يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Franklin Resources (BEN): Examining Current Valuation After Recent Share Price Moves

Franklin Resources, Inc. BEN | 23.48 | +0.04% |

Franklin Resources (BEN) shares have seen modest movement lately, catching the eye of investors seeking clarity around the asset manager's valuation and where it may head next. Recent returns offer a mix of short-term gains as well as longer-term shifts.

The latest price movement in Franklin Resources reflects a year of notable momentum, with a 12.6% year-to-date share price return and a healthy 18.97% total shareholder return over the last twelve months. While the stock has faced short-term pressure recently, long-term holders are still ahead. This suggests underlying confidence in ongoing growth prospects even as market sentiment shifts.

If you’re watching market leaders like Franklin Resources, now is a great time to broaden your investing horizons and see what you discover with fast growing stocks with high insider ownership

With recent gains and valuation indicators sending mixed messages, the real question for investors is whether Franklin Resources is still undervalued or if the current share price already reflects its potential for future growth.

Most Popular Narrative: 10.9% Undervalued

Franklin Resources’ widely-followed narrative values shares above the latest closing price, highlighting a gap investors can’t ignore. This sets the stage for a closer look at what is driving that upside.

The company is actively expanding its presence in non-U.S. and emerging markets, now with $500 billion of AUM outside the US and new mandates in countries like Uzbekistan and Saudi Arabia. This positions Franklin Resources to benefit from the rising global wealth and the increasing allocation of institutional capital worldwide. This is likely to support future AUM growth and top-line revenue expansion.

Want to know what else is fueling this ambitious price target? The most closely-watched numbers are buried in projections for eye-popping profit margins and a sharp pivot in earnings power. The twist is that the case hinges on some bold financial shifts that you might not expect from a mature asset manager. There is more to the story. See what other hidden drivers could unlock value.

Result: Fair Value of $25.45 (UNDERVALUED)

However, ongoing client outflows and fee pressure could quickly undermine the optimistic case if these challenges persist or intensify for Franklin Resources.

Another View: Valuation Through Market Multiples

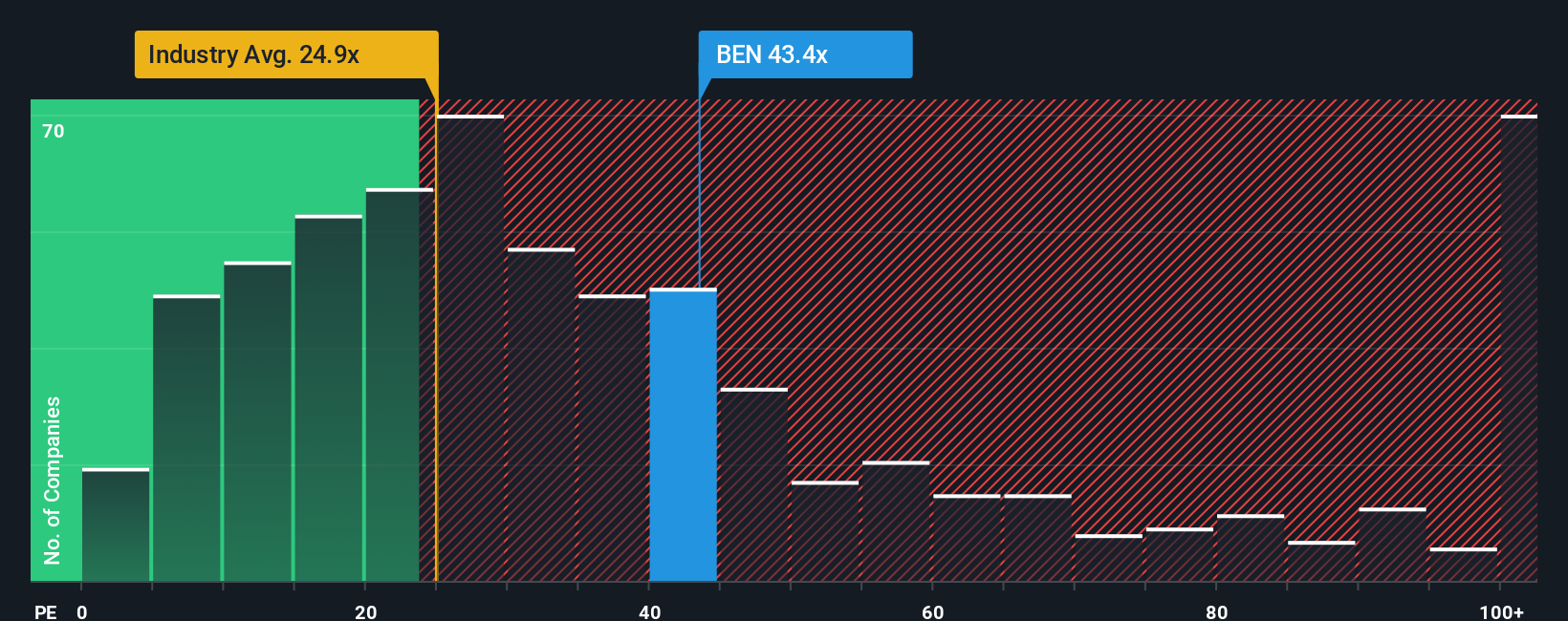

Looking from a different angle, Franklin Resources is valued at 43.4 times earnings, making it look expensive compared to both its industry average (25.9x) and peer group (17.6x). The fair ratio is 18.8x, suggesting the market could reset expectations quickly. Does this premium indicate hidden potential or increased valuation risk?

Build Your Own Franklin Resources Narrative

If you see things differently or want to uncover your own angle from the data, you can shape your own analysis in just a few minutes. Do it your way

A great starting point for your Franklin Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Missing out on fresh opportunities could cost you. Level up your investing strategy by checking out stocks that stand out far beyond the familiar names.

- Tap into the surge in digital finance by finding companies at the forefront using these 80 cryptocurrency and blockchain stocks. This is a way to seize groundbreaking blockchain and cryptocurrency growth.

- Secure higher income potential by targeting attractive yields among quality companies highlighted through these 17 dividend stocks with yields > 3% and get paid while your capital works for you.

- Jump ahead of the curve with innovative businesses transforming industries, all spotlighted in these 27 AI penny stocks as the next wave in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.