يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Genesis Energy (GEL): Evaluating Valuation After Q3 Profit Turnaround and Renewed Growth Optimism

Genesis Energy, L.P. GEL | 15.57 15.57 | -0.13% 0.00% Pre |

Genesis Energy (GEL) has grabbed investor attention after fiscal Q3 results flipped last year's loss into a $9.2 million profit, powered by its offshore pipeline transportation segment and efficient use of existing infrastructure.

That turnaround story seems to be feeding into the stock, with the latest share price at $15.61 and a powerful year to date share price return of nearly 48 percent. A 1 year total shareholder return above 60 percent shows momentum is still very much alive despite some recent cooling.

If Genesis Energy’s run has you thinking about what else might be setting up for a similar move, now is a good time to explore fast growing stocks with high insider ownership.

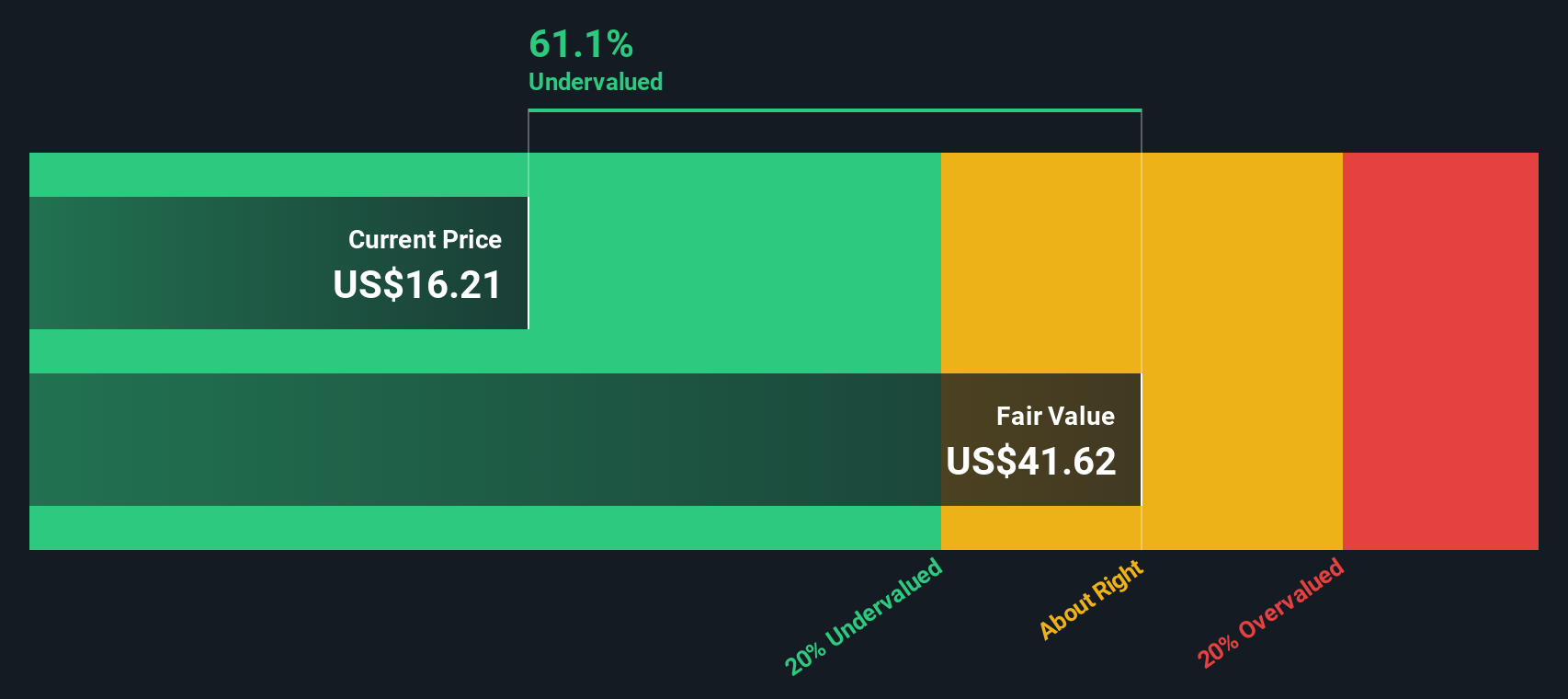

With the units still trading at a hefty discount to analyst targets despite a big run, investors now face a key question: Is Genesis Energy still undervalued, or is the market already pricing in its next leg of growth?

Price-to-Sales of 0.7x: Is it justified?

On a price-to-sales basis, Genesis Energy trades at 0.7 times revenue, a level that screens as cheap versus both its industry and close peers.

The price-to-sales ratio compares a company’s market value to its revenue. This can be a useful lens for midstream and infrastructure names where earnings can be volatile or temporarily depressed. For Genesis Energy, this low multiple suggests the market is not fully rewarding existing cash generating assets or the scale of its pipeline and logistics footprint.

Against the broader US oil and gas industry average of 1.4 times sales and a peer average of 2.8 times, Genesis Energy’s 0.7 times stands out as heavily discounted in relative terms. However, set against an estimated fair price-to-sales ratio of just 0.3 times, the current multiple also looks rich versus where valuation could settle if sentiment turns. This highlights a clear tension between what peers trade on and where a fundamentals driven fair ratio points.

Result: Price-to-Sales of 0.7x (UNDERVALUED)

However, risks remain, including steep revenue declines and recent negative net income, which could quickly pressure sentiment if growth expectations fade.

Another View on Value

Our DCF model paints a far more optimistic picture, suggesting fair value around $47.95 per unit, roughly three times the current $15.61 price. That implies Genesis Energy could be deeply undervalued if cash flows hold up, but can that thesis withstand falling revenue forecasts and balance sheet risks?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Genesis Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Genesis Energy Narrative

If you see things differently or would rather dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Genesis Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next move by tapping into fresh stock ideas on Simply Wall St’s powerful screener so opportunities do not pass you by.

- Look for potential multi-baggers early by scanning these 3642 penny stocks with strong financials that already back their tiny market caps with solid financial strength.

- Explore the structural AI theme by targeting these 26 AI penny stocks positioned at the intersection of powerful algorithms and rapidly scaling demand.

- Strengthen your core portfolio with these 912 undervalued stocks based on cash flows that generate robust cash flows yet still trade at meaningful discounts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.