يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Houlihan Lokey Q3 Earnings Growth Outpaces History And Tests Premium P/E Narrative

Houlihan Lokey, Inc. Class A HLI | 167.82 | +1.02% |

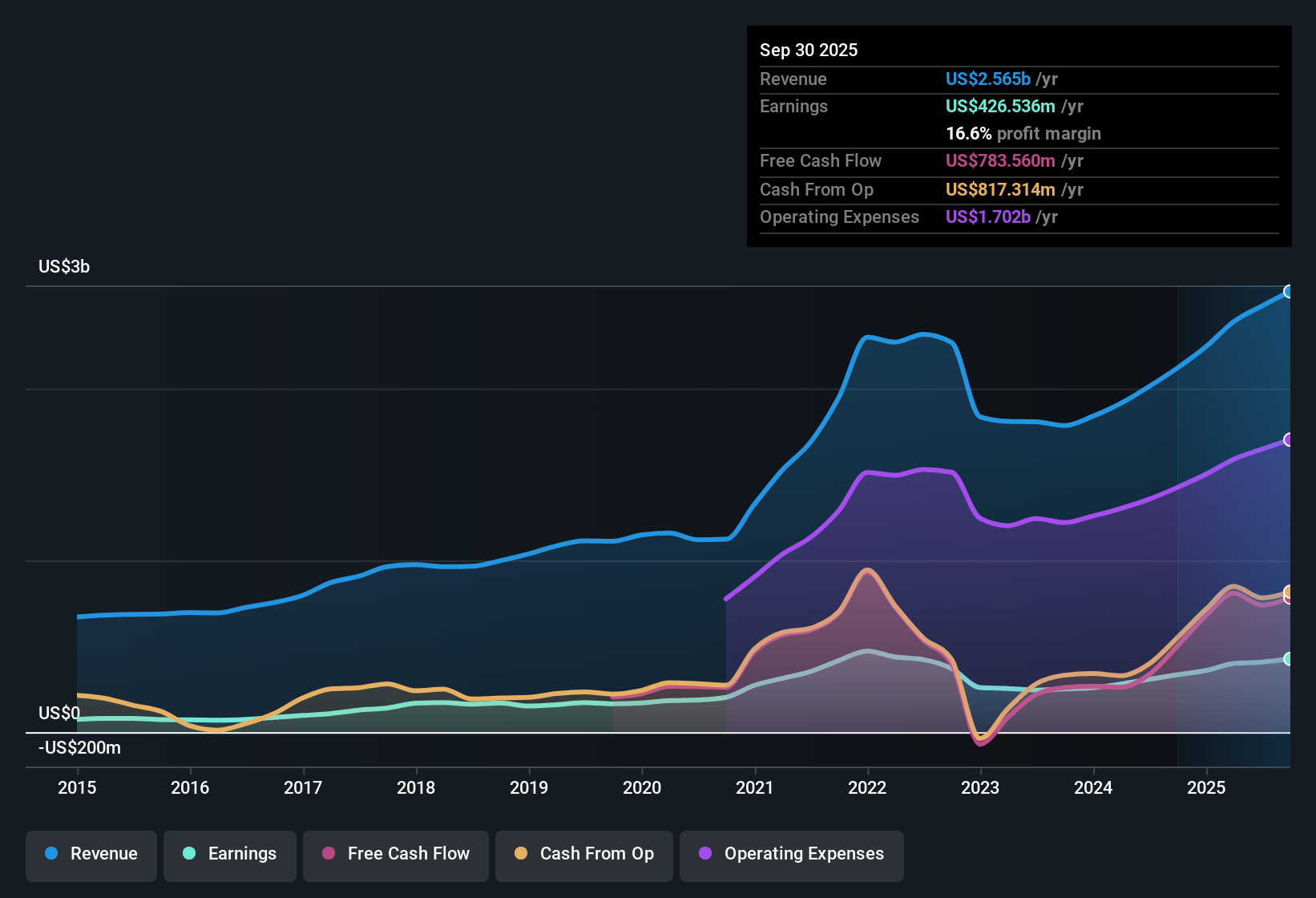

Houlihan Lokey (HLI) reported a busy quarter, with Q3 2026 revenue of US$717.1 million and basic EPS of US$1.75, supported by trailing 12 month EPS of US$6.73 and net income of US$447.8 million on revenue of US$2.6 billion. Over recent quarters the company’s revenue has increased from US$574.9 million and EPS of US$1.42 in Q2 2025 to US$717.1 million and EPS of US$1.75 in Q3 2026. Over the same period, trailing 12 month EPS rose from US$5.15 to US$6.73 and net income from US$334.4 million to US$447.8 million. With net margins holding in the high teens and earnings growth now visible in the historical results, the latest figures present a test of how sustainable investors believe this profitability profile to be.

See our full analysis for Houlihan Lokey.With the numbers on the table, the next step is to consider how they align with the stories investors follow, comparing Houlihan Lokey's recent earnings and margins with the narratives that have been building around the stock.

24.8% earnings growth outpaces 1.8% history

- Over the last 12 months, earnings grew 24.8% while the five year annual pace was 1.8%, with trailing net income at US$447.8 million on US$2.6b of revenue.

- What stands out for a bullish view is how the recent 24.8% earnings growth and trailing EPS of US$6.73 contrast with the much slower 1.8% five year pace.

- Supporters can point to three straight quarters of higher revenue, from US$574.9 million in Q2 2025 to US$717.1 million in Q3 2026, alongside EPS moving from US$1.42 to US$1.75.

- At the same time, anyone leaning bullish needs to keep in mind that the stronger year still sits on top of that more modest multi year trend, which keeps the question on how durable this faster phase really is.

Margins at 16.9% with revenue near US$2.6b

- Trailing net margin sits at 16.9%, up from 16.0%, based on net income of US$447.8 million on about US$2.6b of revenue over the last 12 months.

- Supporters of a bullish angle on profitability see the 16.9% margin and Q3 2026 net income of US$116.5 million as evidence of disciplined execution.

- They can also reference that quarterly net income over the latest four reported periods ranged between roughly US$95 million and US$122 million, which lines up with the idea of consistently profitable advisory work.

- What keeps the discussion grounded is that the margin move from 16.0% to 16.9% is incremental rather than dramatic, so the bullish case rests more on consistency than on a step change in profitability.

P/E premium and US$206.25 price target

- The shares trade on a P/E of 26.3x versus 24.5x for the US Capital Markets industry and 19.1x for peers, while the current price of about US$168.81 sits close to the DCF fair value of roughly US$168.31 and below the US$206.25 analyst price target.

- Critics with a bearish tilt focus on that P/E premium and the fact forecast earnings growth of about 13.6% per year sits below the broader US market forecast of 16.1%.

- They argue that paying 26.3x earnings when peers average 19.1x can be hard to justify if growth expectations do not clearly outstrip the wider market.

- On the other hand, the gap between the current share price of US$168.81 and the US$206.25 target, alongside a 1.42% dividend yield, gives investors a different read than a pure P/E comparison, especially with the DCF fair value almost level with the market price.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Houlihan Lokey's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Houlihan Lokey pairs solid profitability with a richer 26.3x P/E and earnings growth forecasts of about 13.6% per year that sit below the wider US market.

If that mix of premium pricing and more modest growth expectations makes you cautious, use our these 869 undervalued stocks based on cash flows to quickly focus on companies where valuations look more compelling against their earnings profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.