يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

How Investors Are Reacting To Victory Capital Holdings (VCTR) Extending and Refinancing Its Credit Facilities

Victory Capital Holdings VCTR | 63.75 | +0.30% |

- On September 23, 2025, Victory Capital Holdings announced amendments to its existing credit agreement, extending the maturity of its US$100,000,000 revolving credit facility to September 2030 and reducing its drawn interest rate margin by 0.25% per annum, while also refinancing US$985,000,000 in term loans at new rates and terms.

- The changes to Victory Capital’s debt agreements enhance financial flexibility, which may support ongoing operating initiatives and reinforce stability as the company continues its global expansion efforts.

- We'll now explore how enhanced credit terms and extended debt maturities could influence Victory Capital's growth outlook and investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Victory Capital Holdings Investment Narrative Recap

To invest in Victory Capital Holdings, investors typically need to believe in the firm’s ability to drive sustained growth through global expansion and product innovation, supported by strong cash flows. The recent extension and repricing of its credit facilities bring lower interest costs and longer maturities, which could boost flexibility in pursuing acquisitions, the key short-term catalyst, but do not themselves address the continued risk of persistent net outflows and pressure on organic growth.

The most significant recent company announcement related to this is the August extension of Victory Capital’s share buyback program by US$300,000,000, bringing the total planned repurchases to US$500,000,000 through 2027. This move underscores management’s confidence in the company’s cash generation but, like the new credit agreements, its impact on asset retention and net inflows, the central risks, remains limited.

However, investors should be aware that despite improving financial flexibility, Victory Capital still faces headwinds from persistent net outflows and...

Victory Capital Holdings' outlook anticipates $1.8 billion in revenue and $735.1 million in earnings by 2028. Achieving these targets implies a 20.4% annual revenue growth rate and an increase in earnings of $470.5 million from the current $264.6 million.

Uncover how Victory Capital Holdings' forecasts yield a $76.43 fair value, a 19% upside to its current price.

Exploring Other Perspectives

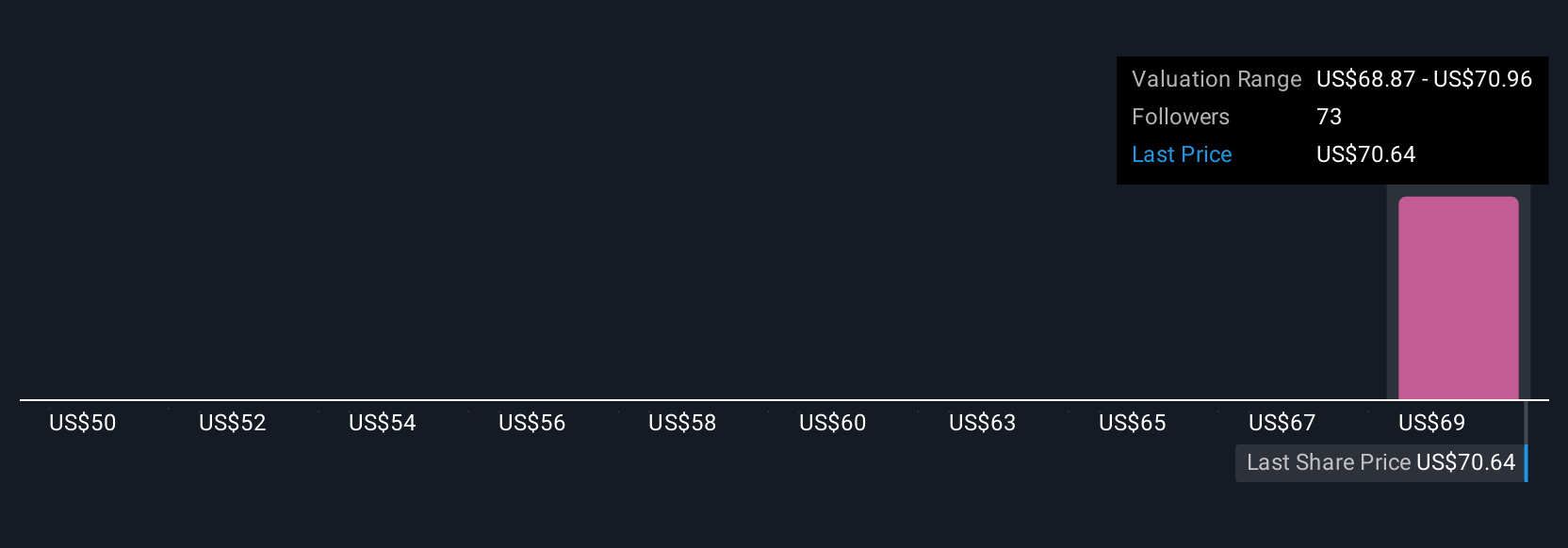

Simply Wall St Community members estimate fair values between US$63.48 and US$76.43, based on three independent views. With ongoing fee compression among industry risks, there is clear value in exploring how your own outlook compares to this wide range.

Explore 3 other fair value estimates on Victory Capital Holdings - why the stock might be worth as much as 19% more than the current price!

Build Your Own Victory Capital Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Victory Capital Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Victory Capital Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Victory Capital Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.