يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Herc Holdings (HRI) Valuation Check After Strong Revenue Growth And H&E Integration Progress

Herc Holdings, Inc. HRI | 153.46 | +6.87% |

Dividend decision and operational updates at Herc Holdings

Herc Holdings (HRI) has attracted fresh attention after reporting 30% growth in equipment rental revenue and 35% growth in total revenue, reaffirming full year guidance and advancing its H&E Equipment Services integration.

Herc Holdings' recent quarterly update, dividend declaration and upcoming conference appearances have coincided with a 4.64% 1 day share price return and 20.36% 7 day share price return, while its 1 year total shareholder return of 9.33% and 5 year total shareholder return of 160.34% suggest long term momentum that has experienced a recent setback.

If this equipment rental story has you looking beyond a single name, it could be a good moment to broaden your search with 22 top founder-led companies for fresh ideas.

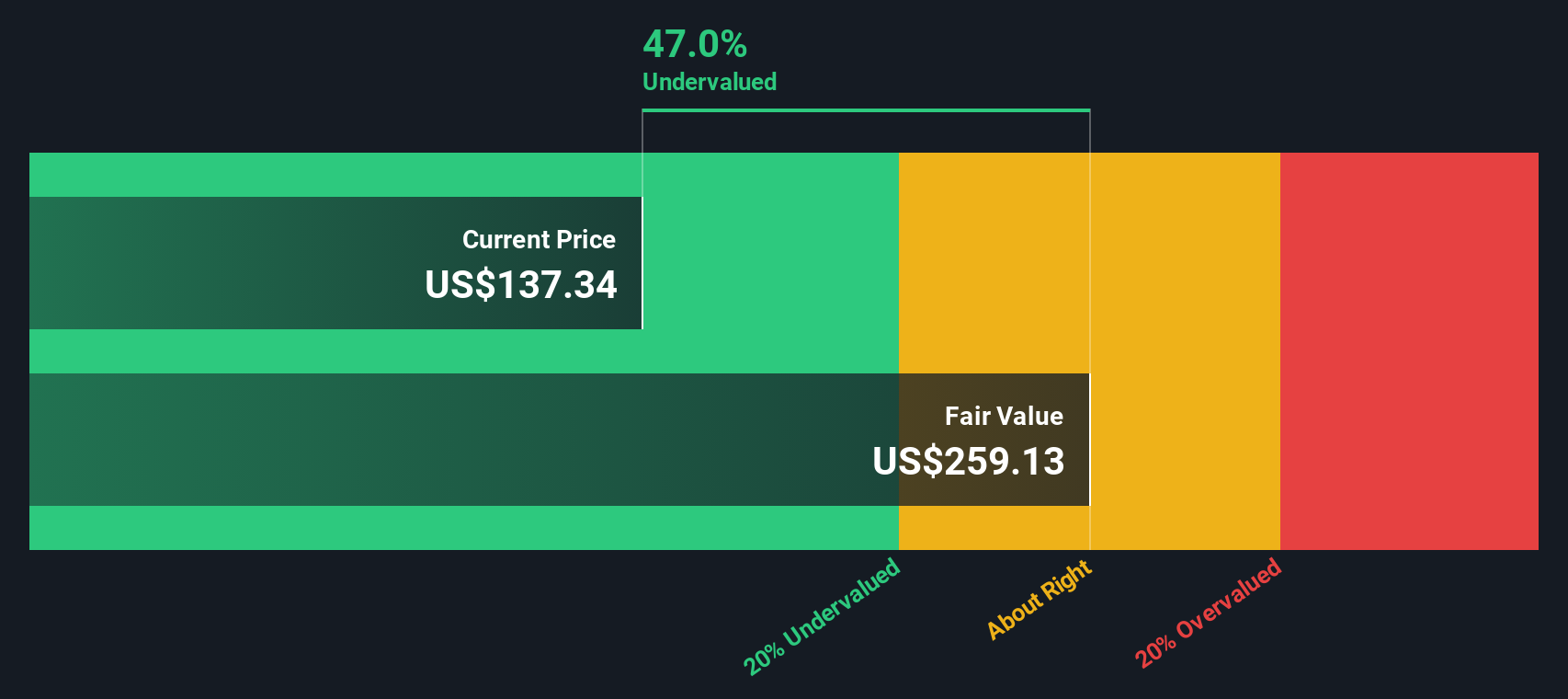

With the share price up strongly in recent weeks, a value score of 4, a reported intrinsic discount of 38.40% and a 1 year total return decline, you have to ask: is this a mispriced rental heavyweight, or is the market already baking in the next leg of growth?

Most Popular Narrative: 0.9% Overvalued

With Herc Holdings closing at $180.31 against a narrative fair value of about $178.73, the current setup rests on a finely balanced valuation story.

Realization of expected acquisition synergies, $350 million in revenue and $125 million in cost synergies, combined with stabilized workforce and disciplined capital management (including fleet optimization and targeted CapEx), should drive higher EBITDA, free cash flow generation, and accelerate deleveraging, providing upside to long-term earnings and shareholder returns.

Curious what kind of revenue path and margin rebuild is baked into that outlook? The narrative leans on ambitious earnings growth and a richer future earnings multiple. Want to see exactly how those moving parts stack up over time and what sort of cash flow profile they imply? The full breakdown lays out the numbers behind that fair value call in clear detail.

Result: Fair Value of $178.73 (OVERVALUED)

However, you still have to weigh integration strains at legacy H&E branches and Herc Holdings' higher debt load, which could pressure margins and limit financial flexibility.

Another angle on valuation

Our DCF model presents a very different picture. On this view, Herc Holdings at $180.31 is trading about 38.4% below an estimated future cash flow value of $292.72, which points to undervaluation. Which story do you think better aligns with your expectations for cash generation and risk?

Build Your Own Herc Holdings Narrative

If you see the numbers differently or just prefer to stress test the assumptions yourself, you can shape the story in your own way in a few minutes: Do it your way.

A great starting point for your Herc Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Herc has sharpened your thinking, do not stop here. The real edge often comes from comparing a few well chosen ideas side by side.

- Spot underappreciated quality by scanning 52 high quality undervalued stocks that pair strong fundamentals with prices that may not fully reflect them yet.

- Focus on resilience first with 84 resilient stocks with low risk scores that score well on stability, earnings consistency and balance sheet strength.

- Get ahead of the crowd with a screener containing 24 high quality undiscovered gems that most investors are not paying attention to yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.