers strengthens the argument that FUNC is overlooked by the market.

- DCF fair value of $68.47 compared with the current share price of $36.98 implies further runway, which may strengthen bull cases centered on undervaluation and stable execution.

Consistent Growth Outpaces Sector Norms

- The annualized earnings growth rate of 7.4% and revenue growth forecast of 7.7% both track above what many regional banks have achieved in a challenging macro backdrop.

- Steady top-line and bottom-line expansion supports market views highlighting First United’s resilience and constructive operational momentum.

- Recent performance, including the 54.4% one-year earnings increase, suggests that FUNC’s defensive profile does not come at the expense of growth.

- Sustained financial momentum further distinguishes the bank in a sector where predictability has been difficult to achieve.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on First United's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite standout profit growth, First United still lags sector leaders in forecasted long-term revenue and earnings expansion. This poses questions about its future pace compared to peers.

If you're seeking smoother performers, target steady results and fewer surprises by focusing on stable growth stocks screener (2087 results) that deliver growth with greater consistency year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.