يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Four Corners Property Trust FFO Supports Income Narrative Despite Valuation Premium Concerns

Four Corners Property Trust, Inc. FCPT | 25.26 | +0.84% |

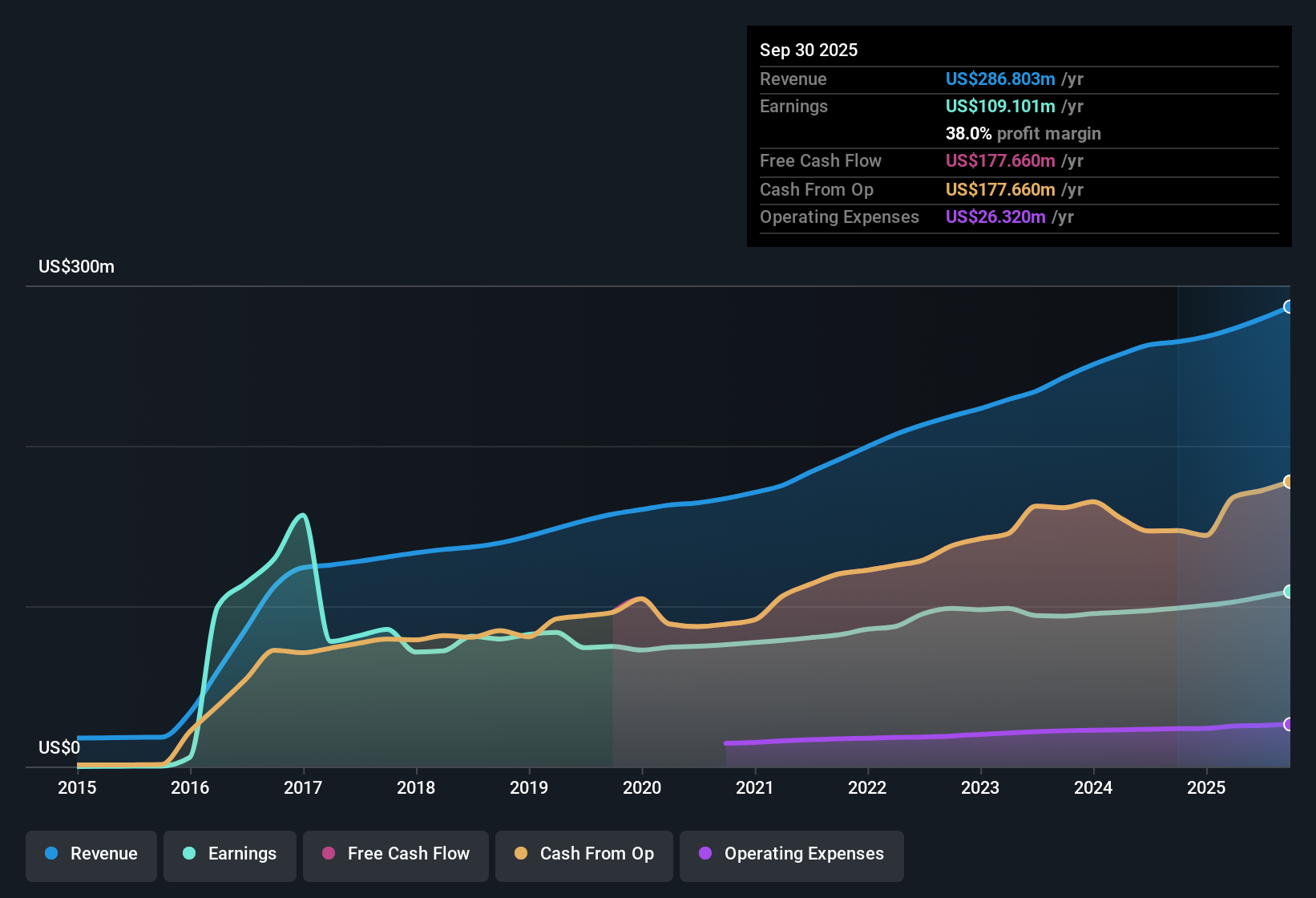

Four Corners Property Trust (FCPT) has wrapped up FY 2025 with fourth quarter total revenue of US$75.7 million, basic EPS of US$0.28 and funds from operations of US$45.7 million, giving investors a fresh look at the REIT's cash generation. Over the past six quarters, the company has seen total revenue move from US$66.8 million in Q3 2024 to US$75.7 million in Q4 2025. Trailing twelve month revenue sits at US$294.1 million and EPS at US$1.09, framing the latest results for income-focused investors.

With the headline numbers in place, the next step is to weigh this result against the key narratives around FCPT, highlighting where the recent performance aligns with the current story and where it may prompt investors to reassess their expectations.

FFO And Margins Support The Income Story

- Trailing 12 month funds from operations sit at US$172.7 million on US$294.1 million of revenue, which lines up with a 38.2% net profit margin compared with 37.5% a year earlier.

- Analysts' consensus view leans on FCPT's focus on e commerce resistant, essential service properties to keep cash flows predictable, and the current 38.2% net margin together with quarterly FFO of US$45.7 million is consistent with that, even though casual dining still accounts for 66% of rents and leaves some reliance on one segment.

- Supporters point to the move toward automotive service and medical retail tenants as a way to reduce that 66% casual dining exposure over time, which would help keep FFO and margins resilient if restaurant trends weaken.

- At the same time, modest rent escalators averaging 1.4% over five years mean future margin expansion is not guaranteed, so the current 38.2% margin mainly indicates that the existing portfolio is holding its line rather than rapidly widening profitability.

Valuation Gap Versus DCF Fair Value

- FCPT trades at a P/E of 23.5x and a share price of US$24.37 compared with a DCF fair value of about US$47.54 and a sector peer P/E average of 22.1x and specialized REIT industry average of 30.1x.

- What stands out for the bullish view is that the stock price sits materially below the US$47.54 DCF fair value while FFO over the last year reached US$172.7 million, which supporters argue points to a disconnect between cash generation and the current market multiple.

