يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

How Investors Are Reacting To Centuri Holdings (CTRI) Raising $292.5M and Upgrading 2025 Revenue Outlook

Centuri Holdings, Inc. CTRI | 28.93 | +4.40% |

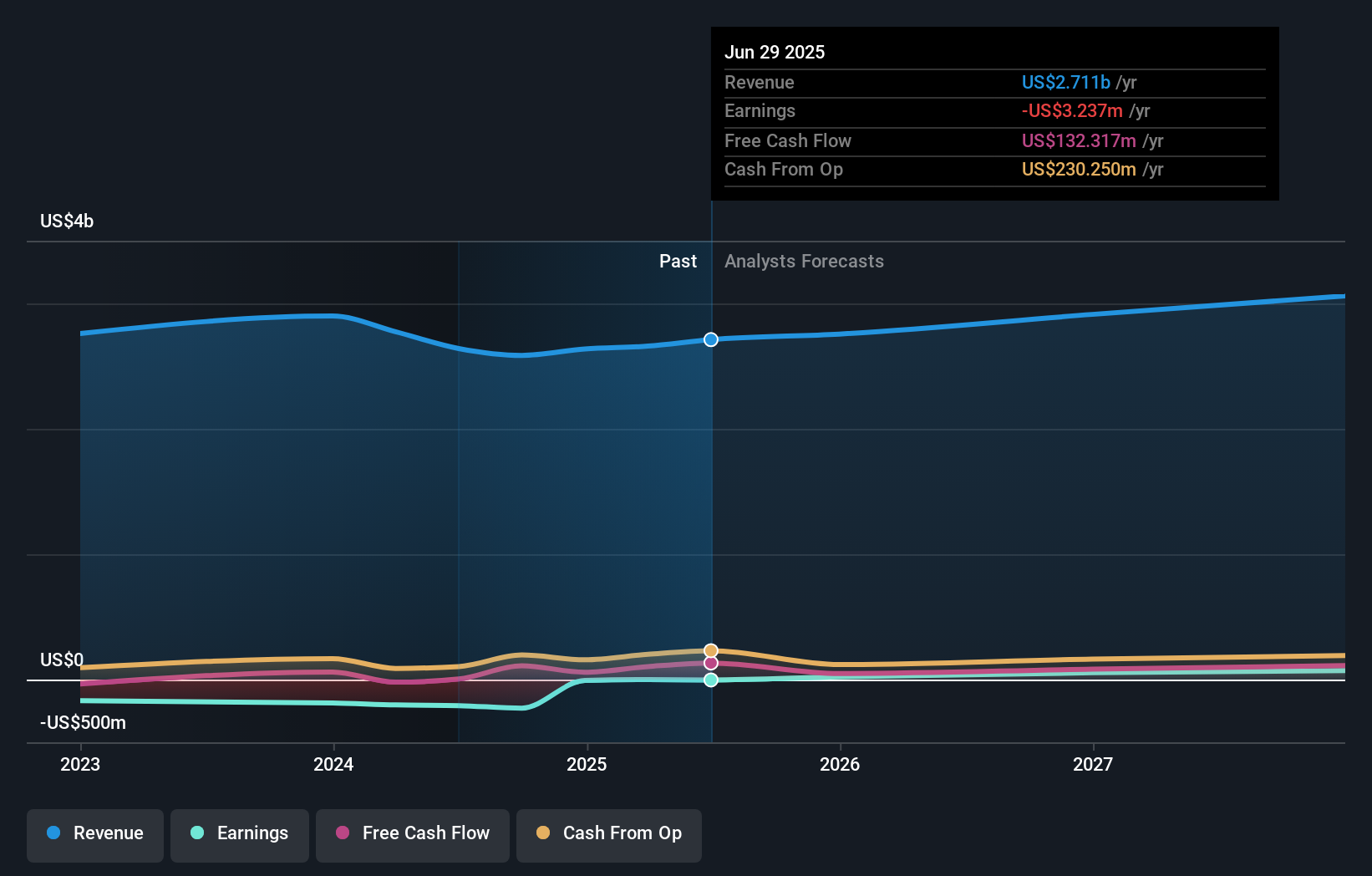

- Centuri Holdings recently announced the completion of a follow-on equity offering, raising US$292.5 million through the issuance of 15,000,000 new shares at US$19.50 each, alongside an increase in its full-year 2025 revenue guidance to between US$2.70 billion and US$2.85 billion.

- The combination of new capital raised and a higher revenue outlook stands out against a backdrop of year-over-year quarterly revenue growth but a decline in net income.

- With the company boosting its 2025 revenue guidance during a capital raise, we explore how this dual update shapes Centuri Holdings' investment narrative.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Centuri Holdings' Investment Narrative?

For anyone considering Centuri Holdings, it’s clear that belief in the company’s ability to convert sales growth and new contract wins into sustainable profitability is pivotal. The recent follow-on equity offering, which injected US$292.5 million in fresh capital just as revenue guidance was raised, marks a potentially material shift for the short-term outlook. This capital boost could reinforce Centuri’s ability to deliver on its substantial backlog, address operational challenges, or even fund further growth initiatives, all of which might add momentum to near-term catalysts like contract execution and margin improvement. At the same time, the discount pricing of the offering and the ongoing lack of profitability place even greater attention on the company’s operational discipline in the quarters ahead. Risks now tilt a bit more toward how effectively new funding translates to earnings improvement, especially with ongoing questions around board experience and leadership transitions.

On the flip side, board turnover and management inexperience are factors investors should not overlook.

Exploring Other Perspectives

Explore 3 other fair value estimates on Centuri Holdings - why the stock might be worth as much as 14% more than the current price!

Build Your Own Centuri Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centuri Holdings research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Centuri Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centuri Holdings' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.