يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

خسارة هيركوليز كابيتال (HTGC) لمرة واحدة بقيمة 71 مليون دولار تُثير تحديات في سرديات استرداد الهامش

Hercules Capital, Inc. HTGC | 16.93 | +0.74% |

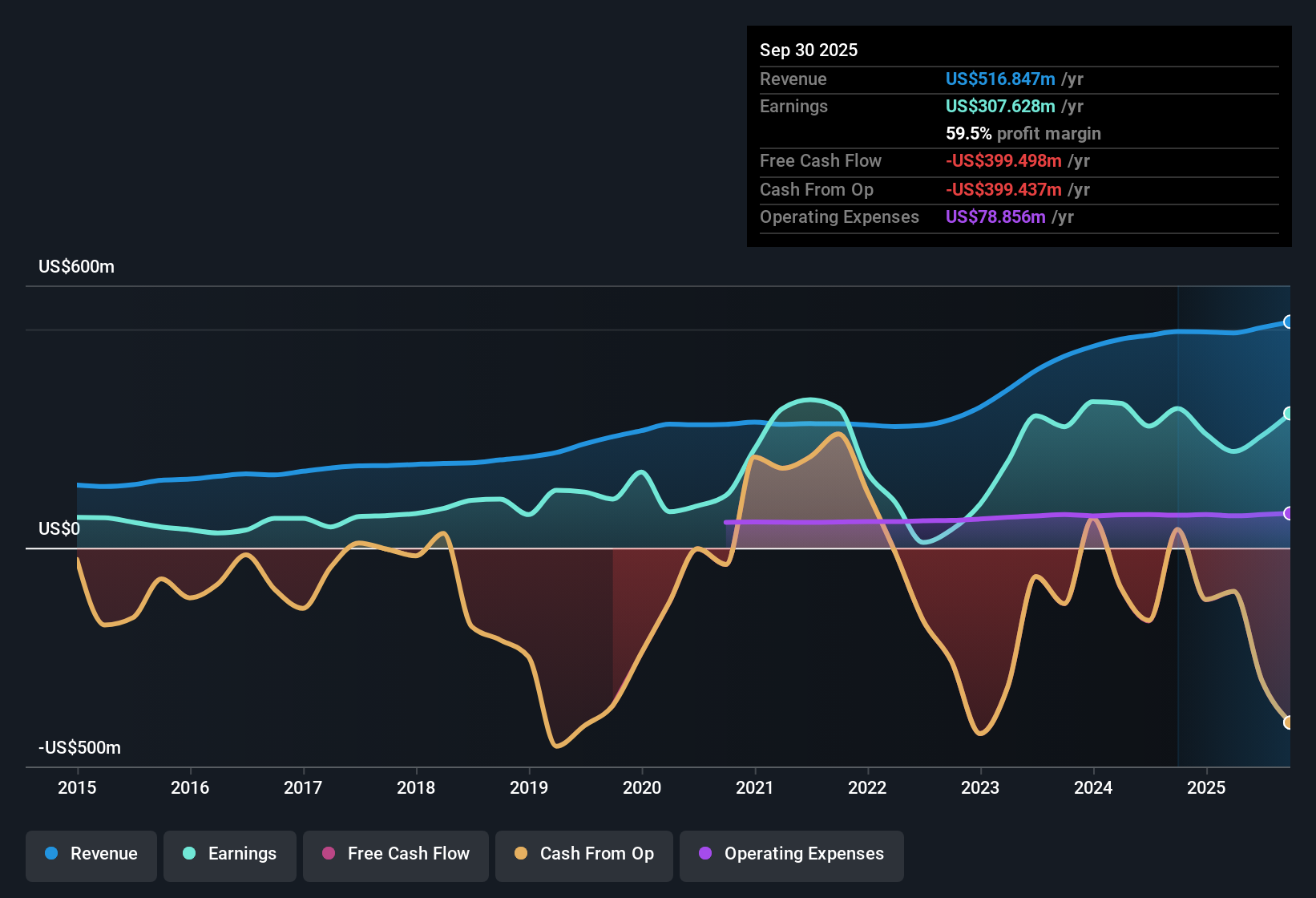

أعلنت شركة هيركليز كابيتال (HTGC) عن هوامش ربح صافية بلغت 50.9% خلال الاثني عشر شهرًا المنتهية في 30 سبتمبر 2025، متراجعةً من 57.2% في العام السابق. وقد تأثرت النتائج الحالية بخسارة كبيرة لمرة واحدة بلغت 71.1 مليون دولار، مما أثر سلبًا على توقعات الأرباح على الرغم من سجل الشركة القوي في تحقيق نمو سنوي في الأرباح بنسبة 8.2% على مدى السنوات الخمس الماضية. ومع توقعات تشير إلى نمو الأرباح والإيرادات بنسبة 9.5% و7.8% سنويًا على التوالي، وكلاهما أقل من متوسط اتجاهات السوق الأمريكية، يُقيّم المستثمرون حاليًا جاذبية تقييم الشركة البالغ 12.5 ضعفًا لمضاعف الربحية، بالإضافة إلى الخصم على القيمة العادلة، في مقابل الضغوط المستمرة على هوامش الربح وجودة الأرباح.

اطلع على تحليلنا الكامل لشركة هرقل كابيتال.دعونا نرى كيف تتطابق هذه الأرقام الرئيسية مع الروايات السائدة حول شركة هرقل كابيتال. ستتحقق بعض التوقعات، بينما قد يفاجأ البعض الآخر.

هدف هامش ربح المحللين: 67.2% خلال ثلاث سنوات

- يتوقع المحللون أن ترتفع هوامش ربح شركة هيركليز كابيتال من 50.9% الحالية إلى 67.2% بحلول عام 2028، مما يمثل تحسناً كبيراً إذا تحقق ذلك.

