يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Hope Bancorp (HOPE): Assessing Valuation After Strategic Updates and Second-Quarter Results

Hope Bancorp, Inc. HOPE | 12.51 | +0.64% |

If you have been watching Hope Bancorp (HOPE) lately, the company has given investors plenty to digest. After announcing its second quarter results, which included a net loss of $27.9 million due to one-time items, company leaders doubled down on highlighting recent strategic moves and financial resilience. This comes just as Hope Bancorp took the stage at the Barclays 23rd Annual Global Financial Services Conference, aiming to showcase how they are tackling industry headwinds and carving out a path for future growth.

This news seems to have caught the market’s eye. Despite the setback from second quarter results, Hope Bancorp’s stock managed to climb about 8% over the past three months, hinting at a shift in investor sentiment. The past year, though, tells a different story, with the stock down 7%. Still, the company’s longer-term return over five years is up noticeably, pointing to cycles of volatility mixed with potential. As management continues to promote their strategic vision, recent momentum suggests some investors are buying into the idea that the bank is positioning itself for better days.

So after a quarter filled with both challenges and optimism, is Hope Bancorp now attractively undervalued, or has the market already factored in much of its future potential?

Most Popular Narrative: 10.7% Undervalued

The most widely followed narrative sees Hope Bancorp as undervalued, with a calculated fair value that is more than 10% higher than the current share price. This perspective reflects optimism about the company’s ability to capture future growth and boost profitability in the years ahead.

“Significant ongoing investment in digital platform enhancements and fintech partnerships is poised to improve operational efficiency and customer retention, which could translate into a sustainably lower cost-to-income ratio and improved net margins over time.”

Curious about the math behind this bullish call? The narrative is driven by bold forecasts about rapid earnings growth and profit margin expansion, along with a future valuation multiple rarely seen in regional banks. Wondering which financial catalysts are fueling these projections? Uncover the full narrative to see how these ambitious assumptions stack up and what they could mean for Hope Bancorp’s share price outlook.

Result: Fair Value of $12.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy exposure to commercial real estate and lingering integration costs from recent acquisitions could challenge Hop Bancorp’s ability to deliver on these projections.

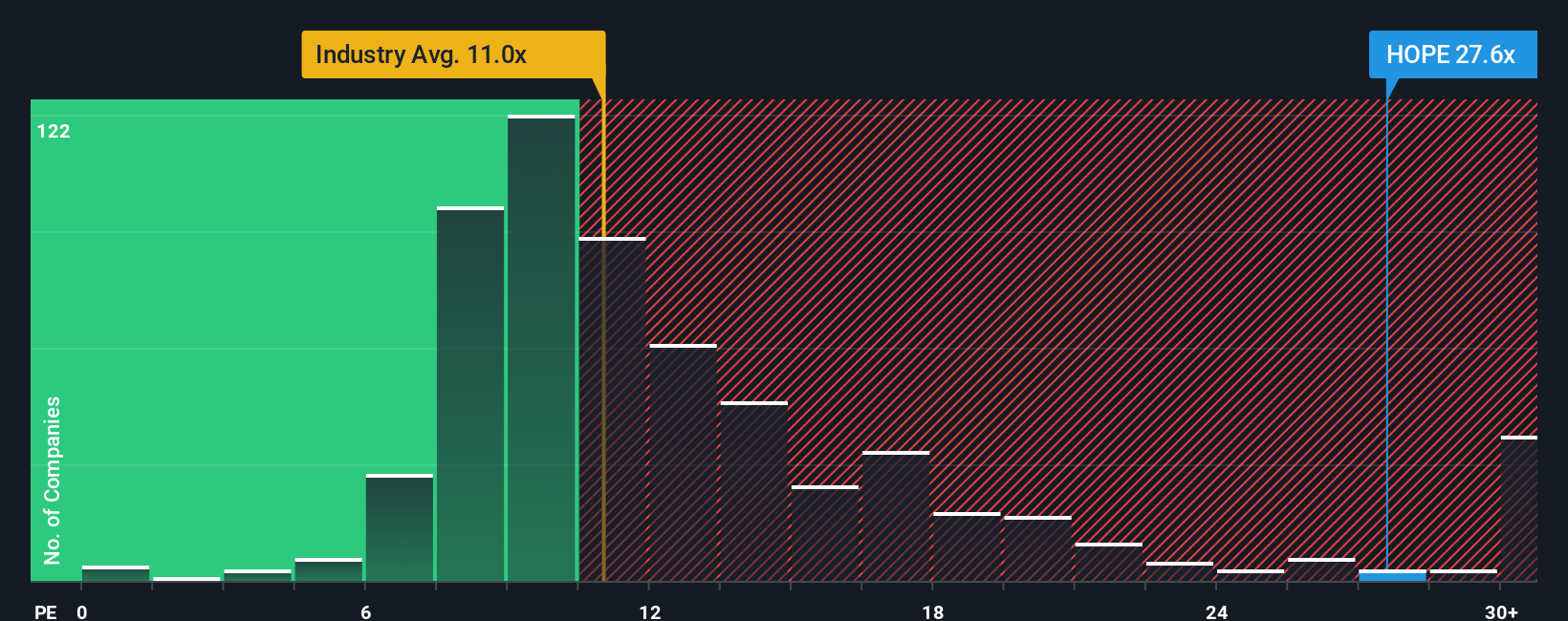

Find out about the key risks to this Hope Bancorp narrative.Another View: Market Ratio Reality Check

While the first approach sees Hope Bancorp as undervalued based on future growth and fundamentals, another perspective uses a straightforward market ratio comparison. This method suggests the company might actually be expensive, which casts doubt on the growth story. Which view holds up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hope Bancorp Narrative

If you see things differently or enjoy digging into the numbers yourself, take a few moments to build your own perspective and put the data to the test with your own narrative. It only takes a couple of minutes. Do it your way

A great starting point for your Hope Bancorp research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always stay ahead of the curve by researching new themes and emerging opportunities. Don’t miss your chance to find your next winning stock. Simply Wall Street’s powerful screener puts you in control.

- Tap into the potential of smaller companies poised for growth by selecting penny stocks with strong financials to uncover hidden gems before the crowd catches on.

- Supercharge your portfolio with future-focused picks in artificial intelligence by checking out AI penny stocks featuring innovators who are shaping tomorrow’s world.

- Strengthen your income stream with steady payers by using dividend stocks with yields > 3% and pinpoint stocks offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.