يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

German American Bancorp (GABC) Net Interest Margin Improvement Tests Bullish Narratives

German American Bancorp, Inc. GABC | 43.67 | +1.16% |

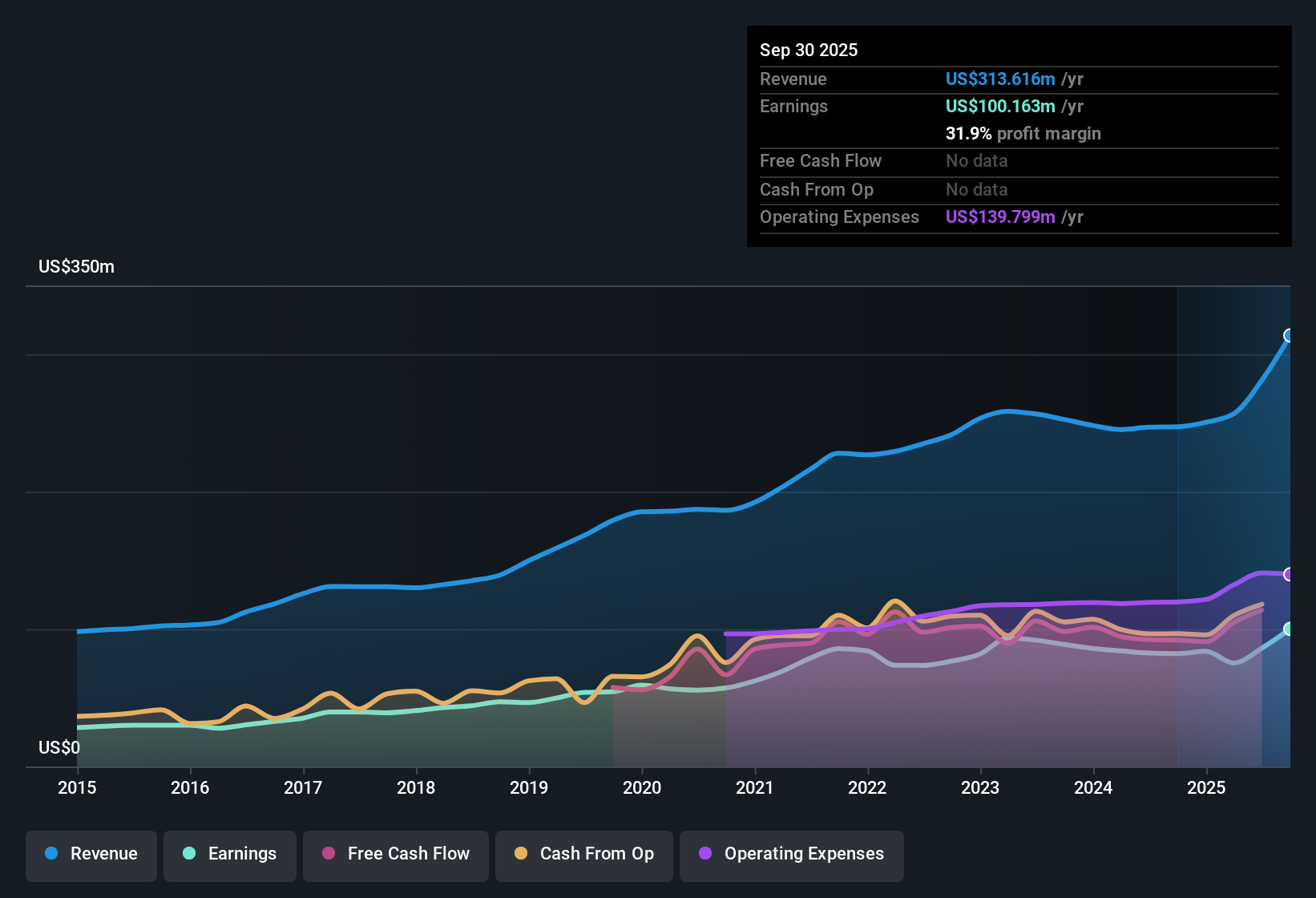

German American Bancorp (GABC) just posted its FY 2025 fourth quarter numbers, reporting revenue of US$94.0 million and EPS of US$0.95, supported by quarterly net income of US$35.7 million. The bank’s revenue moved from US$64.5 million in Q4 2024 to US$94.0 million in Q4 2025, while quarterly EPS increased from US$0.78 to US$0.95 over the same period, indicating a notably different earnings profile than a year ago. With a trailing 12 month net profit margin of 32% and a P/E above sector averages, the latest earnings leave investors balancing solid profitability against the risks associated with richer pricing.

See our full analysis for German American Bancorp.With the headline figures on the table, the next step is to see how these results compare with the most widely held narratives about German American Bancorp and to identify where the numbers begin to challenge those views.

4.02% net interest margin supports earnings story

- On a trailing 12 month basis, German American Bancorp earned a 4.02% net interest margin, compared with 3.43% in the earlier 2024 data, alongside US$341.3 million in revenue and US$112.6 million in net income.

- What is interesting for a bullish view is how the margin and profit figures line up, because:

- Trailing 12 month EPS of US$3.06 sits alongside a 32% net profit margin, so the bank is turning a meaningful portion of its US$341.3 million in revenue into bottom line profit.

- Bulls pointing to 22% earnings growth over the last year can point directly to these higher margin levels compared with the 3.47% and 3.43% net interest margin snapshots from the 2024 data as support for that argument.

Cost to income ratio trends under 50%

- The cost to income ratio moved within a relatively tight band during FY 2025, around 54.1% in Q1 and then below 50% in Q2 to Q4, with Q4 landing at 48.55% against revenue of US$94.0 million and net income of US$35.7 million.

- For a bullish narrative that focuses on efficient operations, this cost profile and the earnings numbers give some concrete support, because:

- Across FY 2025, the combination of sub 50% cost to income ratios in three quarters and quarterly net income between roughly US$31.4 million and US$35.7 million shows that expenses stayed contained while profit remained solid in dollar terms.

- When you line this up with trailing 12 month net income of US$112.6 million, it challenges any bearish concern that expense growth is pressuring profitability in a way that would fully offset the earnings growth reported for the year.

Loan growth comes with higher non performing balances

- Total loans increased in the reported figures from US$4,133.3 million in Q4 2024 to US$5,884.4 million in Q4 2025, while non performing loans in those snapshots went from US$11.1 million to US$29.4 million over the same period.

- For a more cautious or bearish angle, critics might focus on this credit quality mix, because:

- Non performing loans of US$29.4 million at Q4 2025 and US$29.4 million in the trailing 12 month snapshot are higher than the US$9.7 million to US$11.1 million range seen in the 2024 data, so asset quality metrics require close attention alongside the loan book expansion.

- At the same time, trailing 12 month net income of US$112.6 million and a 32% net profit margin show that profitability remains strong, which tempers a simple bearish claim that growing non performing loans are already eroding overall performance.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on German American Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

German American Bancorp’s earnings and margins sit alongside richer pricing, a higher P/E than sector averages, and rising non performing loan balances that add credit risk.

If that mix of premium pricing and asset quality concerns feels uncomfortable, check out solid balance sheet and fundamentals stocks screener (386 results) to focus on companies with sturdier finances and cleaner loan books right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.