- وفقًا لرأي المحللين المتفق عليه، فإن أحد العوامل المحفزة لهذا التوسع هو توجه الشركة نحو التكنولوجيا وعلوم الحياة، مما يغذي النمو المستمر للمحفظة ويدفع إلى زيادة صافي دخل الاستثمار.

- يؤكد السرد المتفق عليه أن الحجم والتحسينات الأخيرة في المنصة من شأنها أن تزيد من الرافعة التشغيلية، مما قد يدعم هذا التوسع في هامش الربح.

- ومع ذلك، فإن ارتفاع النفقات المرتبطة بالنمو السريع للمحفظة الاستثمارية معرض لخطر التعويض الجزئي عن مكاسب الهامش، مما يجعل التحكم الفعال في التكاليف أمرًا بالغ الأهمية.

- مع توقعات المحللين التي تعتمد على هوامش ربح طموحة، تُشكّل النتائج الأخيرة معيارًا عاليًا. تعرّف على مدى توافق التوقعات مع أساسيات شركة هيركوليس. 📊 اقرأ التقرير الكامل حول هيركوليس كابيتال.

يتسع نطاق الخصم المقدم من النظراء والقطاع إلى ما بين 20% و50%

- يتم تداول أسهم شركة Hercules Capital بنسبة سعر إلى ربحية تبلغ 12.5 ضعفًا، مما يعني أن تقييمها يقل بنسبة 20٪ عن متوسط المجموعة النظيرة (14.9 ضعفًا) ويقل بنسبة 50٪ عن متوسط صناعة أسواق رأس المال الأمريكية الأوسع (25.6 ضعفًا).

- يرى المحللون بالإجماع أن فجوة التقييم هذه تمثل فرصة محتملة، بالنظر إلى التوقعات بشأن استمرار نمو الإيرادات والأرباح.

- تشير الرواية المتفق عليها إلى السيولة الوفيرة للشركة وعلاقاتها القوية مع الرعاة، مما يوحي بأن الأساسيات قد تدعم إعادة التقييم نحو مستويات الشركات المماثلة.

