يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Garmin (GRMN): Valuation Check as Product Upgrades and Major Partnerships Drive Innovation in Wearables and Health Tech

Garmin Ltd. GRMN | 202.33 | +1.83% |

Garmin's Innovation Wave: Big Launches and Bold Partnerships Shake Up the Outlook

If you have been eyeing Garmin (GRMN) and wondering whether now’s the time to take action, the latest flood of news could make your decision a little more complicated but also a lot more interesting. Over the past two weeks, Garmin rolled out a suite of upgraded products like the Venu 4 premium smartwatch, the Bounce 2 for kids with integrated LTE, and a new Instinct Crossover AMOLED. These all offer expanded health tracking, safety, and accessibility features. Add in a headline-stealing partnership with Meta, bringing live Garmin biometric data to next-generation AI eyewear, and a massive research tie-up with King’s College London for maternal health. The company is not just flexing its innovation muscles; it is staking out new territory in both consumer tech and digital health.

This wave of positive announcements seems to have caught the market’s attention, with Garmin chalking up a 40% total return over the past year and solid double-digit growth so far in 2025. Momentum has been especially strong over the past 3 months, while a three-year return north of 200% highlights how far the business has come. The stock’s climb has outpaced the broader market, but the recent rush of partnerships and tech updates could be shifting risk and rewarding those betting on Garmin’s long-term vision.

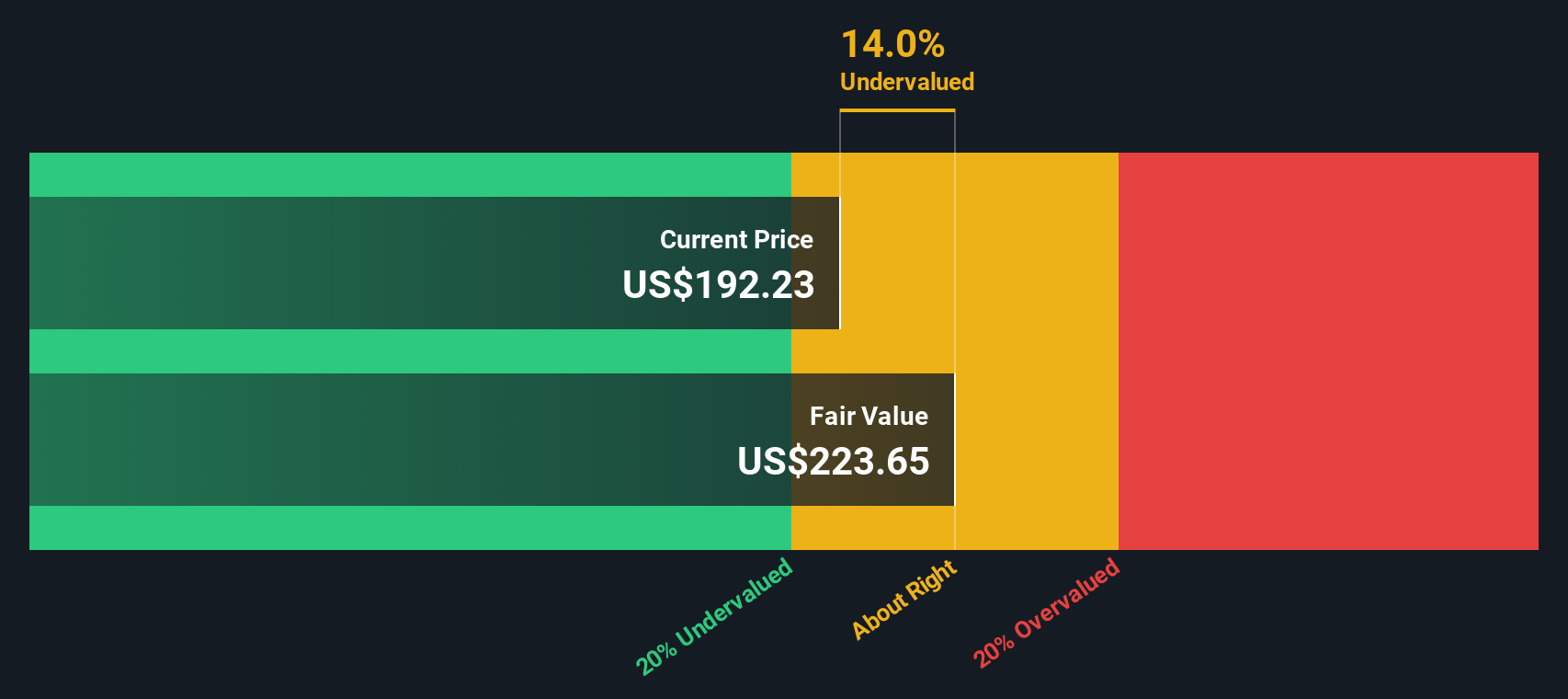

So after this run and all the innovation, is Garmin trading at a bargain, or has the market already priced in another leg of growth?

Most Popular Narrative: 9% Overvalued

The prevailing narrative suggests Garmin’s current share price is running hot compared to what analysts consider its fair value, given growth expectations and current market conditions.

The launch of the Garmin Connect+ premium service, which offers AI-based health and fitness insights, is likely to boost subscription-based revenue growth and improve overall margins through higher-margin services. The new vívoactive 6 smartwatch release, with advanced features like an AMOLED display and enhanced sports apps, suggests potential revenue growth in the Fitness segment, supported by strong demand for advanced wearables.

Curious about the bold math behind this premium price tag? The narrative hints at aggressive future earnings and revenue projections, combined with rich valuation multiples, a pattern usually reserved for sector leaders. If you want to know exactly which bullish assumptions are driving Garmin’s above-market valuation, dive deeper for the full breakdown.

Result: Fair Value of $215 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising operational expenses and global trade uncertainties could easily dent Garmin’s growth trajectory. This could make current lofty expectations vulnerable to disappointment.

Find out about the key risks to this Garmin narrative.Another View: What Does Our DCF Model Reveal?

Looking beyond market optimism, our SWS DCF model suggests Garmin may be trading above its underlying worth. While growth stories are compelling, this approach raises additional questions about what is truly priced in.

Build Your Own Garmin Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own case in just a few minutes. Do it your way.

A great starting point for your Garmin research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Thousands of investors are tracking game-changing sectors that are shaping the next wave of opportunities. Get ahead of the curve and see where your next smart move could lead.

- Uncover undervalued gems packed with growth potential by using our undervalued stocks based on cash flows.

- Pounce on breakthrough medical technology trends with our powerful healthcare AI stocks.

- Capture income opportunities from companies delivering steady cash flow with our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.