يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

How Investors May Respond To T. Rowe Price Group (TROW) and Goldman Sachs’ Strategic Asset Management Partnership

T. Rowe Price Group TROW | 103.81 | +0.17% |

- Goldman Sachs announced a partnership with T. Rowe Price Group that includes a planned investment of up to US$1 billion and the potential acquisition of up to a 3.5% stake in the firm, targeting the development of new diversified investment solutions.

- This collaboration has drawn renewed interest from market analysts and underscores the increasing trend of asset managers joining forces to expand their offerings and reach.

- We'll explore how the Goldman Sachs partnership may influence T. Rowe Price's investment narrative and future business prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

T. Rowe Price Group Investment Narrative Recap

To own T. Rowe Price Group shares, you typically need confidence in the firm's ability to adapt to industry-wide trends, particularly the move from active management to lower-cost investment products. The recent partnership with Goldman Sachs, with its potential US$1 billion investment, highlights a cooperative push to expand offerings but does not materially shift the key short-term catalyst: whether new product launches and partnerships can meaningfully stem persistent net outflows. The primary risk remains continued investor preference for passive and low-fee vehicles, which could challenge revenue stability even if headline collaborations attract attention.

Among recent announcements, the Goldman Sachs collaboration stands out, aiming to bolster T. Rowe Price’s presence in both public and private market strategies. With co-branded target-date funds and up to a 3.5% equity stake at play, this move is closely connected to the firm’s efforts to counter fee pressure and attract new clients, a central catalyst for future asset growth.

But investors should also keep in mind, even with new alliances, how the shift to passive investments has affected core revenue and may continue to shape results over coming quarters...

T. Rowe Price Group's narrative projects $7.6 billion revenue and $2.3 billion earnings by 2028. This requires 2.3% yearly revenue growth and a $0.3 billion earnings increase from $2.0 billion today.

Uncover how T. Rowe Price Group's forecasts yield a $105.38 fair value, in line with its current price.

Exploring Other Perspectives

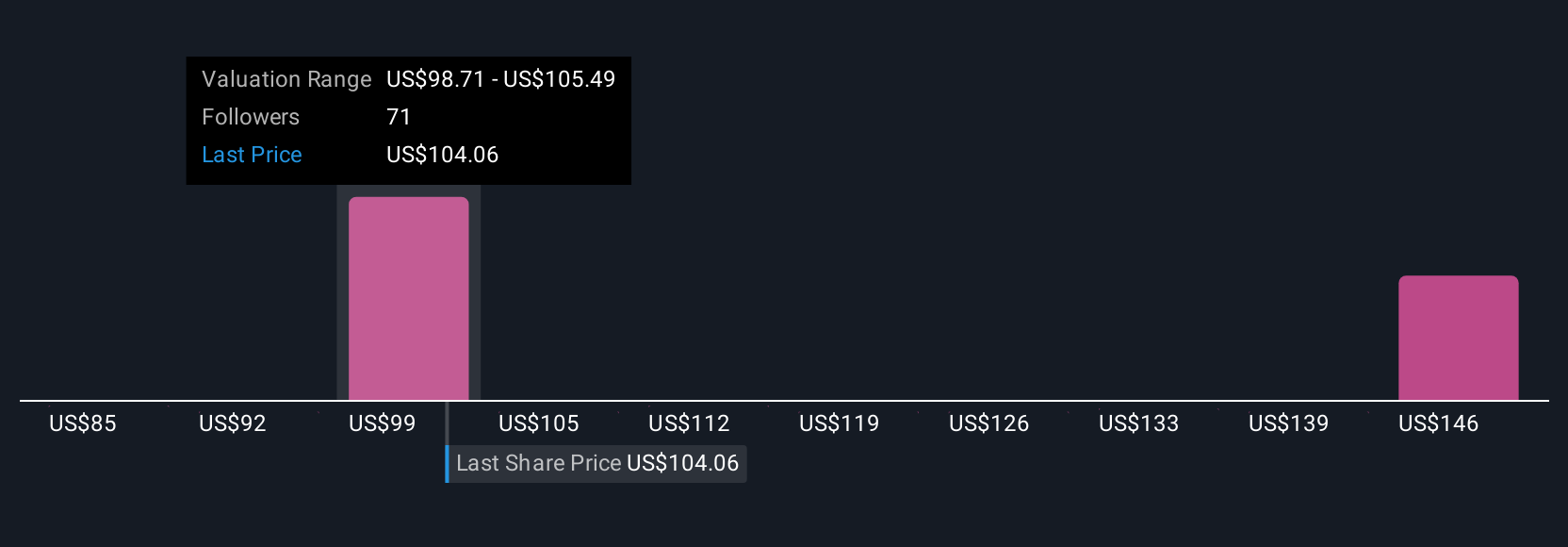

Eight community-sourced fair value estimates for T. Rowe Price range widely, from US$85.16 to US$163.04 per share. While some see undervaluation, others may be factoring in long-term pressure from the sector’s migration toward passive and lower-fee solutions, reminding you to consider multiple viewpoints before drawing your own conclusions.

Explore 8 other fair value estimates on T. Rowe Price Group - why the stock might be worth 20% less than the current price!

Build Your Own T. Rowe Price Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your T. Rowe Price Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free T. Rowe Price Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate T. Rowe Price Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.