- كما يسلط الضوء على أن مخاطر مثل تركيز القطاع وانخفاض هوامش صافي الفائدة قد تمنع شركة هرقل من سد الفجوة بالكامل.

خسارة لمرة واحدة بقيمة 71 مليون دولار تُلقي بظلالها على استدامة توزيعات الأرباح

- إن الخسارة التي تكبدتها شركة هيركليز كابيتال هذا العام، والتي بلغت 71.1 مليون دولار، ليست مجرد رقم في العنوان، بل إنها تؤثر بشكل مباشر على استقرار الأرباح وقد تهدد استدامة توزيعات الأرباح.

- يشير سرد المحللين المتفق عليه إلى أن هذه الرسوم الاستثنائية تشكل خطراً رئيسياً يجب مراقبته، حيث تأثرت جودة الأرباح الأخيرة، وقد تؤدي أي خسائر مستقبلية غير متكررة إلى زيادة الضغط على تغطية توزيعات الأرباح.

- ويشير النقاد أيضاً إلى أن زيادة نفقات البيع والتسويق والإدارة ونفقات الفائدة، إذا لم تتم إدارتها، يمكن أن تحد من الأرباح القابلة للتوزيع وربما تضع ضغطاً تنازلياً على مدفوعات المساهمين.

- ينبغي على المستثمرين ترقب أي مؤشرات في التقارير المستقبلية تدل على أن الشركة تعمل على السيطرة على البنود غير المتكررة لتعزيز مدفوعاتها.

الخطوات التالية

للاطلاع على كيفية ارتباط هذه النتائج بالنمو طويل الأجل والمخاطر والتقييم، راجع مجموعة كاملة من روايات المجتمع لشركة Hercules Capital على موقع Simply Wall St. أضف الشركة إلى قائمة مراقبتك أو محفظتك حتى يتم تنبيهك عند تطور القصة.

هل لديك وجهة نظرك الخاصة حول هذه الأرقام؟ لا يستغرق الأمر سوى بضع دقائق لتحويل وجهات النظر الجديدة إلى سردك الخاص وتشكيل الحوار. افعل ذلك على طريقتك.

تُعد تحليلاتنا التي تسلط الضوء على 3 مكافآت رئيسية و3 علامات تحذيرية مهمة قد تؤثر على قرارك الاستثماري نقطة انطلاق رائعة لأبحاثك حول شركة هيركليز كابيتال.

اكتشف المزيد مما هو متاح

إن انخفاض هوامش الربح لشركة هيركليز كابيتال، وارتفاع التكاليف، والخسارة الأخيرة التي تكبدتها لمرة واحدة، تثير مخاوف بشأن اتساق واستدامة مدفوعات الأرباح.

إذا كانت الأرباح الموزعة الموثوقة هي أولويتك، فقارن خياراتك مع أسهم توزيعات الأرباح لعام 2008 ذات العوائد التي تزيد عن 3٪ لتحديد الشركات التي تقدم عوائد أعلى مع سجلات دفع مستقرة.

هذا المقال من Simply Wall St ذو طبيعة عامة. نقدم تعليقاتنا بناءً على البيانات التاريخية وتوقعات المحللين فقط، باستخدام منهجية محايدة، ولا يُقصد بمقالاتنا أن تكون نصائح مالية. لا يُشكل هذا المقال توصيةً بشراء أو بيع أي سهم، ولا يأخذ في الاعتبار أهدافك أو وضعك المالي. نهدف إلى تزويدك بتحليلات طويلة الأجل مدفوعة بالبيانات الأساسية. يُرجى ملاحظة أن تحليلنا قد لا يأخذ في الاعتبار آخر إعلانات الشركات الحساسة للسعر أو المعلومات النوعية. لا تمتلك Simply Wall St أي أسهم في أي من الشركات المذكورة.