يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Hawkins Wins Orange County Reuse Deal As NanoStack Thesis Builds

Hawkins, Inc. HWKN | 146.50 | +1.08% |

- Hawkins' subsidiary WaterSurplus will supply 1,050 NanoStack coated membranes to the Orange County Water District’s Groundwater Replenishment System.

- The decision follows a successful pilot and represents deployment into what is described as the world’s leading potable water reuse system.

- The project highlights Hawkins' role in advanced water treatment solutions for large scale reuse facilities.

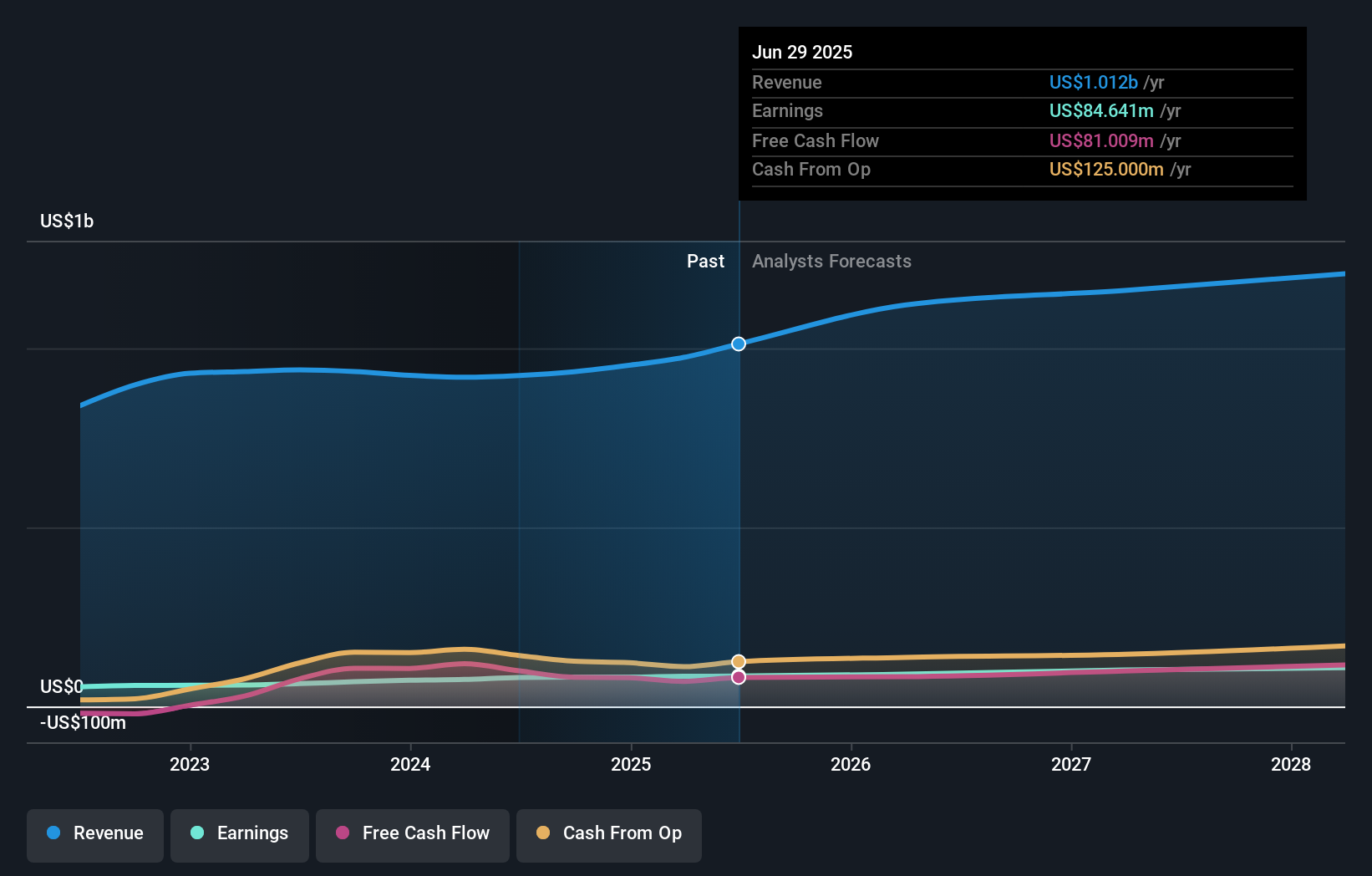

For investors watching NasdaqGS:HWKN, this contract sits alongside a share price of $143.51 and a 1 year return of 28.6%, with a very large gain over 5 years. The company’s value_score of 1 suggests it often screens as attractively valued on certain metrics, which can draw additional attention when paired with tangible commercial wins like this one.

The Orange County win gives Hawkins a high profile reference site for its NanoStack technology in potable reuse, a segment facing complex treatment requirements globally. If the installation performs in line with expectations, other large facilities may look more closely at similar membrane solutions for cost and energy efficiency goals.

Stay updated on the most important news stories for Hawkins by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Hawkins.

This NanoStack rollout gives Hawkins a foothold in one of the most demanding potable reuse facilities in the world, which matters if you are thinking about long term product traction. The pilot results spell out a clear value proposition for utilities and industrial users: less fouling, fewer clean in place cycles and more than 15% lower reverse osmosis energy consumption. With energy being a major operating cost, WaterSurplus’ estimate of a payback period of under two years speaks directly to budget holders who need quantifiable savings before approving new technology. For Hawkins, that kind of contract level proof point can be useful when talking to other large operators that might otherwise stick with incumbent suppliers like Xylem, Veolia or Pentair. It also sits against a backdrop where sales grew to US$244.08m in the latest quarter, while earnings per share eased slightly compared to a year earlier, and the board maintained a US$0.19 quarterly dividend. That combination of ongoing capital returns and product led opportunities in water treatment is likely to be an area many investors watch closely, especially as utilities look for lower lifecycle cost solutions rather than just lowest upfront price.

The Risks and Rewards Investors Should Consider

- ⚠️ Execution risk if NanoStack results at full scale do not match pilot performance, which could slow follow on orders from other reuse facilities.

- ⚠️ The company has been flagged as having a high level of debt, which can limit flexibility if market conditions or large projects do not play out as expected.

- 🎁 Earnings grew by 0.7% over the past year, suggesting Hawkins has been able to grow profit even while investing in product development and pilots like this one.

- 🎁 Earnings are forecast to grow 9.3% per year and analysts are in good agreement that the stock price will rise by 31%, pointing to an existing set of expectations that already factor in some growth opportunities.

What To Watch Going Forward

From here, the key things to watch are how reliably the NanoStack equipped train performs at Orange County and whether that turns into interest from other large reuse or industrial plants. Keep an eye on how much of Hawkins’ sales mix over time comes from higher margin water treatment technologies versus more traditional chemical products, and whether earnings growth tracks the 9.3% per year that analysts are expecting. The balance sheet is another item to monitor, given the flagged high level of debt, especially if Hawkins pursues more capital intensive projects or acquisitions in water treatment. Finally, the board’s stance on the US$0.19 quarterly dividend can give you a read on how comfortable management is with cash generation as the company scales product launches like NanoStack.

To ensure you're always in the loop on how the latest news impacts the investment narrative for Hawkins, head to the community page for Hawkins to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.