يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Gogo (GOGO) Raises Guidance After Doubling Q2 Revenue Is a New Phase of Growth Emerging?

Gogo Inc. GOGO | 4.70 | -4.28% |

- Gogo Inc. recently reported strong results for the second quarter of 2025, with revenue reaching US$226.04 million and net income of US$12.81 million, both more than doubling compared to the same period last year.

- An important development is Gogo's decision to raise its full-year revenue and earnings guidance, which follows continued operational outperformance, integration progress, and planned 5G product launches.

- We'll explore how Gogo's upgraded financial guidance and integration milestones may influence the company's investment narrative and growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Gogo Investment Narrative Recap

Gogo’s investment story centers on growth in aviation broadband, with expansion into untapped markets, the integration of Satcom Direct, and the rollout of new technology like 5G serving as key catalysts. While the strong Q2 results and raised 2025 guidance are positive, the most important short-term catalyst, the successful and timely launch of Gogo’s 5G product, remains, with delays in 5G rollout still a primary risk. These recent financial updates do not materially reduce the timing risk around 5G deployment.

The most relevant recent announcement is Gogo’s move to increase its full-year revenue and earnings guidance, which reflects management’s confidence in operational progress and upcoming technology launches. This signals that, despite ongoing integration efforts and industry pressures, the company expects continued momentum to support its near-term catalysts.

However, investors should be mindful that, despite raised guidance, upcoming 5G deployment hurdles remain a critical monitor item, especially if...

Gogo's outlook anticipates $1.3 billion in revenue and $155.4 million in earnings by 2028. This is based on a 41.9% annual revenue growth rate and an increase in earnings of $141.7 million from the current $13.7 million.

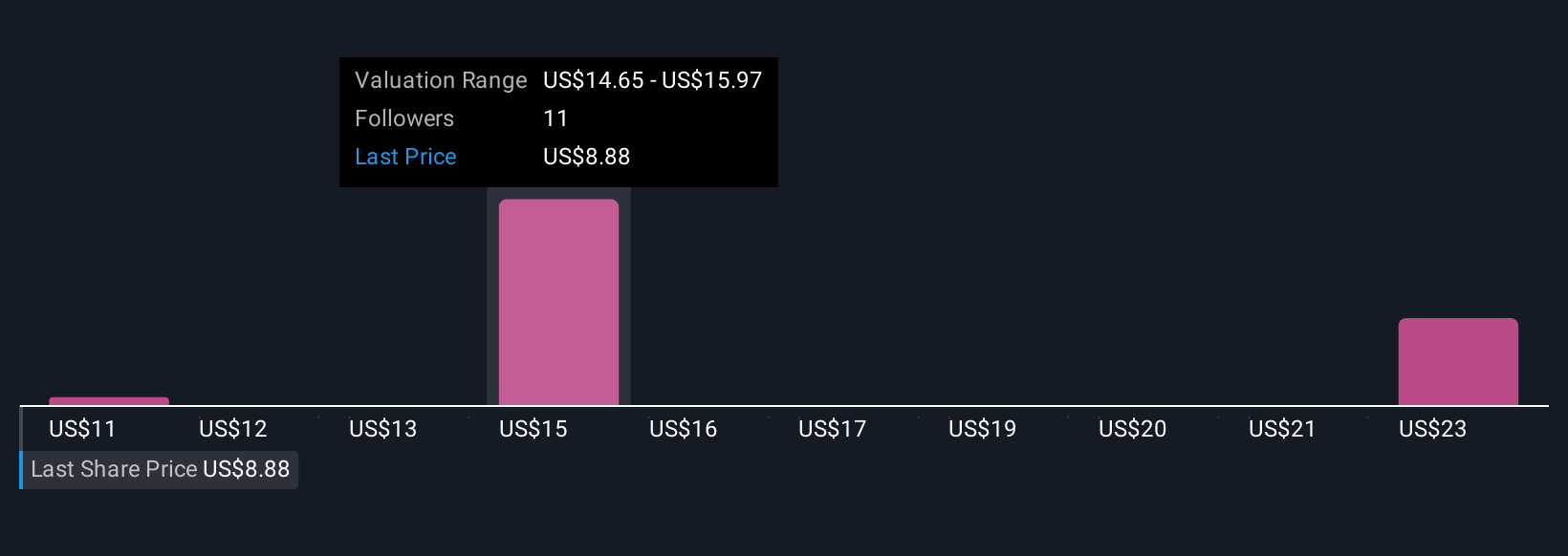

Uncover how Gogo's forecasts yield a $15.75 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Gogo’s fair value between US$10.69 and US$31.67 across three analyses. While these views vary widely, the market’s attention on Gogo’s pending 5G timeline underscores how different perspectives can influence outlooks.

Explore 3 other fair value estimates on Gogo - why the stock might be worth 12% less than the current price!

Build Your Own Gogo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gogo research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Gogo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gogo's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.