يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

How Investors May Respond To Golar LNG (GLNG) Considering a New 144A/Reg S Notes Offering

Golar LNG Limited GLNG | 36.99 | +0.38% |

- On September 22, 2025, Golar LNG Limited began a series of fixed income investor meetings through a syndicate of banks, opening the prospect for a benchmark US$ 144A/Reg S-denominated 5NC2 senior unsecured notes offering depending on market conditions.

- This potential notes issuance may affect Golar LNG’s capital structure and financial flexibility, attracting attention to its approach to future funding and growth initiatives.

- We'll explore how the potential senior unsecured notes offering could influence the investment narrative and future capital strategies for Golar LNG.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Golar LNG Investment Narrative Recap

To be a shareholder in Golar LNG, you need to believe in long-term demand for floating LNG solutions and the company's ability to capitalize on a $17 billion contracted EBITDA backlog. The recent announcement of potential senior unsecured notes may enhance financial flexibility, but it doesn’t materially affect the key short-term catalyst, the continued securing and ramping of long-term FLNG charters, and does little to change the major current risk of heavy capital expenditures tied to new unit development and refinancing pace.

One of the most relevant recent announcements is Southern Energy S.A. reaching final investment decision on a 20-year charter of Golar’s MK II FLNG in Argentina, which supports the business’s focus on locking in long-term earnings visibility. This directly aligns with the company’s main catalyst: maximizing utilization and contract coverage for new and existing FLNG units amid a growth cycle for flexible LNG infrastructure.

In contrast, investors should remain aware that Golar’s expansion plans also bring the risk of significant capital and refinancing requirements if market or project conditions shift...

Golar LNG's narrative projects $434.8 million in revenue and $205.2 million in earnings by 2028. This requires 17.4% yearly revenue growth and a $211.7 million earnings increase from the current earnings of $-6.5 million.

Uncover how Golar LNG's forecasts yield a $51.10 fair value, a 27% upside to its current price.

Exploring Other Perspectives

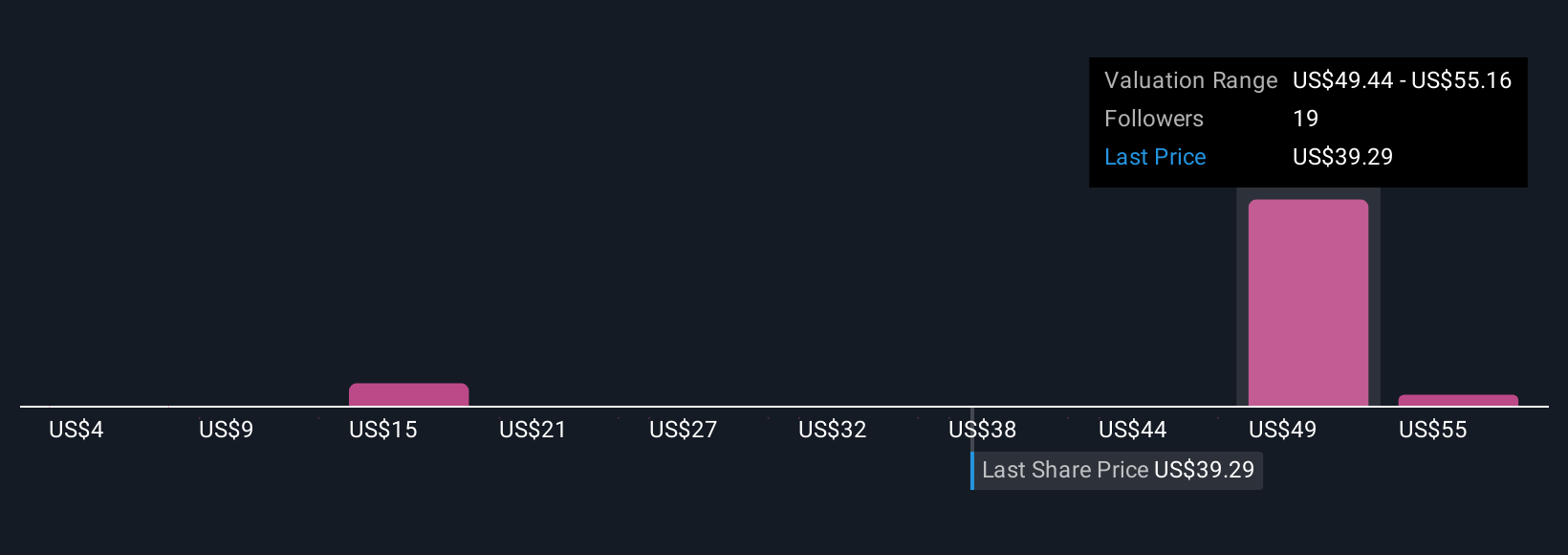

Simply Wall St Community members provided 5 unique fair value estimates for Golar LNG, ranging widely from US$3.72 to US$60.87 per share. While many expect robust long-term cash flows from FLNG contracts, a risk remains if higher capital expenditure or refinancing delays weigh on the company’s financial flexibility, reminding you that the market holds many different views to consider.

Explore 5 other fair value estimates on Golar LNG - why the stock might be worth as much as 52% more than the current price!

Build Your Own Golar LNG Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Golar LNG research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Golar LNG research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Golar LNG's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.