يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

How Investors Are Reacting To Insulet (PODD) Raising Guidance After Surging Q2 Revenue and New Product Launch

Insulet Corporation PODD | 295.70 | +0.52% |

- In the past week, Insulet Corporation reported a 32.9% year-over-year revenue increase for Q2 2025 and raised its full-year revenue and operating margin guidance, citing strong customer adoption in both the U.S. and international markets.

- Innovation remained a focus as Insulet and Pantone launched a new tropical orange-yellow Omnipod insulin pump color, highlighting efforts to improve user experience and support independence.

- We'll explore how robust revenue gains and raised guidance could shift Insulet's growth outlook and international expansion plans.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Insulet Investment Narrative Recap

To be an Insulet shareholder today, you need to trust in the durability of Omnipod's leadership in tubeless insulin delivery, as well as the company's ability to keep outpacing competitors with product and market expansion. The latest revenue surge and boosted guidance are significant, reinforcing confidence in rapid customer adoption, but the most immediate catalyst, continued strong uptake in the US and new international markets, remains sensitive to competitive challenges and shifting patient preferences. If competitive advances quicken or new alternatives gain traction, the fundamental risk of concentrated reliance on Omnipod could become material, but for now, this news does not change the core risk profile.

Among recent announcements, Insulet's update to its full-year revenue guidance stands out as most relevant. The company now expects higher revenue growth due to continued customer gains both domestically and abroad, directly tying into the core catalyst: expanding its user base and driving greater international adoption of Omnipod, which could underpin revenue momentum if demand remains robust in these new geographies.

But in contrast, what investors should be alert to is how quickly competitor innovations or disruptive new technologies might affect Omnipod's share and ...

Insulet's narrative projects $3.9 billion revenue and $542.3 million earnings by 2028. This requires 17.8% yearly revenue growth and a $306.2 million earnings increase from $236.1 million currently.

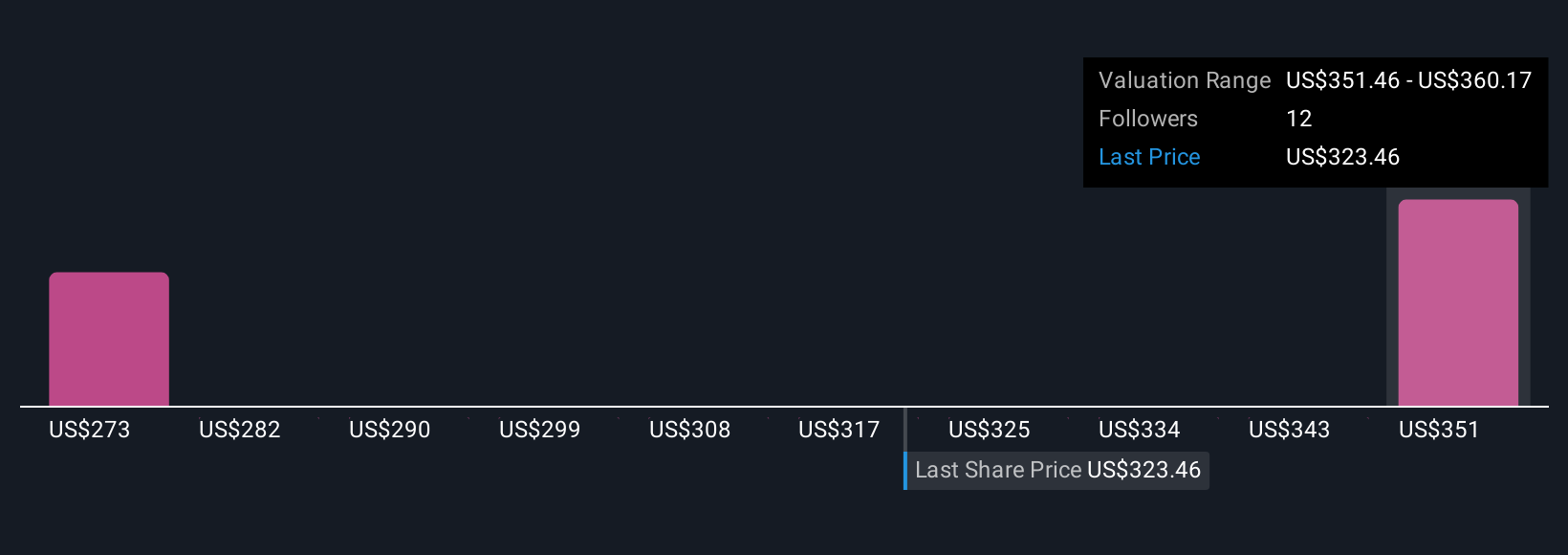

Uncover how Insulet's forecasts yield a $360.17 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have shared two fair value estimates ranging from US$276.41 to US$360.17 per share. While many see upside in Insulet's revenue momentum, concentrated product risk remains a watchpoint that can shape long term performance, review differing perspectives to inform your own view.

Explore 2 other fair value estimates on Insulet - why the stock might be worth as much as 15% more than the current price!

Build Your Own Insulet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Insulet research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Insulet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Insulet's overall financial health at a glance.

No Opportunity In Insulet?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.