يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

How Investors Are Reacting To Houlihan Lokey (HLI) Hiring Senior Paris A&D Banker For Europe

Houlihan Lokey, Inc. Class A HLI | 189.90 | +0.06% |

- In January 2026, Houlihan Lokey announced that Géraud Estrangin has joined as a Managing Director in its Industrials Group in Paris, focusing on aerospace and defence in Europe and supporting France-related transactions across the global platform.

- By adding an executive who co-founded and built a major competitor’s French operation and executed more than 40 industrial deals, Houlihan Lokey is reinforcing its depth in European aerospace and defence advisory.

- We’ll now examine how this senior aerospace and defence hire in Paris could influence Houlihan Lokey’s existing investment narrative and growth assumptions.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Houlihan Lokey Investment Narrative Recap

To own Houlihan Lokey, you generally need to believe in its ability to convert its advisory franchise, global footprint and senior talent bench into durable fee income, despite uneven deal activity and rising costs. The hire of Géraud Estrangin is directionally positive for European aerospace and defence coverage, but does not materially change the near term sensitivity of revenues to M&A volumes or the key risk around high compensation and non-compensation expense ratios.

Among recent announcements, the October 2025 Q2 results are most relevant, as they frame how added senior hires might intersect with already elevated cost ratios and earnings sensitivity. Estrangin’s arrival fits into a broader pattern of senior recruitment across Europe and sector teams, which can support future fee pools but also keeps cost discipline in focus as a near term catalyst for sentiment around margins and valuation.

Yet while new senior hires may support growth, investors should be aware that persistent high compensation and non-compensation costs could...

Houlihan Lokey's narrative projects $3.5 billion revenue and $654.6 million earnings by 2028. This requires 12.5% yearly revenue growth and about a $246 million earnings increase from $408.3 million today.

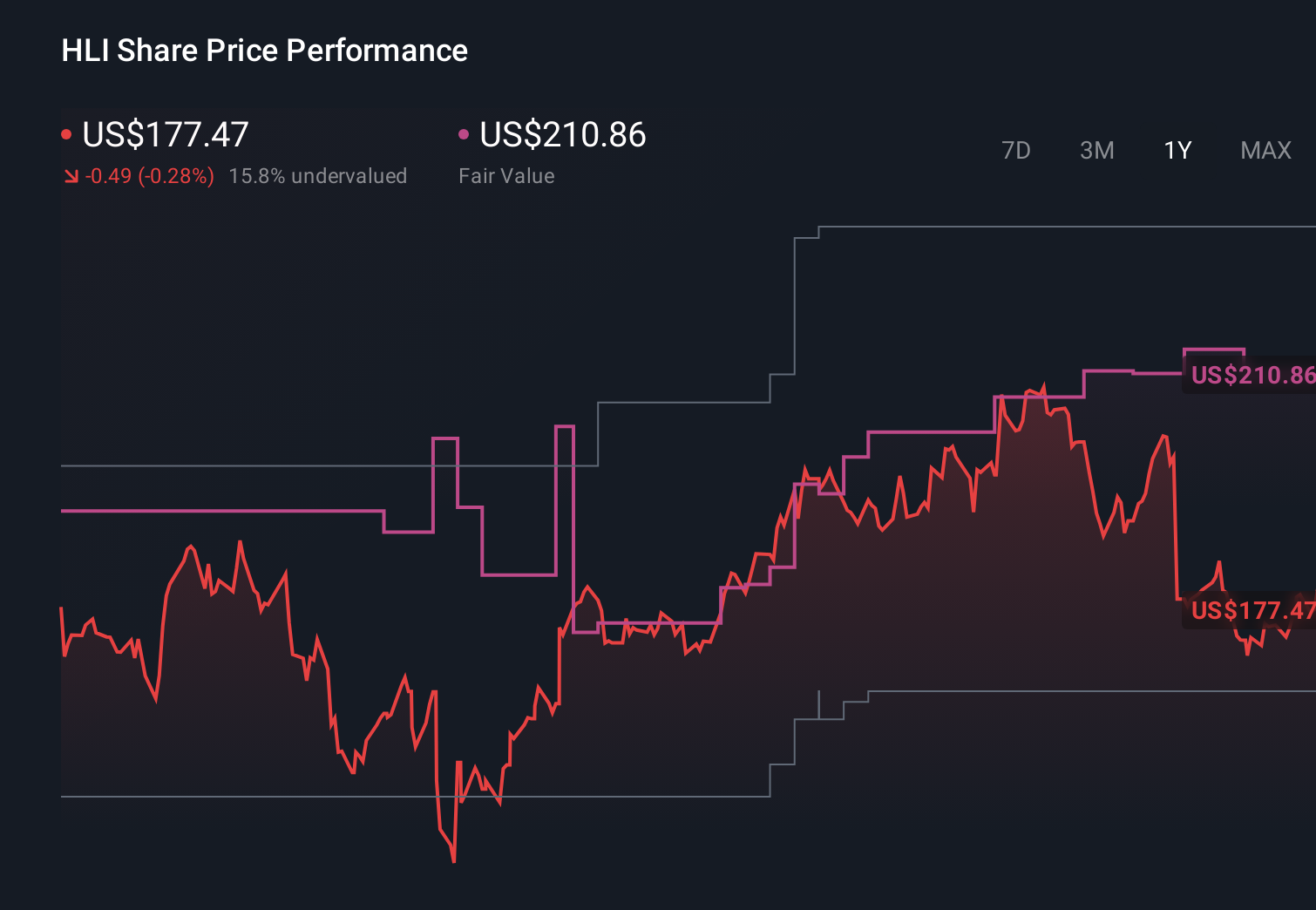

Uncover how Houlihan Lokey's forecasts yield a $210.86 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly US$169 to US$211, underscoring how differently individual investors assess Houlihan Lokey. You can set those views against the current concern that high compensation and non-compensation expenses might pressure margins if deal activity softens, and weigh how that could influence the company’s ability to sustain its recent performance.

Explore 3 other fair value estimates on Houlihan Lokey - why the stock might be worth 6% less than the current price!

Build Your Own Houlihan Lokey Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Houlihan Lokey research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Houlihan Lokey research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Houlihan Lokey's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.