يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

How Itron's (ITRI) Smart Grid Deal in American Samoa Could Shape Its Global Expansion

Itron, Inc. ITRI | 104.05 | +4.51% |

- Earlier this week, Itron announced it had formed an alliance with the American Samoa Power Authority to deploy its Advanced Metering Infrastructure, including smart meters and flexible billing software, as part of the utility's digital transformation roadmap.

- This project highlights Itron’s ability to deliver scalable, reliable smart grid solutions for remote and high-cost regions, underscoring its role in modernizing critical infrastructure where energy needs are particularly complex.

- We'll explore how winning a smart grid deployment in American Samoa could shape Itron’s long-term growth outlook and global reach.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Itron Investment Narrative Recap

For investors in Itron, the core conviction rests on the company’s ability to convert global demand for smart grid solutions into steady revenue and margin growth, while executing complex deployments reliably. The recent alliance with the American Samoa Power Authority demonstrates Itron's technical reach, but the project is relatively small and does not offset the broad risk that prolonged regulatory delays or slowing project approvals in larger markets could weigh on near-term revenue and earnings volatility.

One of Itron’s recent announcements that closely aligns with this news event is the smart metering partnership with Fiji’s Water Authority. Similar to the American Samoa deployment, the Fiji initiative highlights Itron’s focus on building a track record in geographically challenging or underserved regions. These projects underscore how international expansion can supplement the company’s core catalysts, especially as visibility in established markets can ebb and flow amid regulatory or budgetary hurdles.

Yet, despite recent wins, investors should not lose sight of the heightened risk that major utility customers may slow deployments or delay investment decisions due to...

Itron's narrative projects $2.8 billion in revenue and $388.8 million in earnings by 2028. This requires 5.2% yearly revenue growth and a $118.9 million earnings increase from $269.9 million today.

Uncover how Itron's forecasts yield a $144.40 fair value, a 20% upside to its current price.

Exploring Other Perspectives

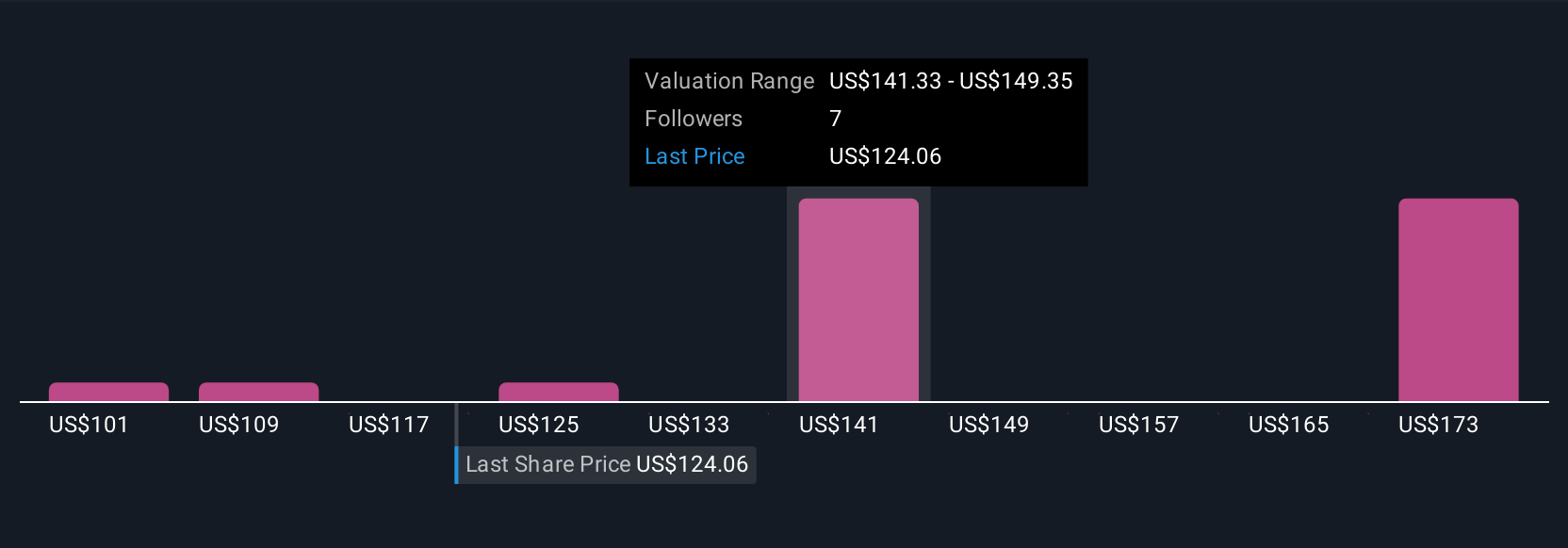

Five members of the Simply Wall St Community estimate Itron’s fair value between US$101 and US$177 per share, a spread of over US$75. With regulatory delays still flagged as a lingering risk for major project revenues, market participants can hold widely divergent assumptions, review several approaches before making up your mind.

Explore 5 other fair value estimates on Itron - why the stock might be worth as much as 47% more than the current price!

Build Your Own Itron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Itron research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Itron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Itron's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 30 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.