يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Hallador Energy Company's (NASDAQ:HNRG) Share Price Is Matching Sentiment Around Its Revenues

Hallador Energy Co HNRG | 18.40 | -2.34% |

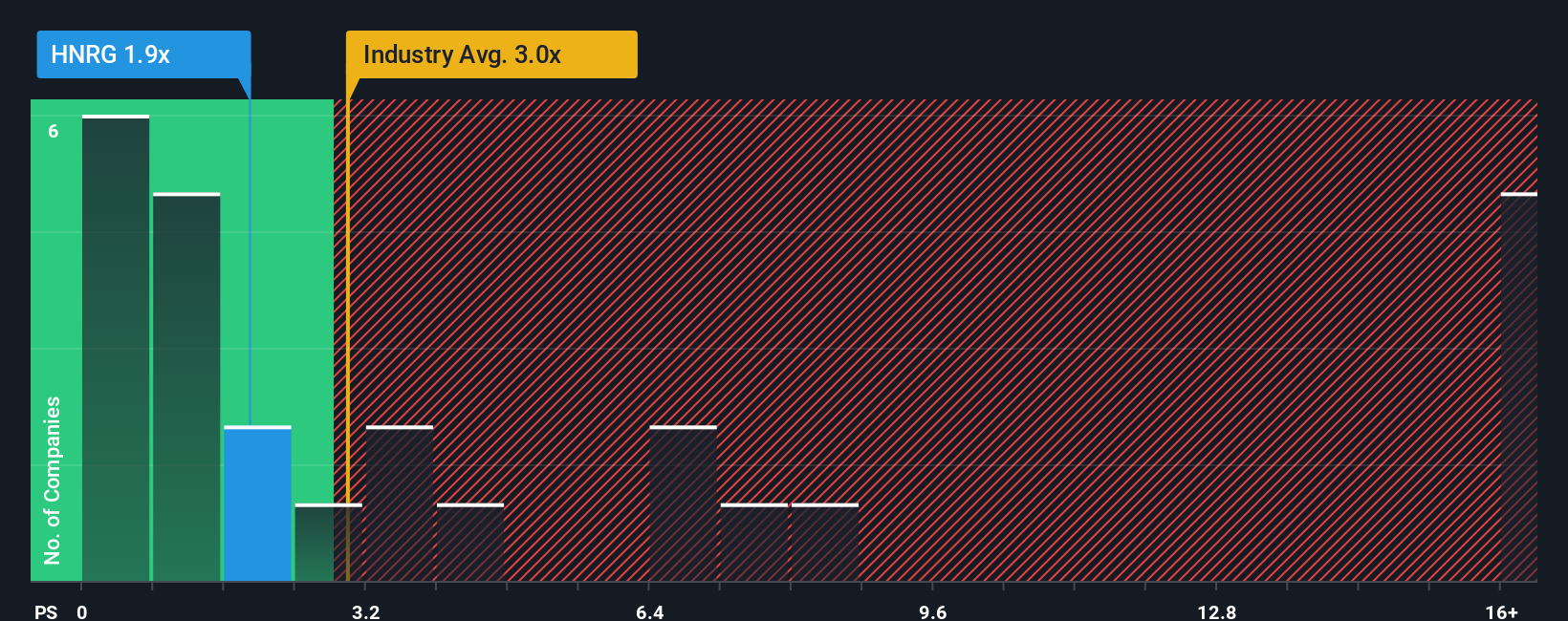

With a price-to-sales (or "P/S") ratio of 1.8x Hallador Energy Company (NASDAQ:HNRG) may be sending bullish signals at the moment, given that almost half of all the Renewable Energy companies in the United States have P/S ratios greater than 3x and even P/S higher than 8x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Hallador Energy's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Hallador Energy has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Hallador Energy will help you uncover what's on the horizon.How Is Hallador Energy's Revenue Growth Trending?

Hallador Energy's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.2%. The latest three year period has also seen an excellent 67% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 5.6% each year during the coming three years according to the three analysts following the company. With the industry predicted to deliver 14% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Hallador Energy's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Hallador Energy's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Hallador Energy's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.