يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Fluence Energy (FLNC): Reassessing Valuation After Landmark Polish Battery Contract and U.S. Delivery Milestones

Fluence Energy, Inc. FLNC | 21.93 | -1.17% |

Fluence Energy (FLNC) recently secured a major contract to supply the largest battery energy storage system in Poland. This will support DTEK’s Trzebinia project. This win, along with progress on U.S. deliveries, has investors taking a closer look.

Momentum has picked up for Fluence Energy, with the stock notching a sharp rally after recent contract wins and buzz around possible ownership changes at its major shareholder. However, its 1-year total shareholder return of -0.39% shows these gains are still working to turn around a sluggish longer-term trend. Growth optimism remains, but investors are watching to see if the recent excitement leads to sustained performance, especially with continuing policy tailwinds and a hefty order backlog in play.

If all the action in clean energy storage has you searching for fresh ideas, now is a perfect moment to discover fast growing stocks with high insider ownership.

With shares rebounding sharply and the company boasting major new wins, the question remains: Is Fluence Energy trading below its true value, or have expectations and future growth already been fully reflected in the current price?

Most Popular Narrative: 69% Overvalued

Fluence Energy’s narrative fair value is $7.74, significantly lower than the last close at $13.05. The numbers driving this narrative point to high future ambition, but the current share price stands far above what is considered justified by consensus assumptions.

Rapid global electrification and surging power demand, driven by data centers, transportation, and industrial sectors, are expected to sharply increase the need for grid resilience and flexibility. This is projected to result in substantial growth for large-scale battery storage. This expansion will drive material revenue growth for Fluence over the next several years.

Curious what bold forecasts fuel this sky-high valuation gap? The fair value hinges on fast-growing sales, rising margins, and a dramatic profit turnaround. Which factors matter most in the math? The surprising logic and critical future milestones are just a click away.

Result: Fair Value of $7.74 (OVERVALUED)

However, persistent tariff uncertainty and heavy reliance on Chinese battery supply chains could disrupt Fluence Energy’s growth and put pressure on future profit margins.

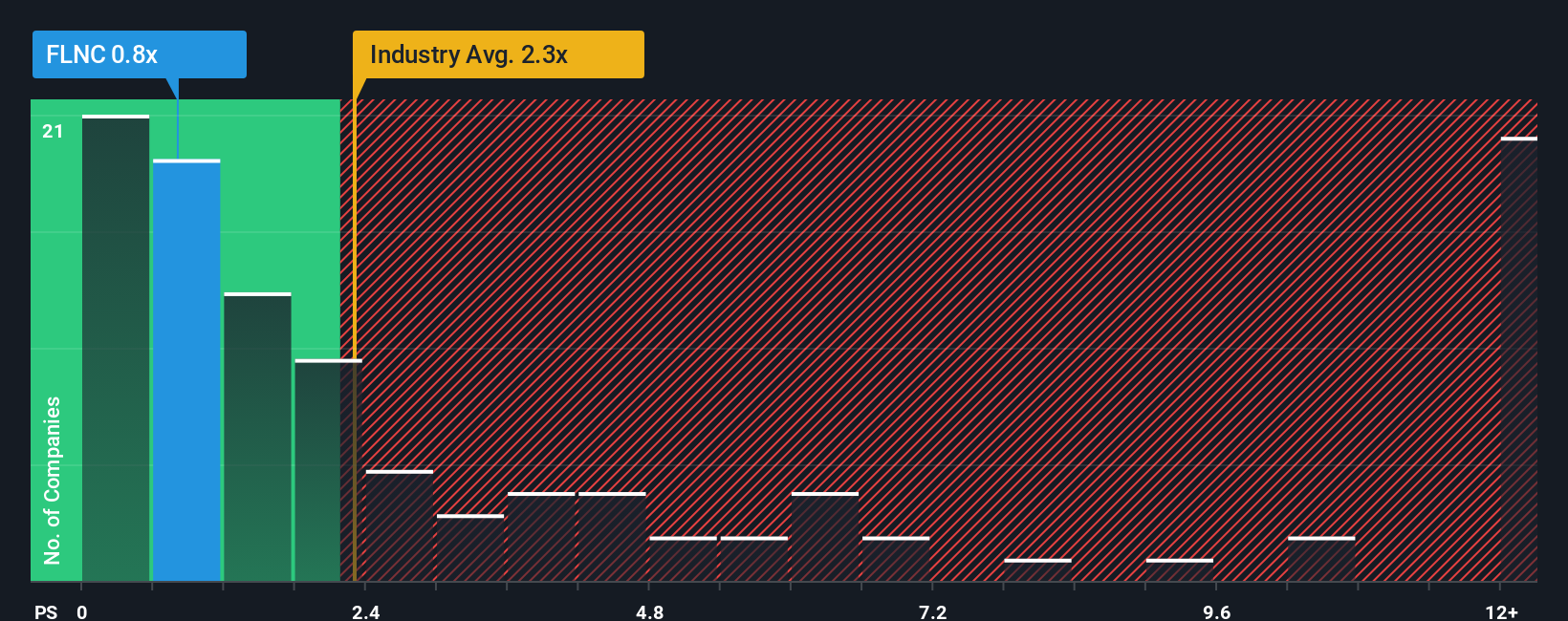

Another View: Market Ratio Signals Good Value

Looking from a different angle, the current price-to-sales ratio for Fluence Energy stands at just 0.7x. This is much lower than the industry average of 2.2x, the peer average of 5.9x, and even the fair ratio of 1.6x our analysis suggests the market could move toward. The low ratio highlights a potential value opportunity for investors, yet it also raises questions. Despite future growth concerns, could the market be underestimating Fluence's prospects, or do value risks still linger beneath the surface?

Build Your Own Fluence Energy Narrative

If you're keen to dig into the numbers yourself or have a different take on Fluence Energy's story, you can piece together your own view in just a few minutes. Do it your way.

A great starting point for your Fluence Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the curve by zeroing in on stocks with standout traits before the market catches on. Put your capital to work where opportunity meets momentum with these fresh screens:

- Boost your search for steady returns and income by targeting these 19 dividend stocks with yields > 3% consistently offering yields above 3% in today’s volatile market.

- Spot exceptional bargains under the radar and tap into these 910 undervalued stocks based on cash flows priced well below their intrinsic value based on cash flows.

- Gain an edge by focusing on innovators in medicine and biotechnology. See these 31 healthcare AI stocks powering breakthroughs in healthcare with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.