- Backers also highlight that trailing net income of US$112.4 million and 11.8% earnings growth over the last year are paired with a 6.02% dividend yield, so they see both income and potential upside to fair value in the same story.

- On the other hand, the P/E of 23.5x is still slightly above the 22.1x peer average, so anyone leaning on the bullish case needs to be comfortable paying a small premium while relying on that DCF fair value of US$47.54 to argue the stock is still attractively priced overall.

Debt Coverage Risk Against 6.02% Yield

- Alongside the 6.02% dividend yield, the key flagged risk is that FCPT's debt is not well covered by operating cash flow over the trailing 12 months, even as trailing net income stands at US$112.4 million and FFO at US$172.7 million.

- Skeptics focus on this balance sheet angle, arguing that weak debt coverage can limit flexibility, and they see the combination of long term leases with 1.4% average rent escalators and sector concentration in casual dining, automotive service and medical retail as a constraint if conditions turn, despite the current 38.2% net margin and high yield.

- The concern is that, with long fixed leases, FCPT has less room to offset higher financing costs or operating pressure through faster rent growth, which makes that debt coverage warning more important than the earnings and revenue growth figures on their own.

- For cautious investors, the 6.02% dividend yield and 11.8% trailing earnings growth do not fully offset the risk that constrained cash coverage of debt could limit future acquisition capacity or make it harder to sustain the same payout level if conditions change.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Four Corners Property Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this update sparks a different take, shape it into your own narrative in just a few minutes and Do it your way

A great starting point for your Four Corners Property Trust research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

FCPT’s flagged weak debt coverage, modest 1.4% rent escalators and sector concentration raise questions about how resilient its income story is if conditions change.

If that balance sheet concern hits home, compare FCPT with companies in our solid balance sheet and fundamentals stocks screener (44 results) and see which names look better positioned to handle pressure without stretching cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.