يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Horace Mann (HMN): Is This Insurer’s 30% Return Still Undervalued?

Horace Mann Educators Corporation HMN | 46.54 46.54 | +1.35% 0.00% Pre |

While Horace Mann Educators hasn’t made headlines with major news lately, its total shareholder return of nearly 30% over the past year suggests momentum is building as investors factor in both growth prospects and a stronger outlook for the business.

If you’re interested in expanding your search for promising stocks beyond insurance, now is a great time to discover fast growing stocks with high insider ownership.

With shares currently trading about 11% below the average analyst price target and reflecting robust revenue and profit growth, the key question now is whether Horace Mann has room to run, or if future gains are already priced in.

Most Popular Narrative: 9.8% Undervalued

The latest narrative indicates Horace Mann Educators could be trading at nearly 10% below its projected fair value, with the last close price meaningfully below the consensus estimate. This difference spotlights expectations for margin expansion, stronger digital engagement, and growth in educator retirement products as key drivers for the next phase.

Ongoing expansion of digital engagement platforms and proprietary technology solutions (such as the Catalyst lead management system) are improving agent productivity and making it easier for educators to engage. These changes are likely to drive increased policy sales, higher customer conversion rates, and improved customer retention, positively impacting both revenue growth and net margins.

Curious what bold projections shape this valuation? Find out which future revenue streams and aggressive profit margin assumptions set the stage for higher returns. Analysts are betting on factors that could shift the company’s growth trajectory. Want to glimpse the exact forecasts they are using?

Result: Fair Value of $49 (UNDERVALUED)

However, persistent challenges such as increased catastrophe losses from climate change or shifts in public school employment could disrupt Horace Mann’s upward momentum.

Another View: What Does Our DCF Model Say?

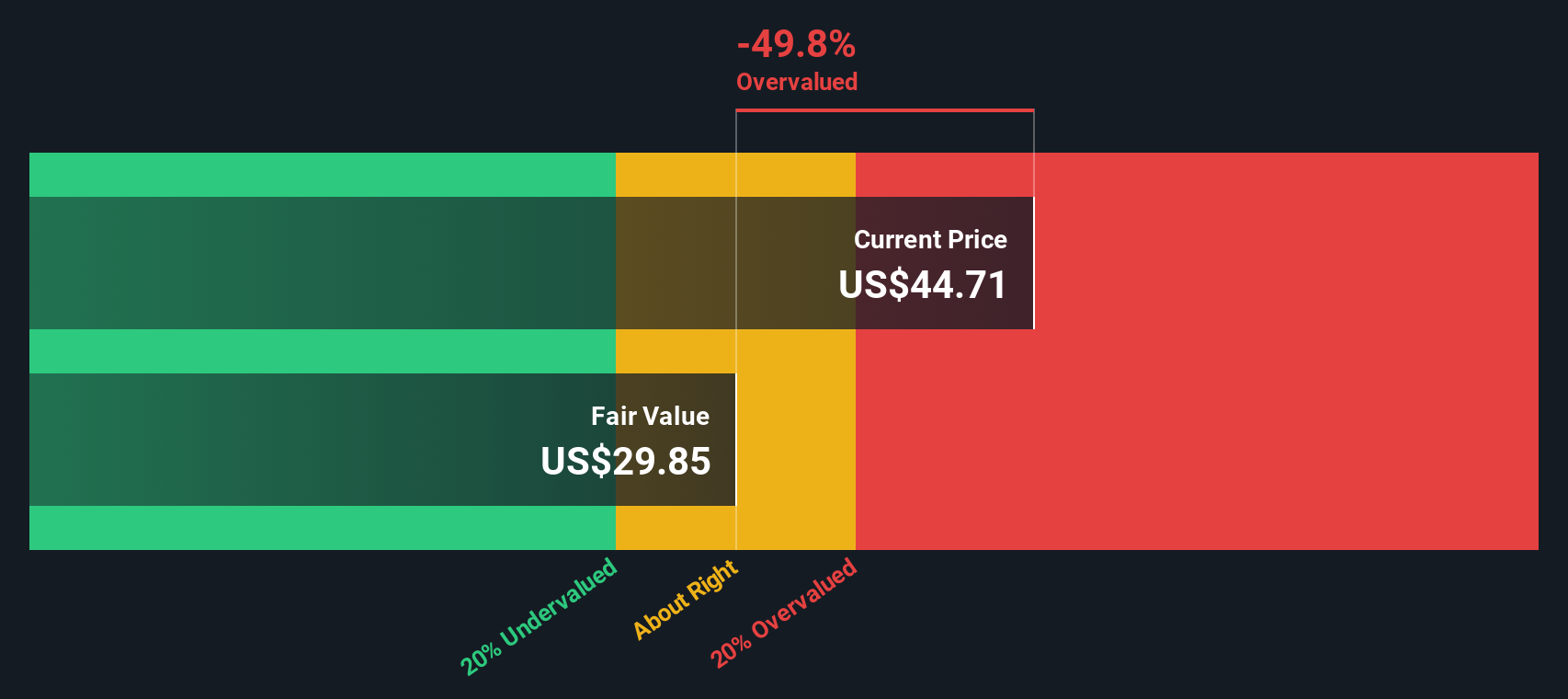

While analysts believe Horace Mann Educators is trading near fair value, our SWS DCF model presents a more conservative view. It suggests that at $44.21, the shares currently sit above our calculated fair value. Is the bullish consensus overlooking certain risks, or is the market pricing in future surprises?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Horace Mann Educators for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Horace Mann Educators Narrative

If you’re interested in drawing your own conclusions or want to dive deeper into the numbers, you can craft and share your perspective in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Horace Mann Educators.

Looking for More Smart Investment Ideas?

Smart investors know that finding the best opportunities means acting early and following the strongest trends. Don’t let market leaders and emerging opportunities pass you by. Start screening today.

- Capitalize on robust yields and long-term wealth by uncovering these 19 dividend stocks with yields > 3% offering high potential for steady income.

- Power up your portfolio with cutting-edge innovation by targeting these 23 AI penny stocks leading breakthroughs in artificial intelligence and automation.

- Secure undervalued gems before they hit the spotlight by reviewing these 914 undervalued stocks based on cash flows poised for future growth based on proven cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.